Chip Shortage Will Impact NIO’s Q1 Deliveries, Growth Story Intact

NIO stock usually rises after it reports delivery numbers due to the positive surprise. Could NIO stock rise on its first-quarter delivery numbers as well?

March 31 2021, Published 9:26 a.m. ET

NIO is scheduled to announce its first-quarter deliveries soon. The stock usually soars after NIO comes up with a delivery report. How will NIO stock react to its first-quarter deliveries? Could the company maintain the upward streak after its first-quarter deliveries?

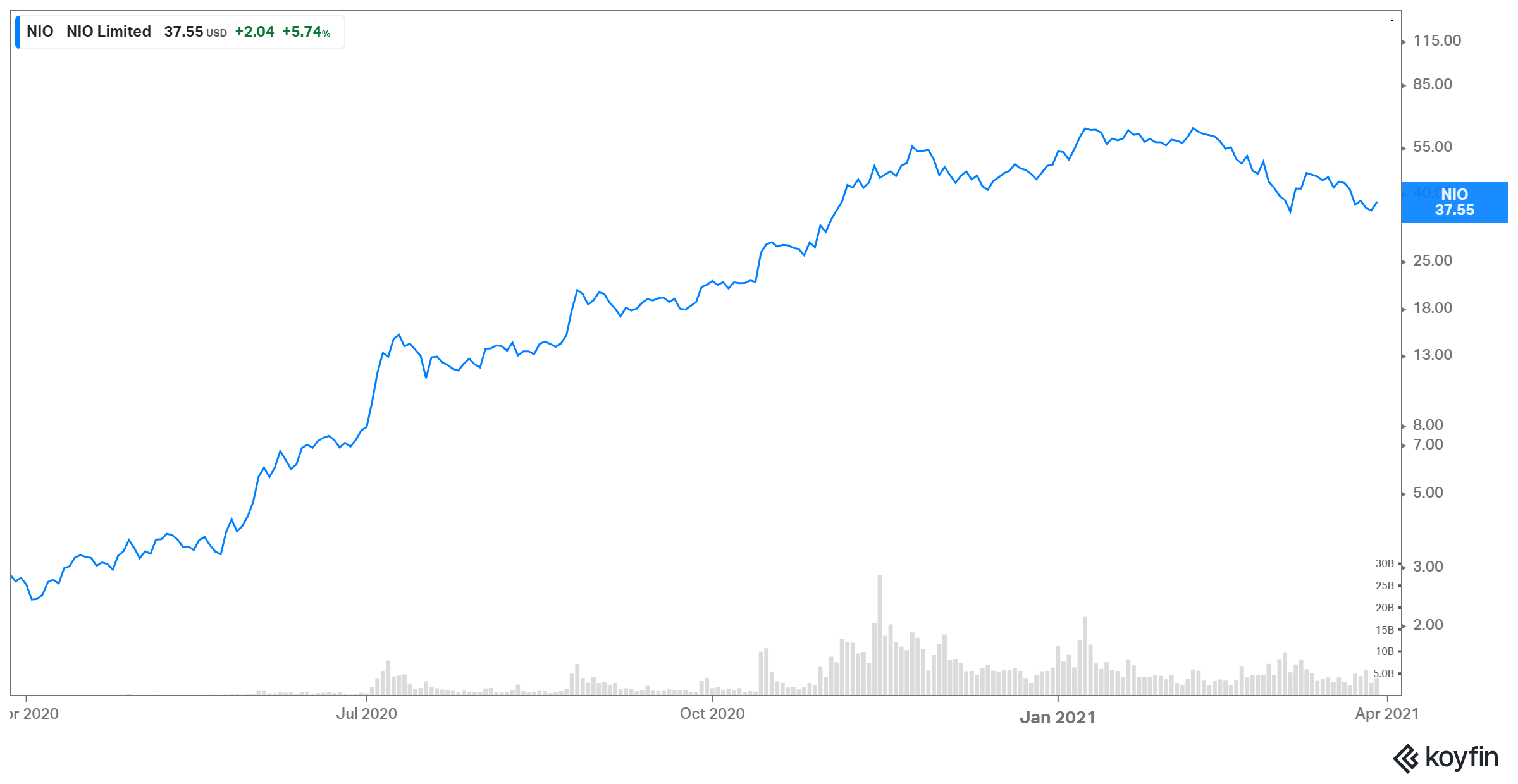

NIO stock has been hit lately by macroeconomic and company-specific issues. The stock is trading down by more than 20 percent YTD. However, NIO isn't the only EV-maker that has witnessed a fall. Most of the EV-makers have seen their stock prices decline.

How many cars NIO could deliver in Q1

NIO usually underpromises and over-delivers when it comes to vehicle deliveries. The positive surprise factor has mainly led to a surge in its stock price after the announcement of delivery numbers. Will the company be able to keep up with this positive surprise factor in its first-quarter deliveries? It seems slightly unlikely. Recently, NIO lowered its guidance for first-quarter deliveries from 20,000–25,000 to 19,500.

How the chip shortage is hurting NIO

The global chip shortage is hurting NIO and many other automakers and phone makers globally. Recently, Ford canceled shifts at two car plants. It also said that profits could be hit by up to $2.5 billion this year due to chip shortages. General Motors is estimating a profit hit of $2 billion.

On March 26, NIO announced that due to the global chip shortage, it's shutting down a factory for five days. The halt, beginning on March 29, will impact its first-quarter deliveries negatively. Its production volume has been impacted negatively during March in general. The company mentioned that due to this shortage, its first-quarter deliveries will be reduced by at least 500 vehicles. NIO guided for deliveries of 20,000–20,500 previously. With the recent update, the number is expected to fall down to 19,500.

During the results for the fourth quarter of 2020, NIO CEO William Li mentioned that while the company’s production capacity had climbed to 10,000 vehicles a month in February from 7,500, a shortage in chips and batteries will force a slowdown back to 7,500 vehicles a month during the second quarter.

