SENS Stock Is Going Up on FDA Optimism: Is Senseonics a Buy?

Senseonics (SENS) stock was trading sharply higher after the company said that the FDA approval for the 180-day implant might come soon. Is SENS stock a buy?

Jan. 5 2022, Published 9:12 a.m. ET

Senseonics (SENS) stock was trading sharply higher in U.S. premarket price action on Jan. 5 after the company provided a business update on its FDA application. What’s the forecast for SENS stock and should you buy it now?

SENS was among the stocks that were popular on Reddit group WallStreetBets in 2021. The stock hit a 52-week high of $5.56, but like fellow meme stocks, it has since fallen.

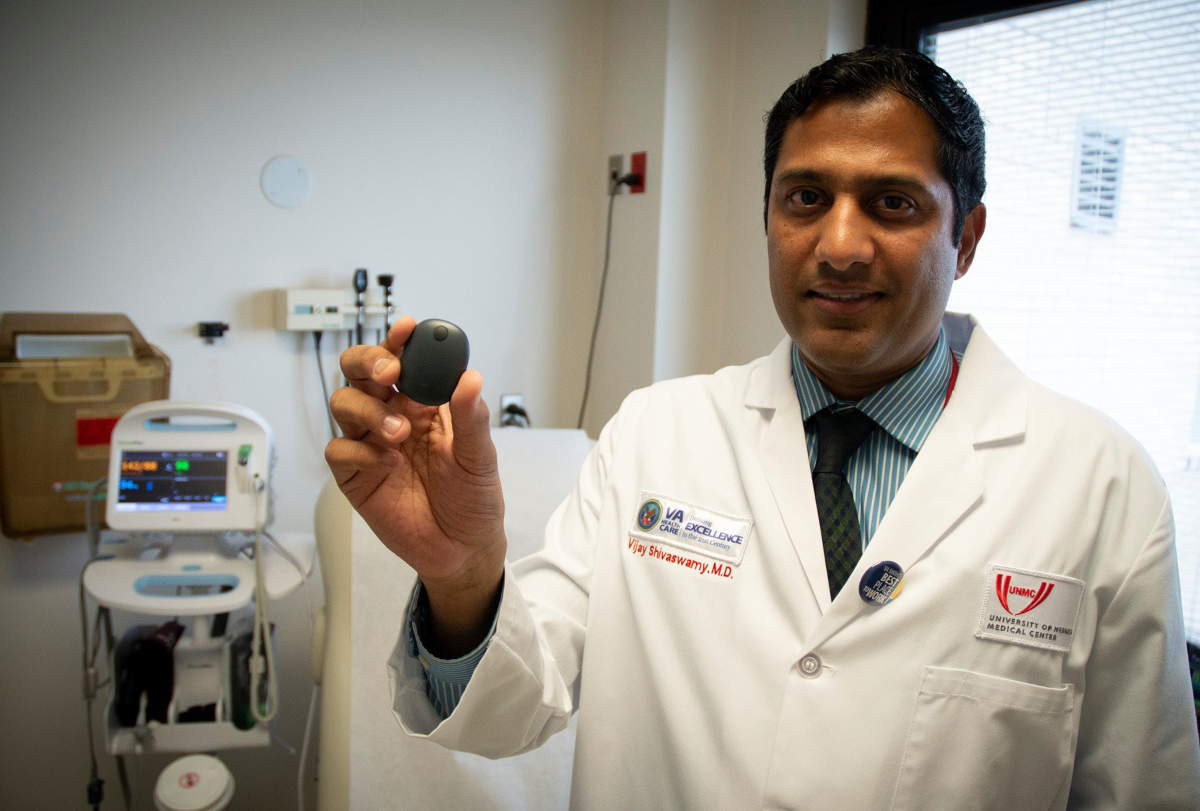

Senseonics produces the Eversense CGM system.

Senseonics is a healthcare company that produces the Eversense CGM (continuous glucose monitoring) system. Eversense is an implantable device that can make tracking sugar levels easy and seamless for diabetic patients.

Senseonics is commercializing the product and offers it in the U.S. and parts of Europe. In 2021, the company expects to post revenues between $12 million and $15 million. The company’s commercialization efforts were slow and in 2021 it outsourced the function to Ascensia Diabetes Care. Another aspect that has been slowing down the commercialization of Eversense has been the implantable life of 90 days.

Under the current approval regime, the Eversense CGM has an implantable life of 90 days. After that period, the user has to visit a healthcare professional to get it removed. A patient using the Eversense CGM has to visit a healthcare professional four times a year, which could be a hindrance for many users who would have otherwise chosen the equipment.

Senseonics expects FDA approval in weeks.

Senseonics filed with the FDA to increase the implantable life of the new Eversense CGM to 180 days. The approval has been pending for months now and has taken a toll on the sales of Eversense CGM and by its extension the SENS stock price.

In a business update, Senseonics said that the FDA is taking longer than expected due to COVID-19 related bottlenecks. Tim Goodnow, Senseonics CEO, said, “We are confident a decision regarding approval of the 180-day system will be made in the coming weeks as the FDA continues to clear out the backlog.”

The FDA approval still isn't certain. However, markets see the business update as a positive. Senseonics also said that it expects to finish the existing inventory in the U.S. in the first quarter of 2022 and then transition to the new product in the second quarter. Senseonics said that it's collaborating with Ascensia on a marketing and go-to-market strategy.

SENS stock forecast: Should you buy it now?

While the FDA approval isn't certain yet, it would be a big achievement for Senseonics if it happens. Wall Street analysts have a bullish forecast for the stock. According to data from TipRanks, the stock has an average target price of $5, which is a premium of 86 percent over the current prices.

Senseonics faces tough competition from heavyweights in the healthcare industry, which makes some analysts apprehensive. Given the company’s strong product proposition and the expected increase in the CGM market, SENS looks like a good stock to buy.

However, Senseonics has to successfully commercialize sales because the projected 2021 revenues don’t justify its $1.2 billion market cap. SENS could be a good buy if the company can achieve scale with the Eversense CGM. The FDA approval to increase the implantable life to 180 days would just be the trigger that Senseonics needs to boost its sales.