Is MRAC SPAC Stock a Good Buy on Enjoy Technologies Merger Rumors?

MRAC stock was trading higher in pre-markets on April 6 amid reports that it's in talks with Enjoy Technologies for a merger. Is MRAC SPAC stock a good buy?

April 6 2021, Published 11:59 a.m. ET

Marquee Raine Acquisition Corp. (MRAC) SPAC fell below its IPO price of $10 on April 5 and joined several other black-check companies that have fallen below $10. However, MRAC stock was trading higher in pre-markets on April 6 amid reports that it's in talks with Enjoy Technologies for a merger. Is MRAC SPAC stock a good buy amid the Enjoy merger rumors?

Bloomberg reported that Enjoy Technology is in talks with MRAC to list through a reverse merger. Investors might recall that Bloomberg first reported that Churchill Capital IV (CCIV) was in talks with Lucid Motors. The merger was eventually announced but CCIV stock trades at a fraction of what it did before the merger announcement.

Marquee Raine Acquisition SPAC news

There isn't any official news yet from Marquee Raine Acquisition on the merger with Enjoy Technologies. However, as is the case with most SPAC mergers, they are first reported as “rumors” only.

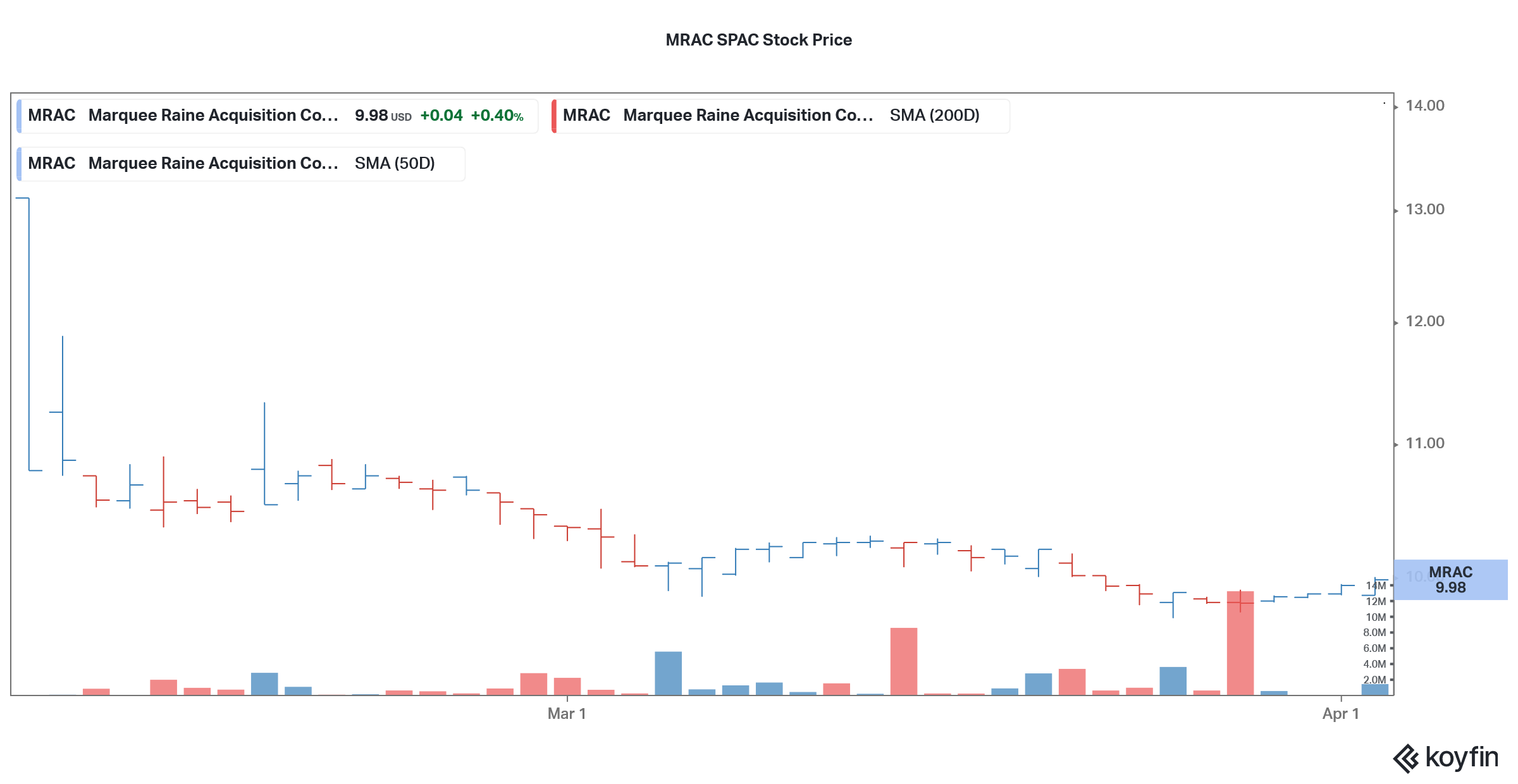

MRAC SPAC stock price chart

MRAC SPAC and Enjoy Technologies merger

Enjoy Technologies is led by former Apple executive Ron Johnson. Riverwood Capital, LCH Partners, Stamos Capital, Highland Capital, Kleiner Perkins, and Oak Capital Management are among the investors in Enjoy Technologies.

Enjoy Technologies operates mobile retail stores in 85 cities across the U.S., Canada, and the U.K. It also offers same-day delivery services. The company has partnerships with EE Limited, AT&T, BT, and Rogers.

Enjoy Technologies' valuation

According to the Bloomberg report, the merger between MRAC and Enjoy Technologies would value the combined entity at $1.6 billion. MRAC raised around $374 million in its IPO in December 2020. The transaction between MRAC and Enjoy Technologies could also involve a PIPE (private investment in public equity), which has been the norm in SPAC reverse mergers.

Enjoy Technologies has raised $374 million as private capital, according to PitchBook data. The company was valued at $900 million in its 2019 funding round. The reported valuation of $1.6 billion would value the company at 1.8x of its most recent private market valuation.

MRAC SPAC stock forecast

Since MRAC hasn’t zeroed down on the merger target yet and we don’t have a concrete valuation, it isn't possible to put forward a forecast for MRAC SPAC stock.

Should I buy MRAC SPAC stock?

MRAC SPAC stock is trading near the $10 price level at which it priced the IPO. Meanwhile, before the blank-check company announces a merger, it will remain a speculative play. However, unless the sponsors really mess up on the merger target or the valuation, the SPAC could rise after the merger is announced.

MRAC stock was trading 2.4 percent higher in pre-market trading on April 6. Markets seem optimistic about the SPAC’s prospects amid its rumored merger with Enjoy Technologies. However, it was trading less than 1 percent higher in early trading and couldn't hold on to higher price levels.

MRAC stock on Reddit

While Reddit groups, especially WallStreetBets, have made waves for pumping stocks like GameStop and AMC Entertainment, MRAC isn't among the most popular names on the platform.

All said, investors have been getting increasingly wary of SPACs, especially after the sharp fall in CCIV stock. There was irrational exuberance in CCIV and at one point in time, it was trading at a premium of almost 550 percent despite not having identified a merger target. While CCIV is still trading a premium of over 115 percent over the IPO price, it trades at almost one-third of its 52-week highs.