Top Publicly-Traded Consulting Firms and How to Invest in Them

Publicly-traded consulting firms give investors a chance to play the global economic rebound after the coronavirus pandemic. Which firms are a good bet?

March 23 2021, Published 2:52 p.m. ET

Many investors are familiar with auditing and consulting giants PwC, Deloitte, KPMG, and E&Y. Unfortunately, they are private entities. If you want to find a good consulting stock, you’ll have to look beyond the Big Four for publicly-traded consulting firms.

Consultancy can be a lucrative business because companies in this space are usually profitable. In addition to price appreciation, many publicly-traded consulting firms also pay dividends. Consulting stocks could be rewarding for investors who make the right picks.

Top publicly-traded consulting firms

Most large consulting firms are private. Being private eliminates the pressure to meet investors' expectations like delivering consistent revenue and profit growth sequentially or YoY. However, investors seeking consulting stocks still have many options. Here are some of the top publicly-traded consulting firms you might want to consider adding to your portfolio.

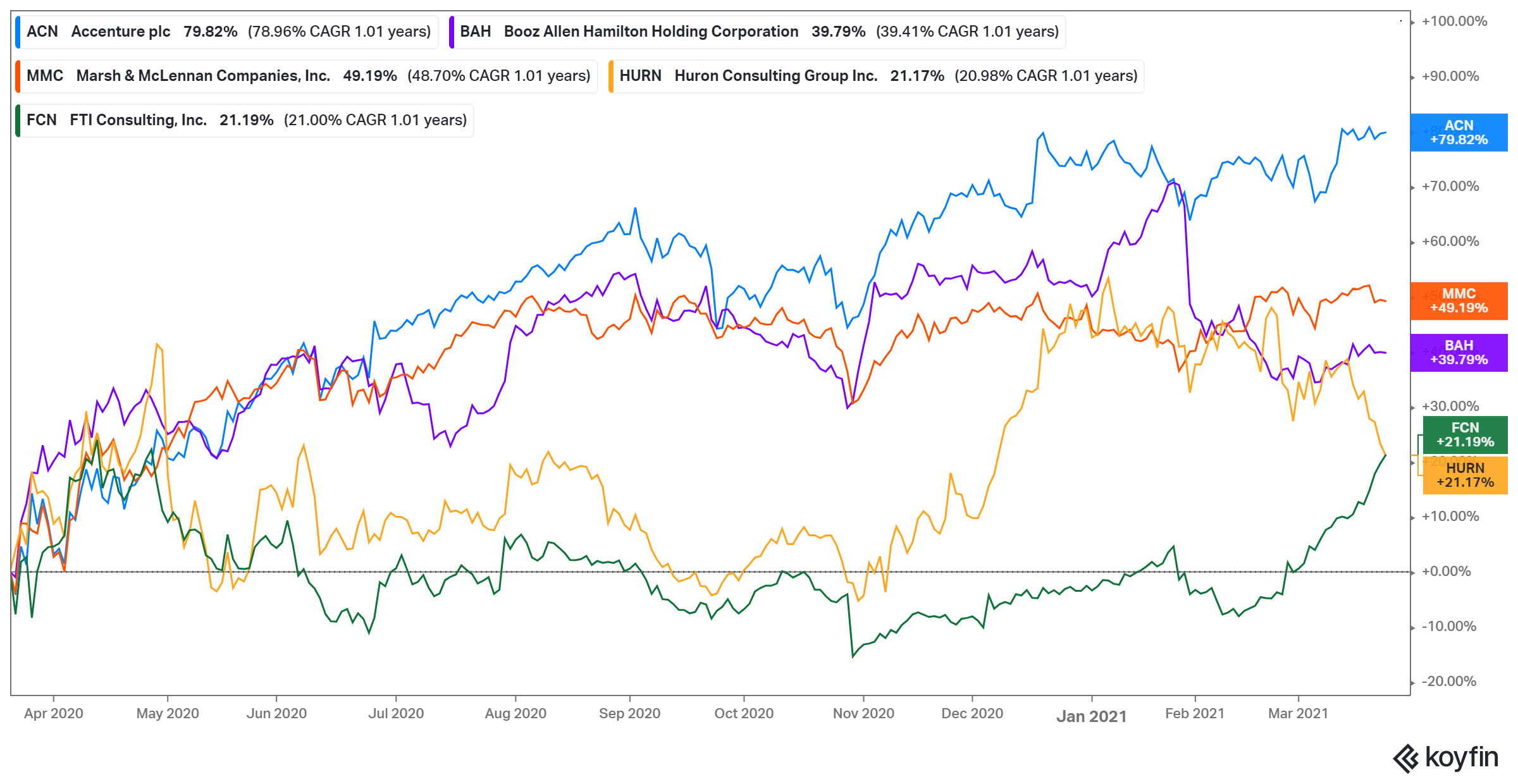

- Accenture (ACN)