The specialized supply chain of semiconductors has been impacted due to several factors. Initially, the COVID-19 pandemic impacted the supplies because factories were shut down. Although the production is back to normal, a surge in demand due to the new normal has outpaced supply. The demand-supply situation might take some time to balance again. It will take time for complex semiconductor facilities to start running.

Why NIO stock has been falling

After having a tremendous 2020 (more than a 1,100 percent gain), NIO stock has been depicting weakness lately. The stock is down over 20 percent YTD and more than 40 percent from the 52-week high it hit on Feb. 9. However, NIO can’t be singled out when it comes to stock weakness. All of the major EV stocks, including Tesla, XPeng, and Li Auto, are falling. The decline is part of the broader sell-off in tech-related names due to the risk-off sentiment and the shift in investor sentiment towards cyclical.

The global chip shortage is also taking a toll on NIO and other EV-makers. NIO has already mentioned that the shortage could lead to lower production during the second quarter. With the recent update, NIO made clear that the shortage has impacted its first-quarter deliveries as well.

Can NIO stock rise after Q1 delivery report?

Usually, NIO stock rises after its delivery report each month since it beats its guidance and analyst estimates. In the first quarter, the margin of error seems thin. NIO revised down its delivery number guidance for the first quarter on March 26. Since the update came in late during the quarter, it seems that NIO has more or less assessed the impact of the negative event on the production already. The company might have kept a slight upside to deliveries but the extent of the upside shouldn't be huge. Therefore, NIO stock might not stage a huge rally after the first-quarter delivery report.

The stock could have an upside. In fact, the recent stock weakness has created an attractive opportunity for long-term investors to buy more. NIO long-term growth story remains intact with dramatic EV growth expected in China due to the government’s aggressive push. The company is still going to nearly double its revenue this year. NIO's margins are going to expand and so will its international reach. The global chip shortage is expected to start easing by the second half of 2021, which should lift the remaining overhang on the stock.