Fintech 'Super App' Revolut Isn't Publicly Traded Yet, Still Possible

With a massive valuation that's on the rise, investors are crossing their fingers and wanting to know if Revolut is a publicly traded company.

July 16 2021, Published 9:07 a.m. ET

U.K. fintech leader Revolut is riding a wave of popularity. The company is on a surging growth trajectory, and investors want to know if they can get a bite.

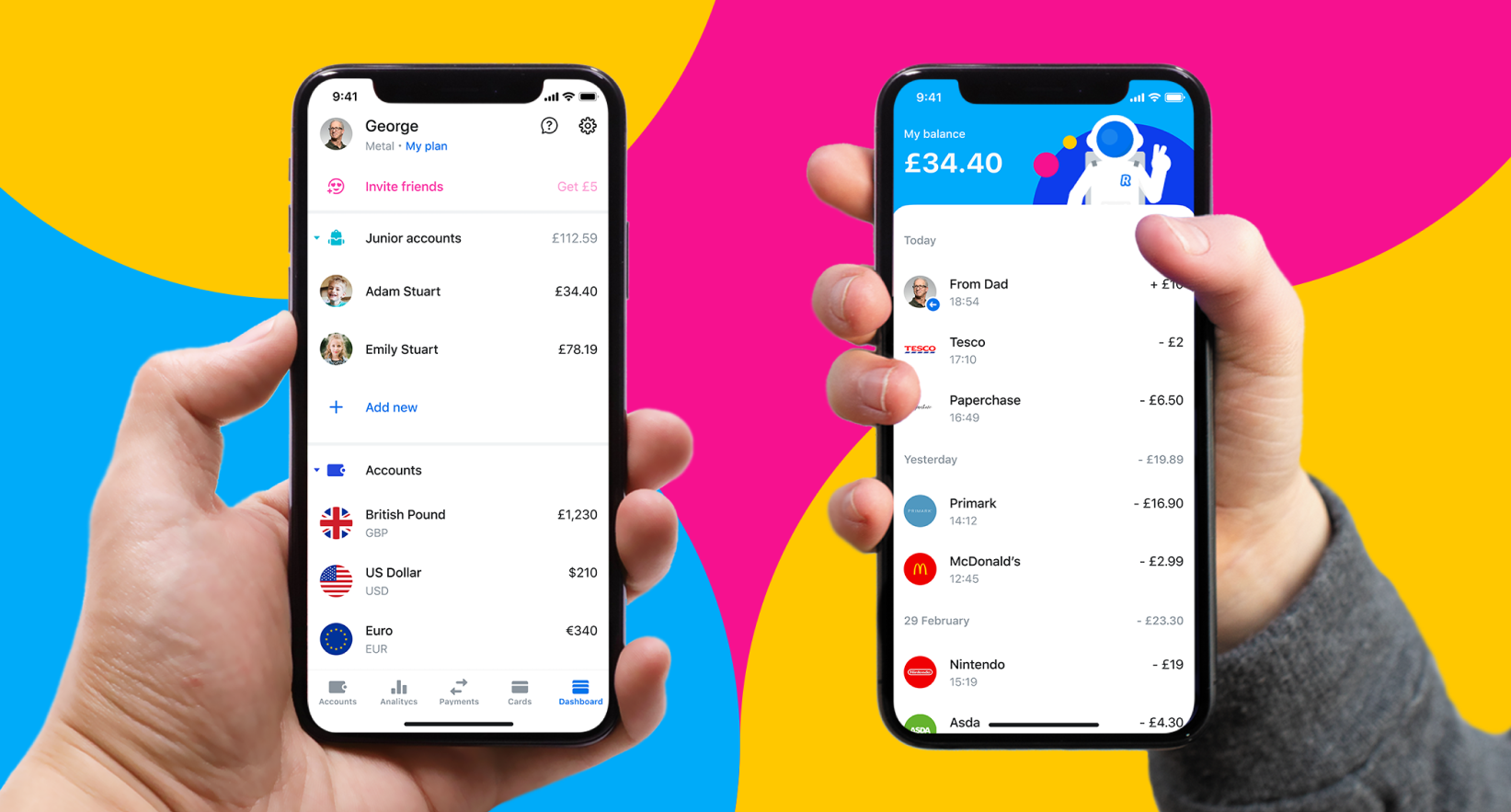

Is the platform—which calls itself a "super app" due to its vast trove of personal and business banking features—owned by a publicly traded company?

What does Revolut do? Better yet, what doesn't it do?

Revolut calls itself a "super app" for a reason. Users can use the app to:

Split bills

Teach kids money skills

Purchase from retail brands

Budget

Set money goals

Convert cash to crypto

Donate to nonprofits

Spend safely with single-use cards

Transfer money internationally

Users can create an account for free, so you can imagine why Revolut is the fastest-growing fintech app in the U.K. With a current user base of about 16 million, the app is now available in the U.S.

Revolut's recent funding round gives it a massive valuation

Revolut scored a hefty funding round worth $800 million. This comes in the form of a Series E round, with Softbank Vision Fund 2 and Tiger Global co-leading the deal.

Prior to this, Revolut's most recent funding round in 2020 closed at $580 million. At the time, the company's valuation was about $5.5 billion.

Now, Revolut has a new valuation, and it's thanks to a lot more than just the $800 million investment. The company is now worth about $33 billion, which is six times its worth just one year ago. This is the kind of movement that growth investors love.

Who founded Revolut?

Revolut was founded by two men named Nikolay Storonsky and Vlad Yatsenko. Storonsky, 36, is currently the CEO of the six-year-old company and is reported to have a personal net worth in the multi billions.

Revolut's expansive features minimize its competitor list

Perhaps part of Revolut's growth is the fact that no other financial app covers the full list of Revolut's features (including CashApp, Venmo, Klarna, TransferWise, and others). The company caters to the innate need for consolidation and is helping users trim the clutter from their home screens.

Storonsky hasn't spoken about whether or not Revolut will go public. However, the company's chief financial officer Mikko Salovaara responded to queries about a potential IPO this year by saying "never say never." How's that for a cliffhanger?

If Revolut does decide to take the public route, would most likely list in the U.K. or U.S. Given its recent expansion to the American market, it's tough to say which they would choose. Revolut will have to test the American waters as more U.S. residents download their app.