- Booz Allen Hamilton (BAH)

- Marsh & McLennan (MMC)

- Huron Consulting (HURN)

- FTI Consulting (FCN)

Accenture stock has moved little in 2021 but it has returned about 70 percent in the past 12 months. Its lifetime returns stand at more than 2,200 percent. ACN's stock forecast shows a 10 percent upside potential from the current level. Accenture pays a dividend and the stock currently offers a 1.33 percent yield. Accenture’s market cap is about $180 billion.

Booz Allen Hamilton stock has climbed more than 20 percent in the past 12 months, but it still trades at a 20 percent discount to its recent high. BAH stock boasts lifetime returns of about 900 percent. At about $80 per share, BAH stock offers a dividend yield of 1.84 percent. BAH's stock forecast shows a 25 percent upside potential from the current level. Booz has a market cap of $11 billion.

Marsh & McLennan has a market cap of $60 billion. Its shares have risen 30 percent in the past 12 months and it boasts lifetime returns of more than 23,000 percent. At $119 per share, MMC stock offers a dividend yield of 1.57 percent.

Huron Consulting stock is down about 10 percent YTD. The stock is up about 20 percent in the past 12 months and sports lifetime returns of about 180 percent. HURN stock doesn’t pay a dividend, but it has big upside potential. Currently, the stock trades at a 15 percent discount to its recent high. The average price of $67 implies nearly a 30 percent upside potential.

FTI Consulting has a market cap of $4.5 billion. Its shares are up 15 percent YTD and have returned more than 3,000 percent in their lifetime. Although FCN stock doesn’t pay dividends, it compensates for that with huge upside potential. The $165 target price implies more than 26 percent upside from the current level. Right now, the stock trades at a 10 percent discount to its recent high.

IBM and Wipro (WIT) are the other publicly-traded companies with consulting divisions, particularly serving the IT sector. They all pay dividends, yielding 5 percent for IBM and 0.22 percent for Wipro.

Outlook for publicly-traded consulting firms

The consultancy industry’s fortunes closely follow the global economic climate. Organizations have more money when the economy is thriving, which in turn enables them to spend more on consultancy. During hard economic times, organizations rush to control spending. Consulting expenditures are usually among the first to see budget cuts. That means less revenue opportunity for consulting firms.

In the U.S., the consulting market contracted to $64.4 billion in 2020 from $73.6 billion in 2019. The decline stemmed from the economic slowdown amid the coronavirus outbreak. With the vaccine rollout allowing the economy to reopen more, the consultancy industry looked primed for a rebound not just in the U.S. but globally. Starting 2021, the global consultancy market is forecast to grow 8 percent annually for at least the next three years. The industry's improving outlook explains why consulting stocks are starting to receive plenty of investor attention.

How to invest in publicly-traded consulting firms.

Consulting stocks have usually delivered attractive gains for investors over the years. To buy shares in a consulting firm listed on the NYSE or Nasdaq, you’ll need to open a brokerage account. You can open the account with online brokers like Robinhood, SoFi, Webull, or CashApp. Many of these brokers allow you to trade consulting stocks commission-free and you can also purchase fractional shares.

Once you set up the account, you’ll need to fund it, which you can do through a bank transfer. It might take a few days before the funds arrive in your brokerage account. After the funds are in your account, select the consulting stocks that you want to buy, the number of shares to purchase, and place your order. The stocks will be added to your portfolio after the transaction is completed.

For consulting stocks traded over-the-counter, you’ll need to find a broker that supports OTC trading. Keep in mind that some brokers might apply an extra charge to give you access to OTC markets. They are usually platforms for trading penny stocks, which are generally considered risky.