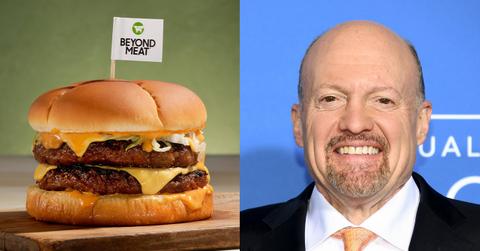

Jim Cramer Highlights Reopening Stocks: Beyond Meat, Disney, and More

What does a reopening economy mean for the stock market? To Jim Cramer, it means companies like Beyond Meat and Disney are set to thrive.

May 24 2021, Published 2:17 p.m. ET

This time last year, stocks like Peloton Interactive Inc. (NASDAQ:PTON) and Tupperware Brands Corp. (NYSE:TUP) were thriving. As the summer approaches and COVID-19 vaccination rates increase, these stay-at-home favorites have shifted out of the limelight to make space for companies focused on eating out and vacationing. That's why Cramer's reopening stocks make sense.

From Beyond Meat Inc. (NASDAQ:BYND) to Walt Disney Co. (NYSE:DIS), here's a rundown of what the Mad Money host has to say about reopening stocks.

Beyond Meat is bullish, according to Cramer and other experts.

With restaurants beginning to loosen restrictions and welcome customers back into the full experience, more food establishments are partnering with meatless burger company Beyond Meat.

Cramer went on Squawk Box to discuss Bernstein's recent double upgrade of Beyond Meat from underperform to outperform.

"When service opens up again, there are many, many places that will have Beyond Meat at a cafe," Cramer quoted on the show. The newly developed Beyond Burger 3.0 is cheaper, has more protein, and is reportedly tastier, too.

BYND stock is responding well to the upgrade with a 10.1 percent upgrade since the market close on May 21. Currently trading at $117.32 per share, BYND stock holds a target price of $130, according to Bernstein.

Disney, Norwegian Cruise Line, and other travel stocks set to improve amid reopenings

Cramer touts travel and leisure staples as go-to reopening stocks. Cruise lines and theme parks largely shut down during the height of the COVID-19 pandemic, and international travel has been hit particularly hard.

Despite the fact that Disney laid off 32,000 employees during H1 of fiscal 2021, parks are reopening and the stock is responding accordingly. DIS stock saw a 2.5 percent increase over the last five days. From a YTD perspective, shares are in a correction, which could make it a good time to buy-in.

Norwegian Cruise Line (NYSE:NCLH) is up 3.36 percent over the last week and 26.7 percent YTD. Wynn Resorts (NASDAQ:WYNN) is up about 3 percent in the past week and 21.3 percent YTD.

According to Cramer, Walmart is profiting off of consumers preparing for reopening.

Cramer views stores like Walmart (NYSE:WMT) and Macy's (NYSE:M) as a market pulse. He says that you can analyze the categories of products people are buying (i.e. travel and entertainment) to help predict future trading behaviors. That's what makes Walmart a reopening stock for Cramer.

Walmart shares are in a 3 percent YTD dip, which can compound long-term growth for this dividend stock.

What a late-stage economy means for these stocks

What usually follows a late-stage economy? A recession. This means a pivot in how people travel and enjoy themselves, which means it's best to invest in stocks that represent attainable products.

With Beyond Meat reducing its price (while the price of chicken soars) and Walmart offering products for vacations close to home, Cramer's logic largely makes sense.