Here Are Six Investments Michael Burry Prefers Over Tesla

If you’re wondering where to invest your hard-earned cash, maybe you should look to the portfolio of legendary investor Michael Burry.

May 21 2021, Published 8:09 a.m. ET

If you’re wondering where to invest your hard-earned cash, maybe you should look to the portfolio of legendary investor Michael Burry.

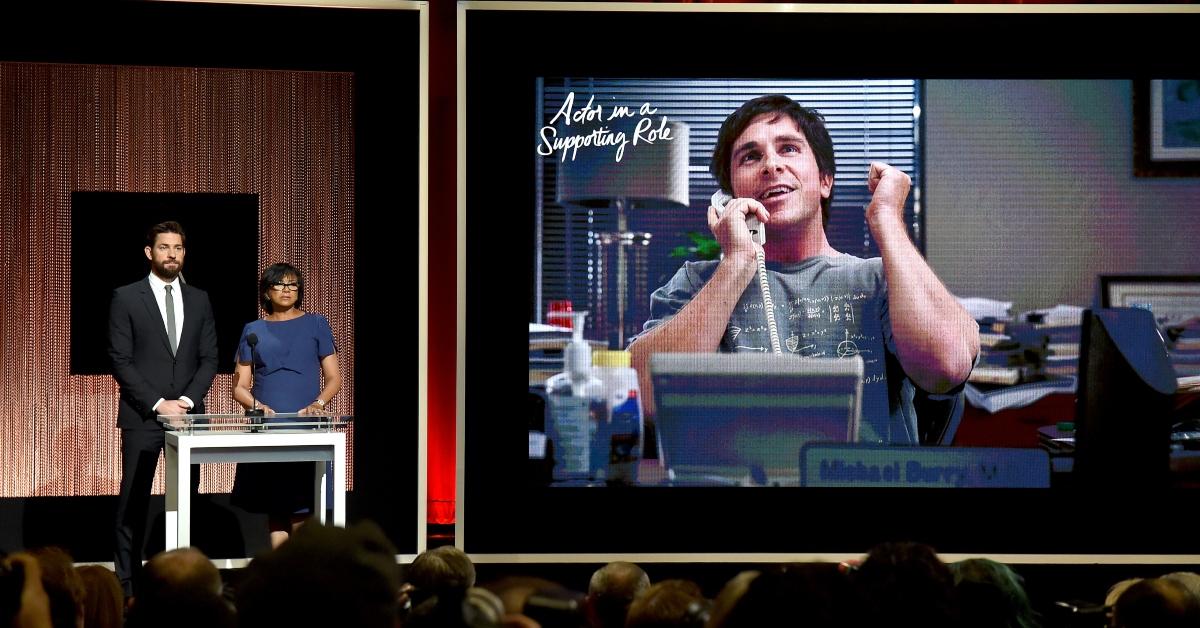

Burry is the hedge fund manager of Scion Asset Management. However, his real claim to fame is being one of the first investors to call and profit from the subprime mortgage crisis of 2007. The story of Burry’s 2007 gain was the focus of the Oscar-winning movie, The Big Short, which starred Christian Bale as Burry.

Michael Burry bets against Tesla.

This week, Burry was in the news again when a filing with the SEC showed that he owns a $534 million short position in Tesla. That means if Tesla loses money, Burry profits.

CNBC reported that Burry said, in a now-deleted tweet, that Tesla’s reliance on regulatory credits to generate profits is a red flag.

Tesla shares dropped 4 percent after Burry’s comments, which put it at a 20 percent loss for the month.

Stocks Michael Burry is buying

Burry has a pretty good track record on investments. Besides the subprime mortgages, he also profited from taking a long position on GameStop about the same time as the stock’s short squeeze.

The investment portfolio of Burry’s Scion Asset Management firm includes Facebook and Google. Here are six other companies on the list of Burry’s top 10 investments:

The Kraft Heinz Company (NASDAQ: KHC)

About 3.5 percent of Scion Asset Management’s portfolio is in The Kraft Heinz Company, a well-known food and beverage company. Burry’s firm owns over 1.1 million shares worth over $46 million. Investors in this stock have received a 43 percent return in the past year.

NetApp, Inc. (NASDAQ: NTAP)

California-based NetApp, Inc. offers data management and cloud services. Scion Asset Management owns 300,000 shares worth over $21 million. It accounts for 1.5 percent of Scion’s total portfolio. It pays regular dividends and returned over 65 percent to investors in the past year.

CVS Health Corporation (NYSE: CVS)

CVS Health Corporation operates over 10,000 retail pharmacy stores across the country. In the past year, CVS Health stock returned over 39 percent to investors. Burry’s firm owns 400,000 shares of the company valued at $30 million. It makes up 2.2 percent of the firm’s total portfolio.

SunCoke Energy, Inc. (NYSE: SXC)

The first-quarter 2021 revenue for SunCoke Energy, Inc. (NYSE: SXC), a raw material processing and handling company, beat market estimates. Within the past year, investors saw returns of more than 130 percent. Scion Asset Management owns over 1 million shares worth over $7.7 million.

Ingles Markets, Inc. (NASDAQ: IMKTA)

Ingles Markets, Inc. operates about 200 supermarkets in six southeastern states. The company’s annual sales revenue is estimated to be almost $4 billion. Scion Asset Management has 150,000 shares in the company valued at over $9.2 million.

CoreCivic, Inc (NYSE: CXW)

CoreCivic manages over 65 state and federal correctional and detention facilities in 19 states and the District of Columbia. Burry’s firm owns more than 1 million shares worth $9.9 million. For the first quarter of 2021, CoreCivic reported over $454 million in revenue.