NIO Stock Forecast: Next EV Stock to Explode After RIVN?

NIO has continued to sag even though other EV stocks have surged. What’s the forecast for NIO stock?

Nov. 17 2021, Published 9:04 a.m. ET

There has been a rally in EV stocks this week. Rivian has continued to rally and its market cap is now almost $150 billion. Some of the other EV names like Lucid Motors, Fisker, Canoo, and Li Auto have also rallied. However, Chinese EV stock NIO has continued to sag. What’s the forecast for NIO stock and could it be the next EV stock to explode?

While EV stocks traded on a weak note in the second and third quarters of 2021, they have looked strong in the fourth quarter. Lucid Motors was the first major EV stock to see buying momentum after the company started deliveries. Then, Tesla stock exploded and continued to rally until CEO Elon Musk announced plans to sell Tesla shares.

EV stocks move in tandem

EV stocks tend to move in tandem and Tesla usually leads the rally. Tesla rose 740 percent in 2020 and its market cap surpassed that of all leading automakers. Now, it's a $1 trillion company—the first automaker to achieve that feat.

NIO stock forecast

NIO stock has lost over 16 percent in 2021 and is among the worst-performing major EV stocks. The stock trades at a discount of 40 percent from its 52-week highs and is in a bear market territory. Its market cap is around $62 billion, which is below that of Lucid Motors.

Meanwhile, the long-term forecast for NIO stock looks positive and it's among the best Chinese EV stocks to buy. Wall Street analysts are also bullish on the stock and consensus estimates call for an upside of almost 50 percent over the next 12 months. While most other EV stocks have run far ahead of their target prices, NIO trades at a steep discount to its consensus target price.

Analysts' estimates shouldn’t be the only indicator that you should base your investment decision on. In many cases, stocks can trade way above or below their target prices. However, the estimates do tell us what analysts expect from a particular company.

Could NIO be the next EV stock to explode?

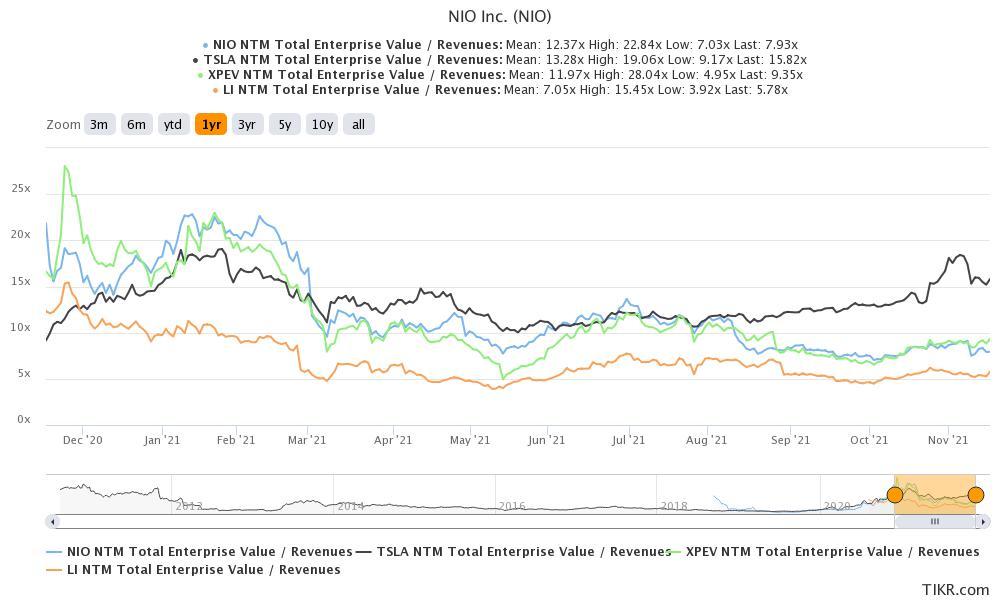

Looking at the current momentum in EV stocks, NIO could be the next EV name to explode. The stock looks attractive from a valuation perspective and trades at an NTM EV-to-revenue multiple of 7.9x, which is almost half that of Tesla.

After its recent underperformance, NIO’s valuation multiples are now even below that of fellow Chinese EV stocks. Xpeng Motors trades at an NTM EV-to-revenue multiple of 9.4x.

The continued momentum in EV stocks combined with the comparatively lower valuations makes NIO a prime candidate for a rerating. However, the stock might also need a trigger to explode. NIO's earnings have been mixed and its short-term outlook has been clouded by the global chip shortage situation.

What could take NIO stock higher?

NIO’s upcoming ET7 sedan could be one trigger that would take the stock higher. Also, NIO Day is expected in December where the company might announce new models. EV stocks tend to rally around these annual events and even legacy automakers have started to hold their own versions of these annual days.

Given the fact that valuations in the EV industry have been relative rather than absolute, NIO appears to be one of the best EV stocks to buy now. NIO has been under pressure due to supply chain issues and the general pessimism towards Chinese stocks, but this quality EV name might not stay at such depressed price levels for long.