PSTH, IPOD, or IPOF: Which SPAC Is Worth a Buy Now After the Crash?

SPACs have fallen sharply and PSTH, IPOD, and IPOE aren't exceptions. Which of these stocks should you buy before the merger date?

April 30 2021, Published 10:48 a.m. ET

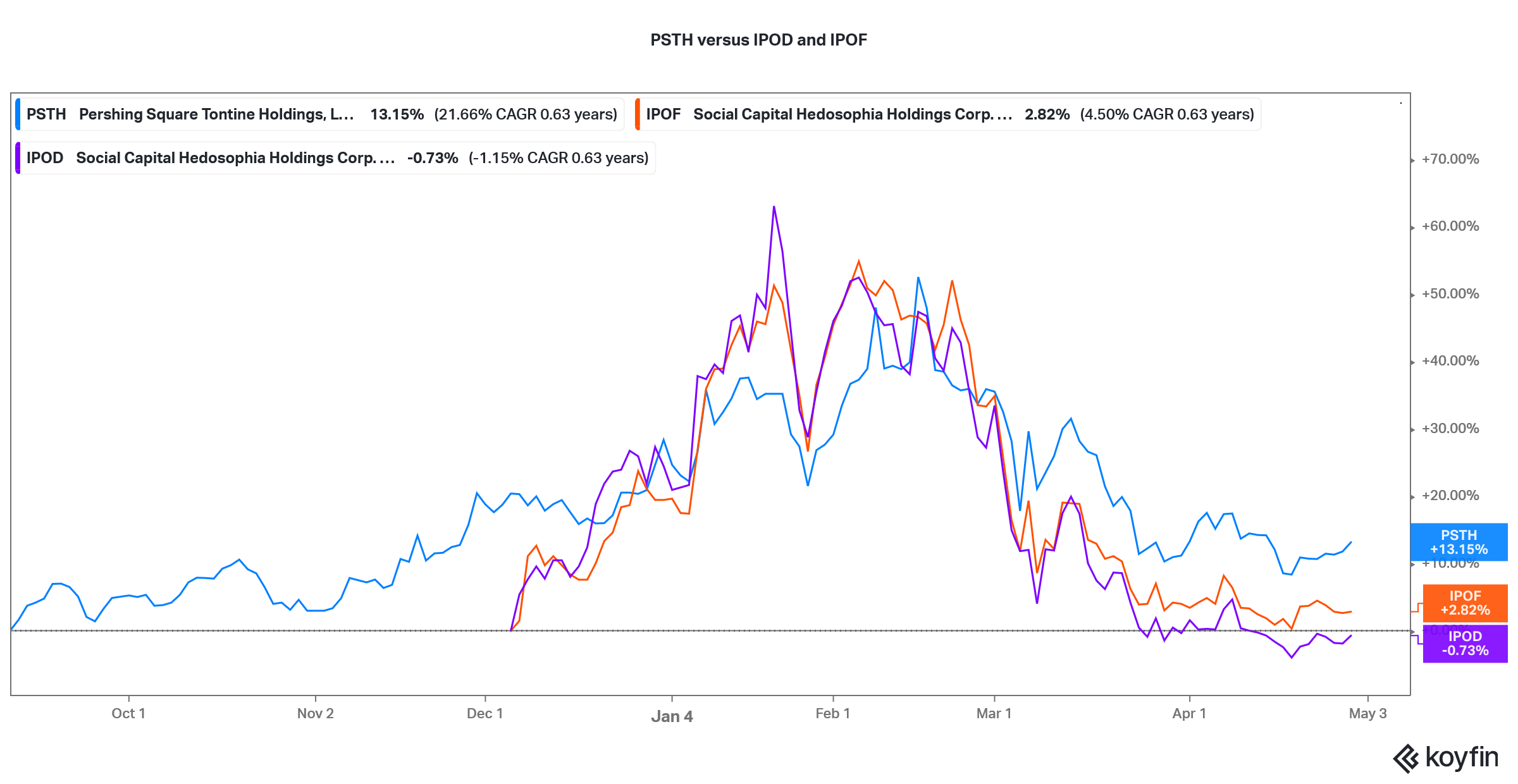

Bill Ackman’s Pershing Square Tontine Holdings (PSTH) is down 28 percent from its 52-week highs. Chamath Palihapitiya’s Social Capital Hedosophia Holding IV (IPOD) and Social Capital Hedosophia Holdings VI (IPOF) are trading 40 percent and 40.5 percent, respectively, below their 52-week highs. Which of these SPAC stocks should you buy now before the merger date?

The SPAC bubble, which hit its peak when bullish investors sent the stock price of Churchill Capital IV (CCIV) to almost a 550 percent premium over its IPO prices, has unfolded. Most SPACs have fallen hard, especially those hunting for targets.

Chamath Palihapitiya versus Bill Ackman

SPACs are known as “blank-check companies” for a reason. While buying a SPAC before it announces the merger, investors trust the competency of the sponsor. Let’s call it the “sponsor premium.”

PSTH versus IPOD and IPOF stock

Now, Palihapitiya’s sponsor premium was strong a few months ago. Companies that went public through a merger with his SPACs, including Virgin Galactic, Opendoor, and Clover Health, were going well. Investors made good returns betting on his ability to find a merger target for the SPACs.

Ackman hasn’t done SPAC deals.

While Ackman doesn't have a track record in executing SPAC mergers, he has solid credentials. First, he was reportedly looking at Airbnb and Stripe as potential merger targets but was snubbed. While Airbnb stock has risen sharply since the IPO, Stripe's private market valuation has surged. Also, Ackman's hedge fund Pershing Square Holdings outperformed the markets by a wide margin in 2019 and 2020.

Ackman rose to fame with his wager against the credit markets and made over $2 billion from the trade, which will go down in the history as one of the best trades ever. However, Ackman isn't a “one-hit-wonder.” He has been a consistent performer over the last two years.

Ackman also had his share of duds. His second bet against the markets in 2020 didn't fetch the desired returns. Also, he sold Berkshire Hathaway stock in 2020. Since then, the stock has outperformed the markets.

PSTH, IPOD, or IPOF: Which SPAC should you buy before the merger?

PSTH is still trading at a premium of over 20 percent over the IPO price, while it's 9 percent and 6 percent, respectively, for IPOD and IPOF stock. Palihapitiya’s sponsor premium has come down for multiple reasons including Hindenburg Research’s allegation against him. Meanwhile, based on a premium over IPO prices, PSTH looks pricey compared to IPOD and IPOF.

However, the premium is justified. While Palihapitiya’s image has been tarnished somewhat, Ackman continues to maintain the aura around him. Second, there's a difference in how the two sponsors have structured their SPACs.

IPOD and IPOF are widely believed to hunt for growth stocks with tech-like abilities. PSTH is looking at mature unicorns and companies that are undervalued compared to their intrinsic value. As I have noted in the past, PSTH is almost looking at the kind of stocks that Warren Buffett buys.

Bill Ackman versus Warren Buffett

The flip side here is that Buffett has been hunting for an “elephant-sized” acquisition for over two years. Ackman’s PSTH is also literally looking for an elephant given the SPAC acquisition criterion. Ackman has been hunting for a target for over nine months, but he hasn’t found one yet.

If I were to pick one out of these three SPACs, I would go with Ackman’s PSTH especially given the shift away from growth stocks to value stocks. While Ackman might not find a pure value company for PSTH, the acquisition criterion is relatively close.