Don’t Fall Prey to the Marin Software-Google Partnership

Marin Software stock was trading higher on Sep. 22 amid a possible short squeeze. What's the forecast for MRIN after the company's Google deal?

Sept. 22 2021, Published 6:47 a.m. ET

Marin Software (MRIN) stock was up in premarket trading on Sep. 22, and has almost doubled in 2021. Why is MRIN stock going up, and should you buy it despite the surge? What’s the forecast for the company amid the rally?

Marin Software, a San Francisco-based advertising company, provides a platform for digital ad buyers. The stock has had a wild ride in 2021, reaching a high of $27.26 in July and then falling below $5 in August. Before its spike on Sep. 22, the stock was trading at $5.69.

Why is MRIN stock going up?

Over the last couple of months, MRIN has had several positive developments. In an update in late Jun. 2021, Marin said that it would support Instacart ads. Then in Aug. 2021, the company announced an integration with Criteo’s commerce media platform.

Commenting on the move, Marin CEO Chris Lien said, “With this integration, we can tap into Criteo's commerce data and intelligence to further our mission of providing advertisers with seamless access to customers across their customer journey, from the top of the funnel to the point of purchase."

The Marin Software–Google partnership, explained

In an SEC filing, Marin said it had entered into a revenue-sharing agreement with Google for developing its enterprise tech platform and other software products. The new agreement will come into effect in Oct. 2021 after the termination of the existing agreement, which was signed in Dec. 2018.

The current agreement will be for three years and end on Sep. 30, 2024. As part of the agreement, Marin will receive payments from Google based on the revenue generated through eligible Google and non-Google searches.

Marin said that each revenue share payment would consist of baseline revenue plus a potential increment payment. It plans to invest a fixed percentage of the baseline revenue it receives during the agreement period toward innovating its tech platform.

That percentage will increase during the contract and reach 100 percent in the third year. As part of the agreement, Marin will also invest its own funds into the enterprise business. Marin's new agreement looks similar to the previous one and seems to be more of an extension to the first.

MRIN stock's forecast

The forecast for digital advertising looks promising amid the digital transformation, and Marin's new deals should further boost its business. However, MRIN's financials don’t look as promising.

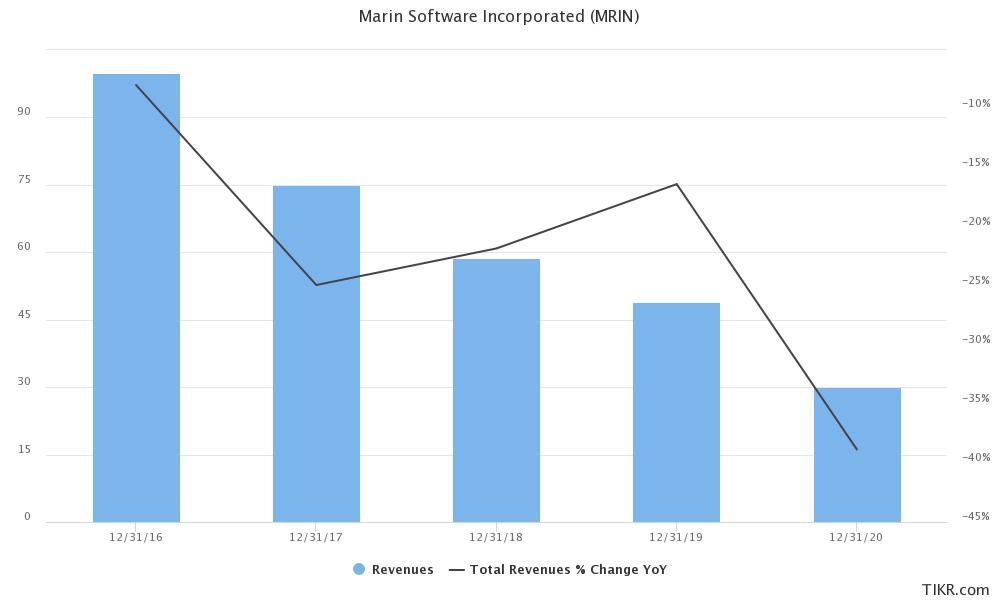

The company had revenue of almost $100 million in 2016, but that has fallen every year since, reaching below $30 million in 2020. In Q2 2021, the company’s revenue fell 16 percent to $6.1 million. Marin has posted operating losses for the last five years.

Marin Software's sales have been falling.

Should you buy Marin Software stock?

MRIN stock looks like a "sell" based on its fundamentals. It has been falling and could continue on that trajectory after the Google partnership news.

MRIN stock's forecast according to Redditors

MRIN stock has been popular on Reddit, with a new subreddit created in Jun. 2021 to discuss the company. Its member count has grown from 500 at the end of Jun. 2021 to 2,800. However, MRIN isn't a popular name on WallStreetBets.

Could MRIN stock be in for a short squeeze?

A short squeeze looks possible for MRIN stock. According to Fintel, its FINRA short volume ratio was only 37 percent on Sep. 21, but its short borrow fee was over 42 percent. The stock could rise in the short term amid a squeeze. However, based on its weak financials, the stock isn't something I'd add to my portfolio for the medium-to-long term.