SentinelOne’s (S) Stock Forecast: Will It Continue To Rise After Its IPO?

SentinelOne (S) went public on Jun. 30, and its stock soared. What’s the forecast for SentinelOne stock after its successful IPO?

July 1 2021, Published 5:54 a.m. ET

SentinelOne (S) went public on Jun. 30 and its stock soared. June was good for the U.S. IPO market, and was its busiest month in over two decades. Several U.S. and foreign companies went public as U.S. stock markets reached record highs. What’s the forecast for SentinelOne stock after its successful IPO?

SentinelOne, a cybersecurity company, sold 35 million shares at $35 in its IPO. It raised $1.2 billion, making it the largest cybersecurity IPO ever. Cybersecurity has been a promising investment amid growing threats from cyberattacks, such as that on the Colonial Pipeline.

SentinelOne priced its IPO above the initial range

SentinelOne first set its IPO at $31–$32, but raised the price based on strong demand. The event was timed well. U.S. stock markets are near record highs, recent IPOs have gone well, and cybersecurity is a hot topic.

SentinelOne stock opened at $46 and went on to hit a high of $46.50. The stock settled at $42.50, 21.4 percent above its initial price. Over 20 million shares changed hands on the first day of trading.

SentinelOne's financials

In its IPO filings, SentinelOne said that it has over 4,700 customers and reported a 97 percent customer satisfaction ratio. It reported revenue of $93 million in fiscal 2021 (ended Jan. 31, 2021), compared with $46.7 million in the previous year. Like most tech IPOs, SentinelOne is seeing losses. In fiscal 2021, its net loss swelled year-over-year to $117.5 million from $76.6 million.

The company has a lot of recurring revenue. In its IPO filing, it reported annual recurring revenue of $161 million. S stock had a market capitalization of $10.8 billion on closing, and after accounting for dilutive securities, its valuation comes to around $13 billion. Based on the company's most recent data points, it has a price-to-sales multiple of over 139x.

SentinelOne's stock forecast

It's worth noting that IPO stock tends to fall after a successful listing as early investors book profits. In the long term, however, the outlook for cybersecurity stocks looks positive, and SentinelOne seems positioned to capitalize on the opportunity. “The market we address is huge,” said SentinelOne CEO Tomer Weingarten speaking with CNBC.

Optimistic on the company’s prospects, he said, “Obviously the incumbent vendors in our space are relatively weak, using antiquated technologies that are not up to par with the current threat landscape, so for us it’s about continuing to grab market share.”

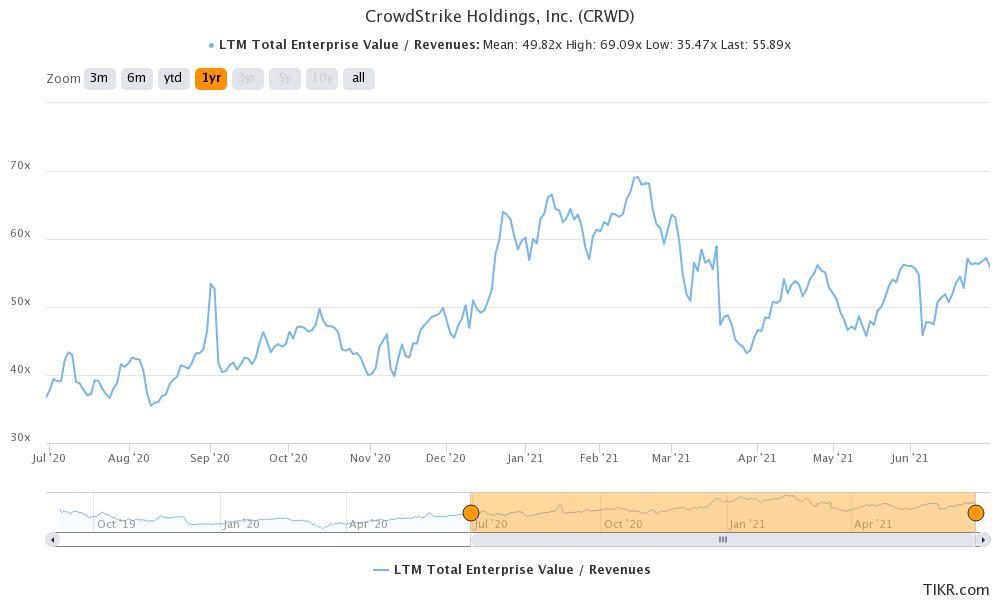

He sees CrowdStrike as SentinelOne's competitor. CrowdStrike has a market capitalization of $56.7 billion and a last-12-month enterprise value-to-sales multiple of 55.9x. Its revenue increased 81.6 percent in fiscal 2021 (ended Jan. 31, 2021) and analysts expect its revenue to rise 56 percent in fiscal 2022 and 36 percent in fiscal 2023.

CRWD stock valuation

Overall, while SentinelOne's outlook looks bullish, its stock looks pricey after its surge. The company could see strong growth and complement that with acquisitions, but most positives seem baked into its stock price for now.