Robinhood Versus Fidelity — Comparing Investing Apps

How do Robinhood and Fidelity compare based on investment options, fees, and usability? Here’s how they stack up.

Oct. 8 2020, Updated 2:13 p.m. ET

Investors are just a few taps away from investing in the stock market with the boom in stock trading applications. Between Robinhood and Fidelity, two of the largest online brokers, is there a winner? Reviews seem to favor Fidelity.

Investopedia said that Fidelity’s brokerage service won top spot overall in its 2019 and 2020 Best Online Broker Awards. Fidelity is also ranked as the best broker for advanced traders. According to Investopedia, Fidelity has continued to improve key pieces of its trading platform. The broker is committed to lowering the cost of investing for traders.

Robinhood’s claim to fame is that it doesn’t charge fees for trading in stocks, ETFs, options, and cryptocurrencies. However, Robinhood isn't the only broker with the distinction now due to industry-wide changes.

StockBrokers.com also ranked Fidelity as the best overall online broker in 2020. Fidelity was ranked above Robinhood, Merrill Edge, Webull, Interactive Brokers, SpeedTrader, and TradeStation. The website said that Fidelity is a value-driven online broker that offers commission-free stock trades, industry-leading research, an easy-to-use mobile app, excellent trading tools, and comprehensive retirement services. Serving more than 30 million users, Fidelity is a winner for active investors.

How much do Robinhood and Fidelity cost?

In October 2019, Fidelity eliminated commissions for online trading. The broker doesn't charge fees for online trading of stocks, options, and ETFs for U.S.-based customers. Fidelity charges $32.95 for each broker-assisted trade and a per-contract option fee of $0.65. The margin interest rates are at par with the industry.

Robinhood’s trading commissions are free. Investors can trade stocks, options, cryptocurrencies, and ETFs at no cost. To trade on margin, an investor needs a Robinhood Gold premium subscription at $5 per month, which includes $1,000 of margin. The investor will be charged 5 percent interest if the margin usage is more than $1,000, which is comparatively low in the industry.

The biggest difference between Robinhood and Fidelity when it comes to expenses and how the brokerage firms make money for and from investors is the price improvement. Fidelity users enjoy a healthy rate of price improvement on their equity orders, but lower than average for options. On average, options orders receive $0.0342 per contract in price improvement and equity orders receive $0.0091 per share. Robinhood doesn’t reveal its price improvement statistics.

What can investors choose with Robinhood and Fidelity?

Fidelity offers a wider range of investment options compared to Robinhood. Fidelity offers investors access to equities (including fractional shares), options, mutual funds, international exchanges, and OTCBB/penny stocks. The brokerage doesn’t offer futures and cryptocurrency trading.

Robinhood allows an investor to trade cryptocurrencies in the same account that's used for options and equities. However, Robinhood users will miss a few asset classes like bonds, mutual funds, and forex.

Fidelity offers banking services like savings accounts, checking accounts, debit cards, and credit cards, while Robinhood only offers debit cards.

Robinhood's and Fidelity's trading platforms and tools

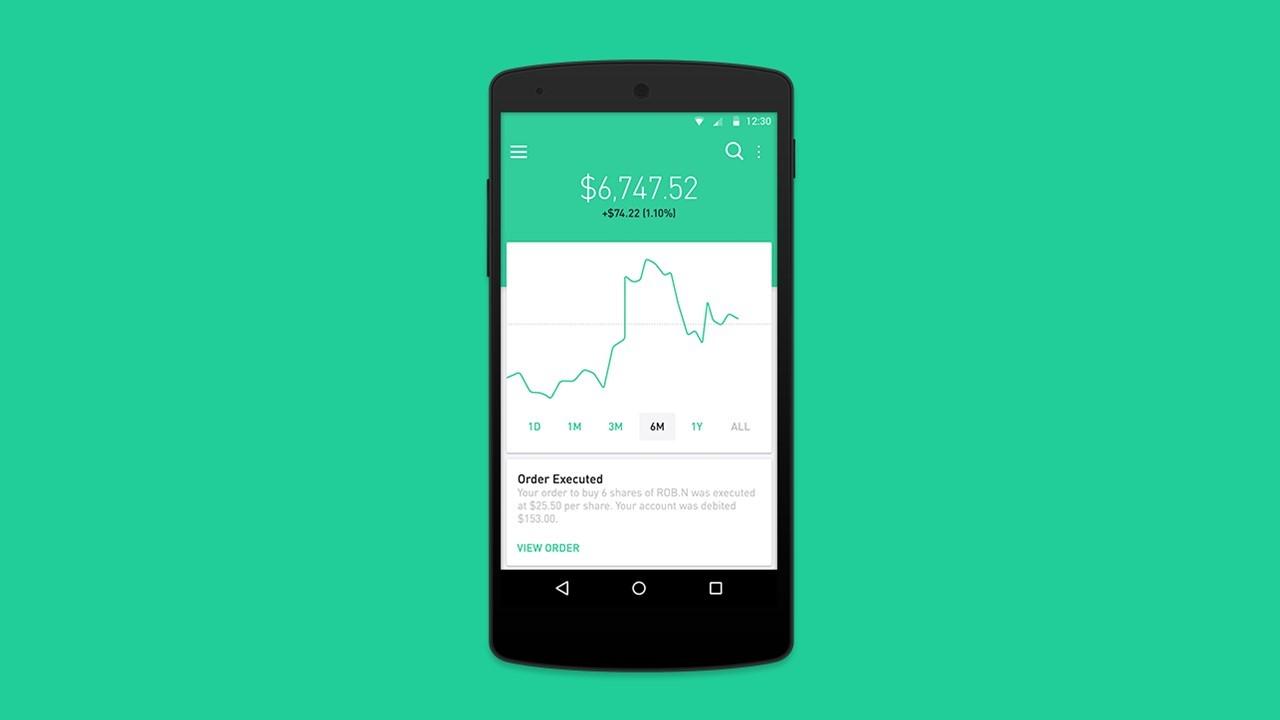

According to StockBrokers.com, Fidelity offers better trading tools, research capabilities, and a mobile app. Fidelity provides a richer experience overall as its trading platform is customizable. In comparison, Robinhood offers a very basic trading platform with lower functionality.