Air Products and Chemicals — Good Bet Among Dry Ice Stocks

There will likely be an increase in the demand for dry ice amid COVID-19 vaccine storage. Should investors buy Air Products and Chemicals (APD) stock?

Dec. 14 2020, Published 8:46 a.m. ET

Dry ice stocks have been popular among investors after positive trial results for Moderna's and Pfizer’s COVID-19 vaccine candidates. Both of the vaccines need to be stored at very low temperatures for them to be effective. Given the expected increase in dry ice demand as more countries rush to approve the two vaccine candidates, should investors buy Air Products and Chemicals (APD) stock?

Positive trial results for the COVID-19 vaccine candidates led to a spike in Pfizer's and Moderna’s stock price. The positive trial results also led to a rally in cyclical stocks that were otherwise having a hard time even as the so-called work-from-home stocks surged. Dry ice stocks also rallied after Modena and Pfizer announced high efficacy during the trials for their COVID-19 vaccine candidates.

What temperature do Moderna and Pfizer COVID-19 vaccines require?

Moderna’s COVID-19 vaccine would require a strong temperature of -20°C, while Pfizer’s vaccine would need to be stored at -70°C to remain effective. The vaccines will need a cold supply chain from production to final delivery. One way to maintain the desired temperature is large scale industrial freezers. However, the freezers are expensive.

Why are dry ice stocks rising?

Given the prohibitive costs of buying freezers and the fact that not many companies would be willing to invest that much money to transport the vaccine, dry ice has emerged as a good alternative. Pfizer has also developed a special type of box for the vaccine that can maintain the desired temperature by using dry ice.

What are some of the good dry ice stocks to buy?

Most of the dry ice companies are privately owned small businesses. While the companies will see a spike in sales as the demand for dry ice rises, investors can't gain much from the opportunity. However, some diversified companies also have dry ice operations as part of their portfolio.

If you are looking for a small-cap company, ThermaFreeze Products (TZPC) is one dry ice stock. Although it rose sharply after the positive trial results, it has since fallen off those highs. Air Liquide is another company that produces dry ice. However, it trades on the OTC market where volumes are quite low.

Is Air Products and Chemicals a good buy?

Air Products and Chemicals and Linde (LIN) are two large-cap U.S.-listed companies that produce dry ice. Air Products and Chemicals acquired ACP Europe S.A. in 2019. The acquisition gave Air Products and Chemicals a good footprint into the dry ice market.

In its fiscal fourth-quarter 2020 earnings call, Air Products and Chemicals faced questions about the shortage of dry ice and carbon dioxide amid strong demand for storing COVID-19 vaccines. However, the company dodged the question diplomatically and cited confidentiality agreements. Markets expect the company to share some details about the business at the upcoming Virtual Hydrogen Conference event on Dec. 16. The event is organized by Bank of America Securities.

Does Air Products and Chemicals have an attractive valuation?

According to the estimates compiled by CNN Business, Air Products and Chemicals stock has a median target price of $305, which is a premium of 14 percent over its closing prices on Dec. 11. While some of the dry ice stocks have rallied over the past month, Air Products and Chemicals hasn’t seen a similar spike.

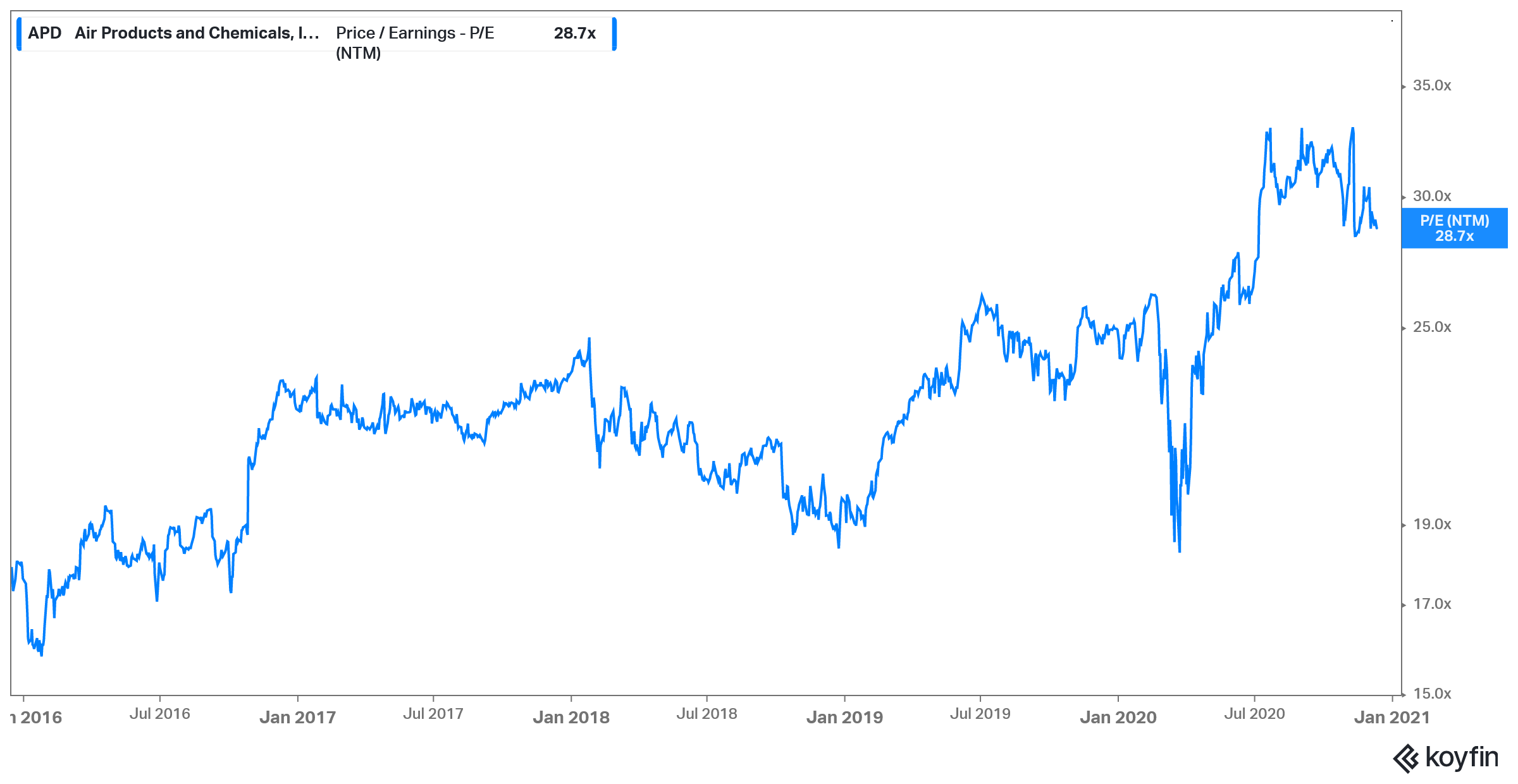

Air Products and Chemicals is up 13.8 percent year-to-date in 2020 based on its closing prices on Dec. 11. The stock has an NTM EV-to-revenue multiple of 6.4x and an NTM PE multiple of 28.7x. Overall, the multiples look reasonable. In the near term, dry ice could be an exciting opportunity for the company. Over the long term, Air Products and Chemicals' hydrogen operations could drive its value as the automotive industry transitions from fossil fuels to hydrogen run and electricity run vehicles.