Alternative Fuel Company Opal Is Going Public in SPAC Deal

Alternative fuel company Opal Fuels is getting a shot at the public market thanks to a multi-billion-dollar SPAC deal. What can investors expect?

Dec. 2 2021, Published 11:56 a.m. ET

Renewable natural gas company Opal Fuels is getting ready to hit the public market. It plans to merge with a SPAC in a multi-billion-dollar deal that could pave the way for innovative renewable fuel solutions.

Here are the details on Opal Fuel—based in White Plains, N.Y. but operating all across the U.S.—and its SPAC IPO to come.

What does Opal Fuels' $2 billion SPAC deal include?

Opal Fuels has reached an agreement to merge with blank-check firm ArcLight Clean Transition Corp. II. The deal is worth $2 billion and will launch Opal into the public market without the need for a lengthy and expensive traditional IPO.

ArcLight Clean Transition Corp. II is the second in a line of SPACs dedicated to sustainability. The first merged with electric vehicle technology manufacturer Proterra (NASDAQ:PTRA), which hit the market in mid-January and has since lost nearly 60 percent of its value.

Opal Fuels will also list on the Nasdaq, although the company likely hopes that its fate will be different than Proterra over its first year of being public.

The $2 billion deal includes a $125 million fully committed PIPE (private placement in public equity) investment. Investors include NextEra Energy, Electron Capital Partners, Gunvor Group, and Wellington Management.

What does Opal Fuels do?

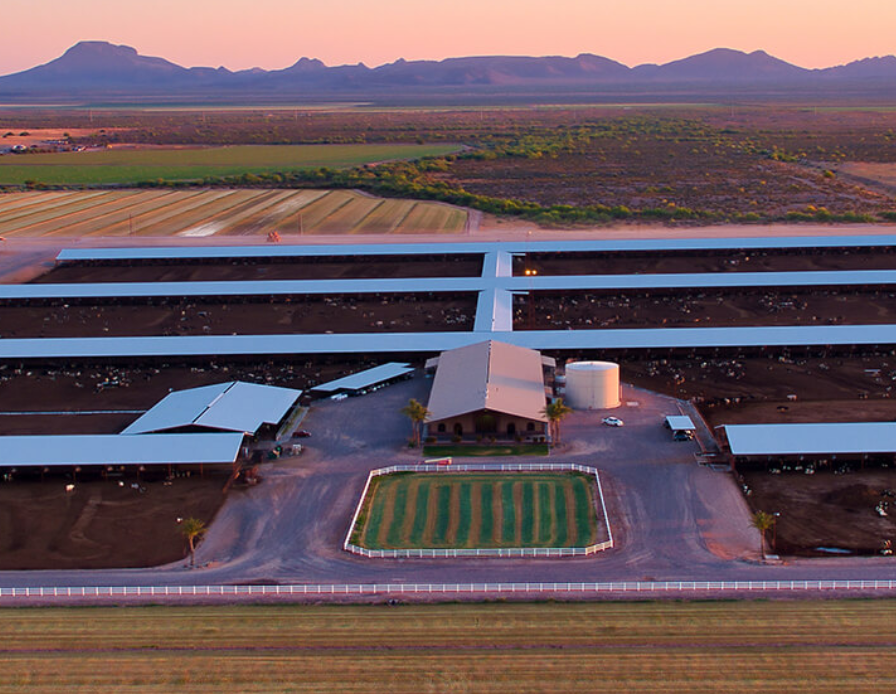

Opal has an innovative business model. It captures methane from landfills and dairy farms—two environments that produce the most methane emissions—and converts the greenhouse gas into a diesel fuel alternative.

"Methane emissions are captured on-site at landfills and livestock farms before they are released into the atmosphere or are required to be burned off," Opal's website says. The company cleans emissions and repurposes them at on-site processing facilities.

Opal also delivers renewable natural gas (RNG) to trucking clients, not the least of which is the UPS and Waste Management. Its fuel stations can be found in 42 states across the U.S.

The company's renewable focus could become more prominent in the years ahead as the market shifts to a more sustainable fuel approach.

Opal is still a young company.

Parent company Fortistar LLC created Opal Fuels in 2020 as a combination of three unique entities—Fortistar Methane Group, Fortistar RNG, and TruStar Energy.

This method juxtaposes recent conglomerate breakups, namely that of General Electric and Johnson & Johnson.

Although Opal was built on existing businesses, its unique makeup is a startup in its own right. Investors should keep that in mind as the Opal SPAC moves forward.

Once the Opal and ArcLight merger is complete, the newly formed company will still be spearheaded by Opal co-CEOs Adam Comora and Jonathan Maurer.

When will Opal Fuel's ticker hit the market?

Right now, ArcLight Clean Transition Corp. II is trading on the Nasdaq under the ticker symbol "ACTD." It went public in May and its stock value has fluctuated, although the value has generally remained consistent.

The company hasn't shared an official merger date yet. However, investors can keep their eyes peeled for the "OPL" ticker symbol.