Planet Labs Boasts a Compelling Growth Story and an Edge in Space

Planet Labs is scheduled to go public on Dec. 8 after its merger with the DMYQ SPAC. What PL's stock forecast after the combination?

Dec. 7 2021, Published 9:16 a.m. ET

On Dec. 3, dMY Technology Group IV (DMYQ) shareholders approved the SPAC's combination with Planet Labs. DMYQ was targeting disruptive companies in the tech space for a merger. The deal is expected to be completed on Dec. 7, and the combined entity will start trading on the NYSE on Dec. 8 under the ticker symbol “PL”. What is Planet Labs' stock forecast after the merger?

Founded in 2010, Planet Labs is satellite imagery provider that sells geospatial data and analytics software to businesses and government agencies. Backed by Alphabet’s Google, the company was established by three former NASA scientists. It has about 700 customers concentrated in industries such as agriculture and mapping.

The Planet Labs-DMYQ merger details

Planet Labs will receive nearly $600 million in gross proceeds in a deal that will value it at about $2.8 billion. The proceeds include $252 million in PIPE (private investment in public equity) from Alphabet, Salesforce, TIME Ventures, and Koch Strategic Platforms. Planet Labs plans to acquire more customers, increase its data offerings, and make more acquisitions through the funds it receives from the merger.

Analysts are bullish on DMYQ thanks to Planet Labs’ attractive business model

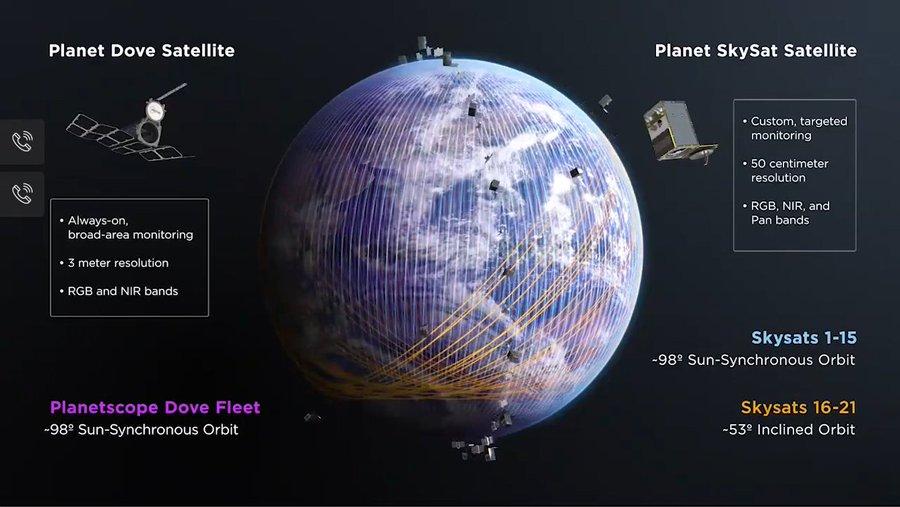

According to MarketBeat, all four analysts covering DMYQ recommend “buy.” Their average target price of $16 implies a 63 percent upside for the stock. Northland likes Planet Labs' data subscription model, which “captures a picture daily of every inch of the globe.”

Is Planet Labs a good buy?

Planet Labs generates its revenue through geospatial data and analytics software subscriptions it sells to businesses and government agencies. In fiscal 2021, it had revenue of $100 million, and it expects that to grow to $191 million by fiscal 2023. The company expects to turn a quarterly profit by fiscal 2025.

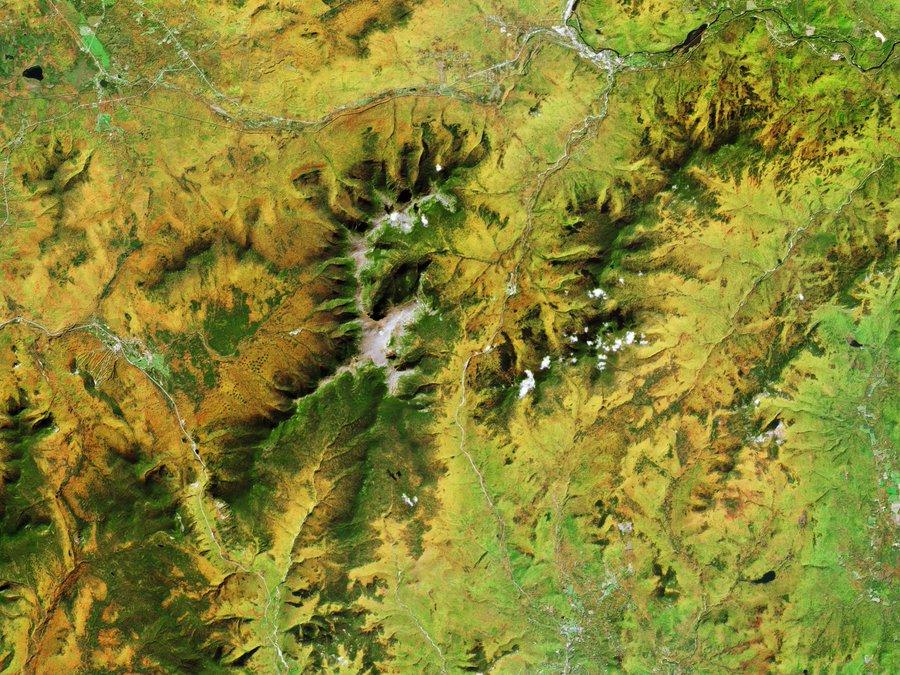

Planet Labs operates the largest constellation of satellites (nearly 200) taking Earth’s photos from orbit. The company upgrades its satellite fleet every three years, and even during the COVID-19 pandemic, ts work pipeline grew by 45 percent.

Over the next five years, the company expects to keep growing by 44 percent annually but doesn't see its costs growing at the same rate. In fact, it foresees its replacement costs holding steady, and expects its gross margins to expand to 74 percent in fiscal 2026 from 40 percent in 2021.

Planet Labs’ forecast after the merger

Companies that go public through a SPAC tend to see their stock fall immediately after their merger's completion. However, although Planet Labs stock could be weak initially, its long-term prospects remain strong.

The stock is a smart play on space and data analytics, and the funds raised through the merger should further its already compelling growth and capabilities. Planet Labs’ long presence in space, suite of expensive satellites, and large data archives should give it an edge in the market.