NYSE Short Sale Restriction List Tries to Bring Stability to a Volatile Market

The NYSE maintains a short sale restriction list. What should investors know about this ever-changing roundup? What does the list intend to do?

Feb. 3 2021, Published 1:24 p.m. ET

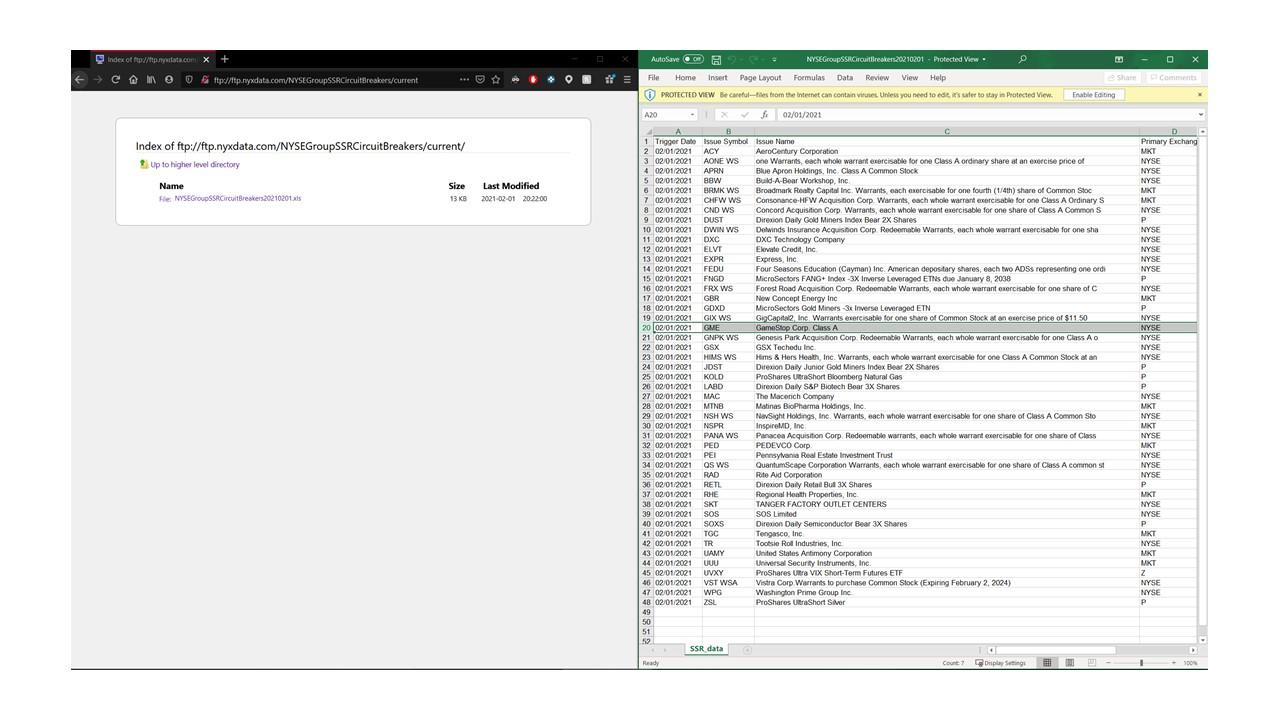

Head to the NYSE Arca Notices section of the exchange's website and you will find a list of the latest short sale restrictions. The list is updated on a regular basis and provides access to ongoing restrictions for shorted stocks on the exchange.

You can imagine that after a period of heavy short squeeze activity, the list becomes all the more relevant. As GameStop's trading volume shrinks from its January 2021 peak, it seems like the NYSE is taking action through short sale restrictions.

What is the short sale restriction list?

Any stock that's on the NYSE is automatically added to the short sale restriction list when there's a loss greater than 10 percent against the value of the prior day's closing. This practice is applicable even when market manipulation from hedge funds and institutional investors is at the core of the value adjustment.

Why does this happen? It has to do with the Uptick Rule or Rule 201 from the SEC. The rule lets investors exit long positions prior to a round of short selling. The rule triggers if the stock has a 10 percent intraday fall. In this instance, short selling is only allowed if the price they're targeting is above the current best bid.

All in all, these efforts from both the SEC and the NYSE help stabilize a volatile market and mitigate stress for retail investors, hedge funds, and everyone in between. Panicked sell-offs can trigger extensive, long-lasting instability, and this rule serves as a way to combat that. It just goes to show how much the stock market is rooted in our psyches, and that sometimes it's best to hand things over to the gatekeepers — if only for the time being.

GameStop was added to the NYSE short sale restriction list in early February

On February 1, 2021, the NYSE added class A stock from GameStop (NYSE:GME) to the list. It's worth noting that this is what the exchange refers to as a "circuit breaker" that lasts temporarily, likely 1–2 market days. However, it really depends on how long prices stay low and could extend further into the week.

Other stocks on the NYSE short restriction list (for now)

The NYSE short restriction list changes frequently, especially in times of high volatility (which early February 2021 effectively falls under). On Feb. 3, the spreadsheet consisted of stocks like Blue Apron (NYSE: APRN), whose stock fell 11.43 percent.

The Pennsylvania Real Estate Investment Trust (NYSE: PEI) fell as much as 10.34 percent, while Tootsie Roll Industries, Inc. (NYSE: TR) fell 21.95 percent.

BlackBerry Limited (NYSE:BB) has also been a short squeeze target in recent weeks. BlackBerry has made its way to the NYSE short restriction list for now after losing 20.69 percent of its share value.

Virgin Galactic Holdings Inc. (NYSE: SPCE) shares fell 16.84 percent in a day, while Washington Prime Group Inc. (NYSE: WPG) dipped a rough 27.74 percent.