Skillz Stock Sees Listing Surge, Good Mobile Gaming Bet

Mobile games platform Skillz listed on Dec. 17 and soared on the first day of the listing. Is Skillz stock a buy despite the surge?

Dec. 18 2020, Published 11:47 a.m. ET

Mobile games platform Skillz listed on Dec. 17 and soared on the first day of the listing. Most IPOs have done well this year with many doubling on the first day of listing. Is Skillz stock a buy despite the surge on Dec. 17?

Given investors' appetite for IPOs, as reflected in the massive rise in stocks on the first day of the listing, fintech company Affirm and online gaming platform Roblox delayed their IPOs in an apparent bid to raise their IPO prices. The sharp rise in IPOs on the first day reflects that companies are probably leaving too much on the table for investors.

How Skillz makes money

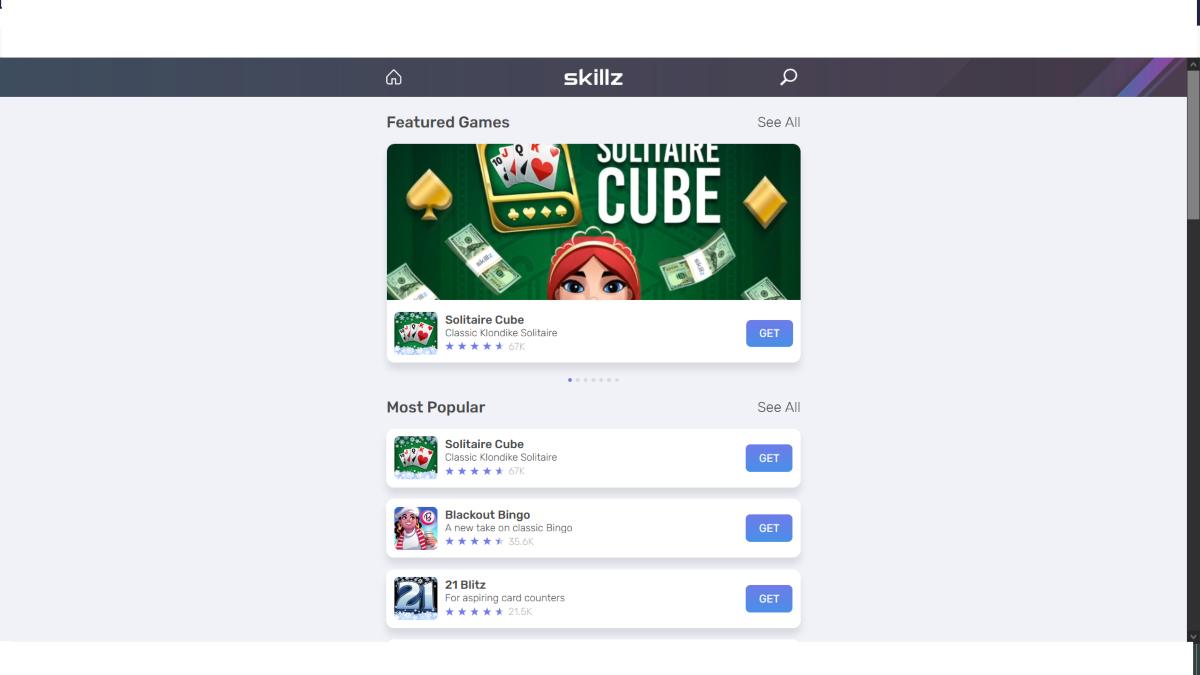

Skillz is a mobile gaming company that connects players. The company mainly makes money through brand sponsorships, competition entry fees, and in-game ads. Creators own the games on its platform and many have built a multi-million business on the platform.

Skillz on Stocktwits

Username Bee4ev on Stocktwits said that Skillz stock is available to trade on Robinhood. The user also said that the company is expanding to India, which looks like a bullish driver.

The demand for gaming has increased in 2020. More people turned to gaming amid the COVID-19 pandemic. While the growth rates that we saw in 2020 might not be sustained in 2021, the industry looks set to grow at a high pace for the foreseeable future. Along with developed markets, emerging markets like India could contribute to gaming companies' growth.

Skillz's stock price and forecast

Skillz stock was trading 2.5 percent lower in pre-market trading on Dec. 18 at $22.15. Since the stock listed recently, not many brokerages are currently covering it. However, brokerages will start covering it soon and assign a target price. Skillz stock rose 28 percent on Dec. 17. Its valuation has doubled since it went for a reverse merger through the SPAC route.

Is Skillz stock a buy?

According to Skillz, only a small fraction of the 2.7 billion gamers globally are on its platform. The company expects the mobile gaming market to double by 2025 to $150 billion. In the release, the company said, “As Skillz moves beyond casual esports into new genres, adds new monetization models, and enters new geographies, the company’s addressable market will increase substantially.”

Skillz also said, “Going international is a significant opportunity for Skillz. The international market is four times larger than the North American market and represents less than 10% of Skillz revenue today.”

Overall, Skillz seems to offer strong growth potential. The stock could rise more as the company expands globally and finds new avenues to increase its earnings and profitability. Skillz stock looks like a good buy for investors who want to bet on the mobile gaming market.