Forget the Stock Split, Nvidia (NVDA) Is a Great Buy Due to Catalysts

Nvidia stock started trading after a 4-for-1 split on July 20. At 11:00 a.m. ET, the stock was trading 2.7 percent lower. What is Nvidia’s stock forecast?

July 20 2021, Published 11:58 a.m. ET

Nvidia is going for 4-for-1 stock split and it started trading on a split-adjusted basis on July 20. Stock splits are just a sub-division of a unit of share and usually don’t impact the fundamental value of the stock. What is Nvidia’s forecast after the stock split?

When popular companies resort to a stock split, the trading volumes could rise since the stock becomes more affordable. This happened when Tesla and Apple did stock splits last year. However, with most trading platforms like Robinhood now providing free fractional trading, a stock split shouldn't be a big draw for investors. That being said, there are multiple reasons for investors to be optimistic about the stock.

Nvidia’s stock outperformance

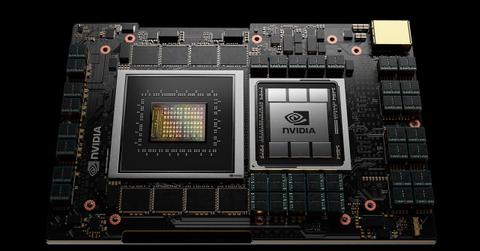

Nvidia stock has risen by more than 80 percent in the last year. The post-pandemic boom in semiconductor stocks is impacting NVDA positively. The stock has also outperformed its peers in the space mainly due to its chips’ capabilities, which make them better for AI performance and mining cryptocurrencies. The crypto boom in 2021 has had positive fallout for the stock.

Nvidia stock forecast—analysts are more constructive

Nvidia is one of the heavily covered stocks with 32 analysts covering it, according to Market Beat. The consensus market rating for the stock is a buy with 28 analysts recommending it, while the remaining three analysts recommend a hold for the stock. Analysts’ consensus target price is $729.7, which implies a potential downside of nearly 3 percent. Recently, many investment banks have turned even more constructive on the stock.

On July 15, Mizuho boosted the stock’s target price to $900 from $710 and reiterated its buy recommendation. The analyst increased his estimates and thinks that Nvidia will remain the dominant leader in the accelerated AI space.

Truist Securities also raised NVDA’s target price from $768 to $910 on July 8. On the same day, Oppenheimer increased NVDA’s target price by 32 percent to $925. BMO Capital Markets hiked its target price to the street high of $1,000 on July 1. The firm cited a bullish view on the semiconductor company’s data center business. Keybanc analyst John Vinh also raised his target price for NVDA from $775 to $950 due to strong demand expectations from video graphics cards, which are used for gaming and crypto mining.

Does Nvidia's valuation look rich?

Nvidia is trading at an NTM price-to-normalized earnings multiple of 47x, which is in line with its last one-year average. While the valuation might look a bit rich, it’s supported by robust demand growth and the company’s superior industry position. The data center and GPU demand is expected to stay strong going forward. Given the 5G supercycle, the multiple looks justified.

Is Nvidia stock a buy?

Nvidia is making a strong move in chips, which are used in driverless cars, supercomputers, data centers, and drug development. These technologies are at the cutting edge of the future. Since AI is incorporated in all of the aspects of future technology, Nvidia is expected to be the leader in this space. This should catapult Nvidia stock to greater heights. The stock seems like a good buy now.