How to Short Silver If SLV Meets the Same Fate as GME

How can an investor short silver? There are various ways including inverse ETFs. You can also go short in the futures market.

Feb. 4 2021, Published 8:56 a.m. ET

The Reddit community WallStreetBets has been instrumental in propping up prices of several stocks like GameStop (GME) and AMC Theatres (AMC). After stocks, the members of the community also tried a short squeeze in silver. While WallStreetBets was successful in pumping stocks in January, stocks like GME and AMC have tumbled in February. Here’s how you can short silver before prices fall and it meets the same fate as GME and AMC stocks.

First, WallStreetBets represents a new class of retail investors that don’t hesitate to take on the Wall Street giants. Billionaire investor Mark Cuban thinks that the group has changed the game. While the short squeeze is relatively easy to execute in stock markets, things are different in commodity markets.

How silver markets and ETFs work

In the silver futures market, a lot of participants are silver producers and buyers that hedge their positions. A silver producer might hedge his inherently long position on the precious metal by going short in the future and hedging the exposure. Also, while the availability of shares is limited unless the company issues new shares, metals companies can increase the supply to meet demand.

Talking of silver ETFs, they are backed by physical silver. So, to move the price of ETFs like the iShares Silver ETF Trust (SLV), the price of silver has to go up. In commodity markets, including gold and silver, demand-supply dynamics drive the prices in the medium to long term. In silver’s case, the supply comes from miners and recycling. Silver has both industrial and investment demand.

How to short silver

Many investors wonder how can they short silver if the precious metal meets the same fate as GME and AMC. There are many ways that you can short silver.

- Short silver ETFs like SLV

- Buy an inverse silver ETF like the ProShares UltraShort Silver ETF (ZSL)

- Short silver in the futures market

- Short silver miners and ETFs that invest in silver mining companies.

We'll see how these instruments compare and what could be the best way to go short on silver before the tide turns.

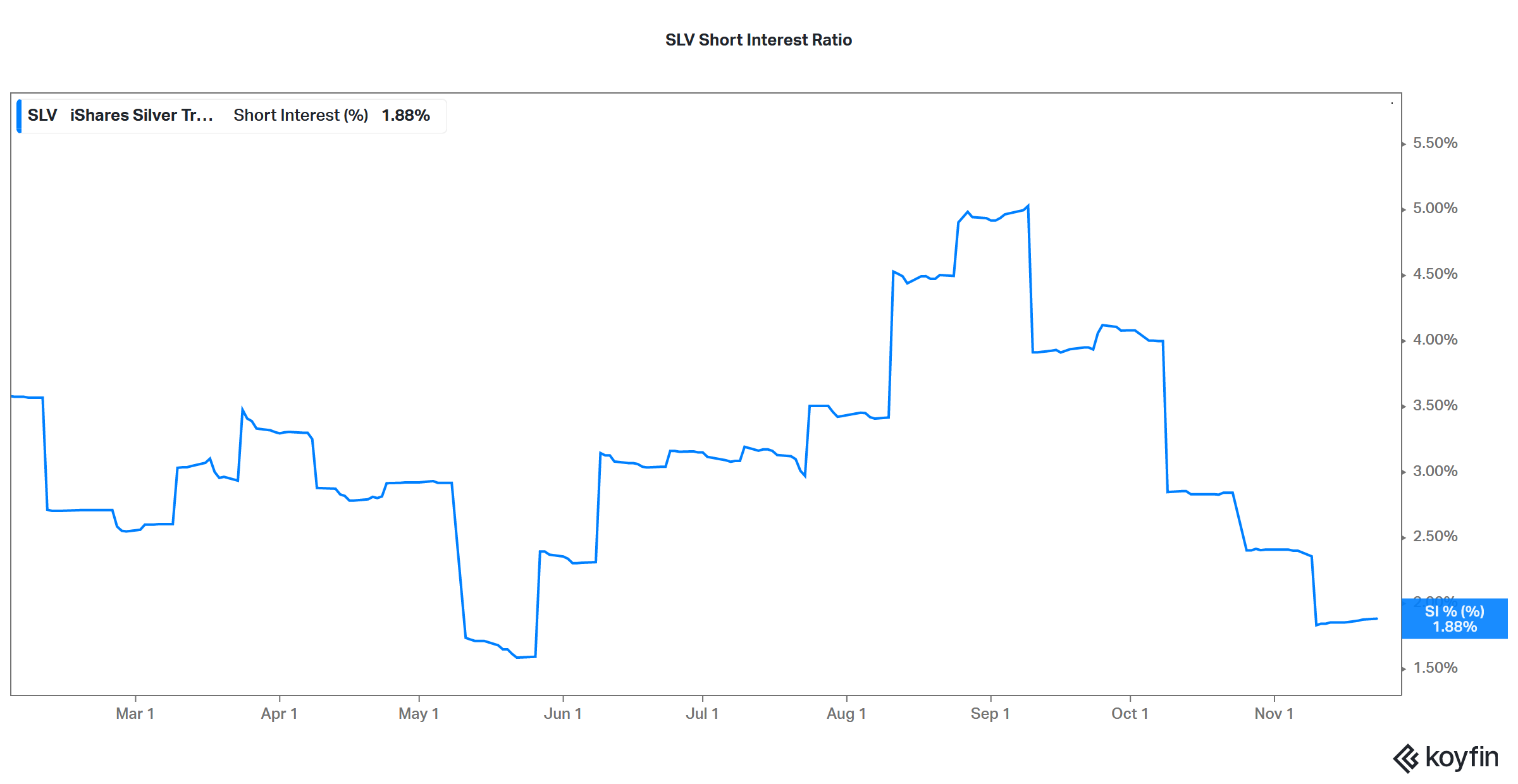

SLV short interest

Incidentally, there isn't much short interest in silver ETFs like SLV, which you can see in the graph above. Also, shorting a silver ETF might not be the best approach if you are bearish on the precious metal.

Inverse ETFs are a good way to short silver

The reason there isn't much short interest in SLV is that there are inverse ETFs that do precisely the same thing. ZSL is a -2x bet on silver prices, which means that the gains would be inverse to the movement in silver prices but twice as much. Instead of shorting SLV, you can go long on ZSL (and hence short on silver).

Given its 2x leverage, ZSL’s gains would be twice as much as the fall in silver prices. But remember, if your bet goes wrong, ZSL would magnify your losses twice as much as silver. Since silver has rallied sharply over the last year, ZSL has lost heavily, which you can see in the graph above.

You can also short silver in the futures market and take a leveraged bet on silver. Since the leverage in the futures market is higher, the risk-return trade-off is different compared to an inverse silver ETF. Your gains and losses would be much more amplified in futures compared to an inverse ETF. If you are comfortable taking the higher risks including margin calls, you can opt for shorting silver futures. Otherwise, ZSL looks like a reasonably good way to short silver.

Shorting silver miners and ETFs that invest in them

You can also go short on silver miners and ETFs that invest in these companies. Shorting silver mining companies can be a good idea and it would be a leveraged bet on silver prices. Silver mining companies' stocks rise or fall more than the movement in silver prices. However, your returns might not mimic silver’s price action. Along with silver prices, company-specific factors also impact mining companies’ stock prices.

Should you short silver?

Currently, silver’s long-term outlook looks positive. There could be higher volatility in the near term and it might not be a bad idea to take a short-term bearish bet if silver goes up more on WallStreetBets' pump.