RKT Stock Looks Undervalued, Might Be Due for Rerating

Rocket Companies (RKT) stock has been very volatile in 2021. It touched an all-time high of $43 in March amid the pumping by WallStreetBets.

April 12 2021, Published 1:23 p.m. ET

Rocket Companies (RKT) stock has been very volatile in 2021. It touched an all-time high of $43 in March amid the pumping by WallStreetBets. However, the stock has fallen since then and is up only about 12 percent for the year. Is RKT stock undervalued and is it a good stock to buy now?

While many of the stocks pumped by WallStreetBets settled at a higher price level before the short squeeze-driven spike, RKT stock trades at almost the same levels that it did before the spike.

Why RKT stock is dropping

The rally in RKT stock was speculative and driven by WallStreetBets. Usually, such short squeeze-driven rallies fizzle out after the initial euphoria and the attention turns to the company’s fundamentals. That said, RKT stock has strong fundamentals, which were hijacked after WallStreetBets pumped the stock.

RKT stock target price

According to the estimates compiled by CNN Business, RKT has a median target price of $24, which is a premium of 5.5 percent over the current prices. Its highest and lowest target prices are $33 and $18, respectively. Amid the WallStreetBets pumping, the stock has soared above its highest target price but is now trading 45 percent below the highest target price.

Among the 14 analysts covering the stock, four rate it as a buy or some equivalent, while two rate it as a sell. Eight analysts have a hold rating on the stock. In March, Morgan Stanley boosted RKT’s target price from $23 to $24, while RBC downgraded the stock from outperform to market perform and assigned a $30 target price. Zelman and Associates also downgraded the stock from buy to hold in March.

Are analysts bearish on RKT stock?

Analysts turned bearish on RKT stock due to the massive rally and not really due to the company’s fundamentals, which look strong. Rocket Companies is predominantly a mortgage lender and also offers mortgage refinancing. The refinancing market was strong in 2020 due to the steep fall in interest rates.

In 2021, the yields on bonds have gone up, which is also reflecting in mortgage rates. While the refinancing market in 2021 might not be as strong as we saw in 2020, the outlook for new mortgage demand is strong looking at the strong economic growth.

RKT stock's valuation

RKT priced its IPO at $18 last year and the stock soared on listing day. The stock hit an all-time high of $43, but it has since fallen over 47 percent from those levels. Is RKT stock undervalued after the crash?

RKT stock valuation

It's worth noting that while Rocket Companies is a mortgage lender, it's also a fintech company. However, it doesn't have the asset-light business model like many other fintech companies that command high valuation multiples.

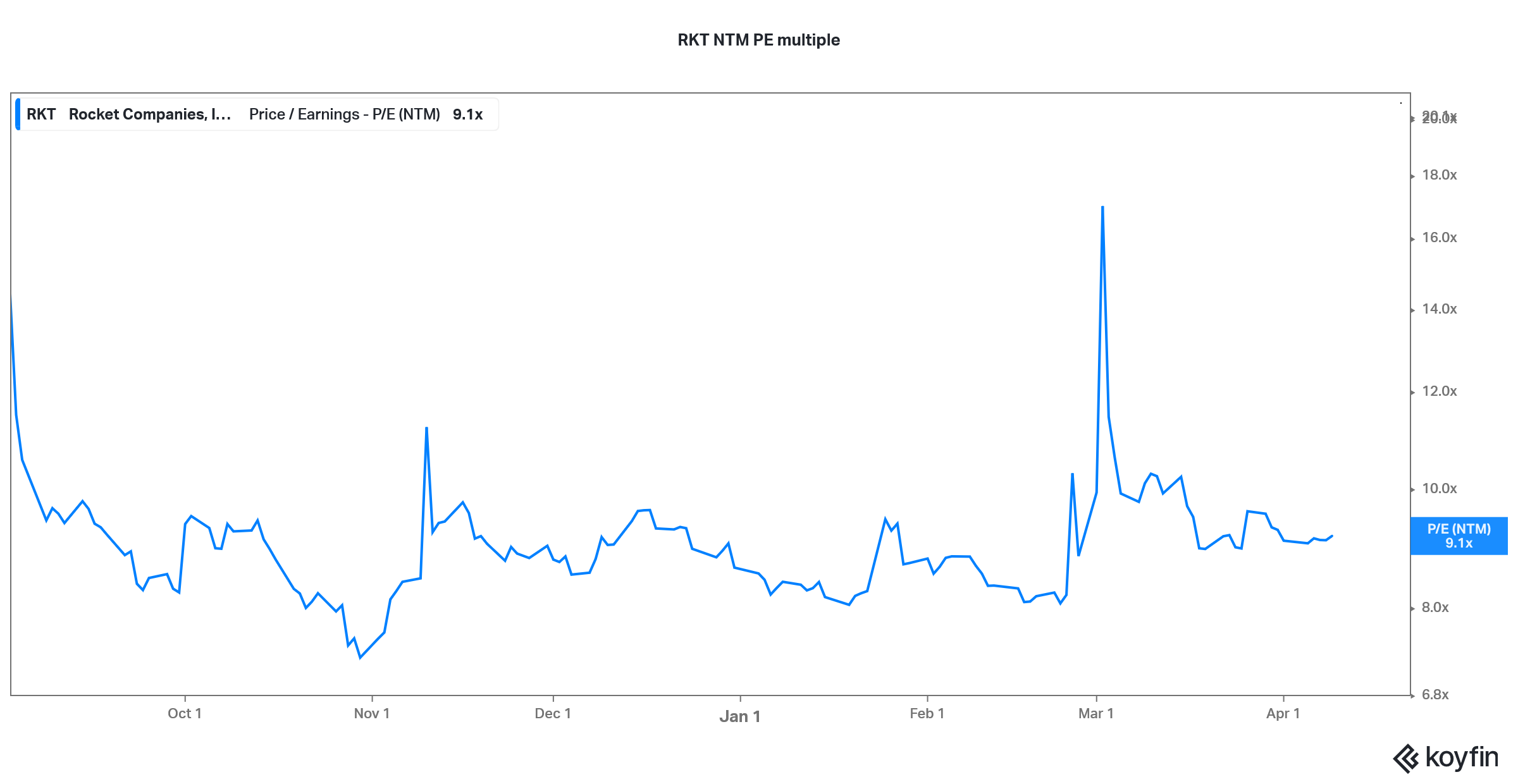

RKT trades at an NTM PE multiple of 9.1x. The multiple is way below the over 14x that it commanded after the IPO and not far away from the 7.3x NTM PE multiple that it bottomed at in October 2020. RKT’s valuation multiples are below what mainstream banks trade at let alone the exorbitant valuation multiples that fintech companies attract. Overall, the stock looks undervalued at these levels and could be ripe for a valuation rerating by the markets.