Hot Dog Chain Portillo’s Files Confidentially for IPO

Restaurant chain Portillo’s is looking to go public. The company confidentially filed a draft Form S-1 with the SEC on Jul. 19 for an IPO.

July 19 2021, Published 11:48 a.m. ET

Fast-casual restaurant chain Portillo’s is looking to go public. The company confidentially filed a draft Form S-1 with the SEC on Jul. 19 for an IPO.

Details about the number of shares being offered and the price range of those shares have not been announced. In confidential IPO filings, the company doesn’t release those details until 15 days before the offering.

According to The Wall Street Journal, the restaurant chain, which Warren Buffett’s Berkshire Partners owns, is reportedly seeking a valuation between $2.5 billion and $3 billion. Shares are expected to be trading by the end of 2021, the WSJ reports.

What is Portillo’s?

Portillo’s is known for its Chicago-style hot dogs, Italian beef sandwiches, char-grilled burgers, and chocolate cake. The restaurant started in 1963 when founder Dick Portillo invested $1,100 to buy a small trailer and open a hot dog stand in Villa Park, Illinois. When the original “Dog House” moved to a more permanent location four years later, the business name was changed to Portillo’s.

Berkshire Partners bought the chain in 2014, intending to open more stores every year.

Today, Portillo’s has grown to over 60 restaurants across nine states, including Wisconsin, Indiana, Florida, and Arizona. Portillo’s fans who don’t have a location nearby can order its food online and have it shipped to them. The chain ships food to all 50 states.

During the pandemic lockdown in 2020, Portillo’s continued to serve customers by launching a self-delivery service, reports QSR Magazine.

The fast-casual restaurant market is expected to grow

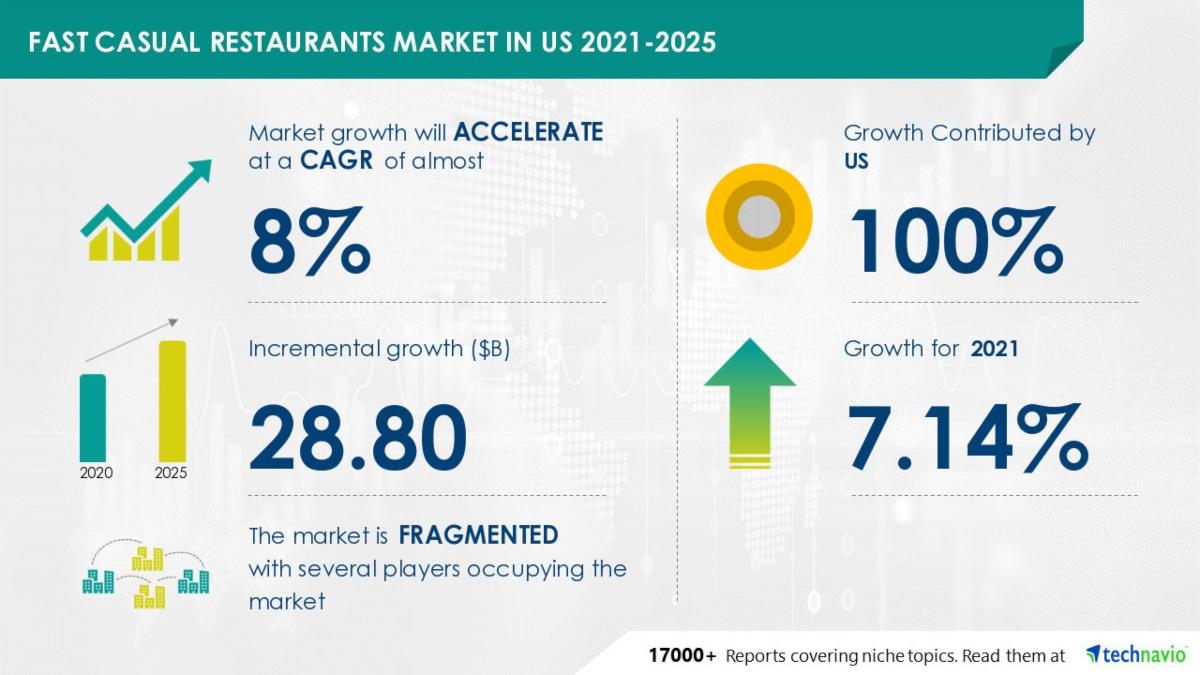

Changing lifestyles and a rise in demand for on-the-go food are driving the popularity of fast-casual restaurants like Portillo’s. According to research company Technavio, the U.S. fast-casual restaurant market is expected to grow by $28.8 billion between 2021 and 2025.

Portillo’s joins other restaurants in going public

That expected growth may be why many restaurant chains are seeking to go public. Portillo’s is one of four chains to announce IPO plans so far this year.

Popular donut chain Krispy Kreme (DNUT) filed to go public in May, and its shares started trading on Jul. 1. Although the company first looked at pricing shares between $21 and $24, its shares opened at $16.30 and climbed to $21 by the end of the day. On Jul. 19, DNUT stock was trading close to its original offering price.

In Jun. 2021, salad restaurant chain Sweetgreen filed confidentially for an IPO. That company is valued at about $1.78 billion. Coffee business Dutch Bros Coffee also filed for a confidential IPO that month, seeking a valuation of about $3 billion.

How to buy Portillo’s stock

After the SEC has completed its review of Portillo’s IPO filing, the company can set how many shares it will sell and at what price range. That information must be released 15 days before the public offering. The company could also decide not to move forward with the IPO.

If Portillo’s proceeds with its IPO, it will have to designate how many shares it will sell and the price range for those shares.