WallStreetBets Pumps Silver, How to Play the Short Squeeze

Silver is rising sharply due to the attention from WallStreetBets. How can investors benefit from the surge and buy silver on the stock market?

Feb. 1 2021, Published 10:37 a.m. ET

The Reddit group WallStreetBets has been behind the rally in stocks like AMC Theatres (AMC), GameStop (GME), and BlackBerry (BB) in 2021. The last thing investors would have expected on a group pushing these stocks was a discussion on silver. Silver prices have spiked after the attention from WallStreetBets. How can investors benefit from the surge and buy silver on the stock market?

The basic premise behind WallStreetBets pumping some assets has been similar. The group has targeted the most heavily shorted stocks and retail traders have driven the short squeeze. There were rumors that Melvin Capital, a hedge fund that was short on GME, was collapsing. The fund denied the rumors even though it admitted to exiting the GME position and repositioning its portfolio.

How to invest in silver

Many investors wonder how they can invest in silver and capitalize on the spike. There are multiple ways that you can gain exposure to silver, including:

- Buying physical silver bars

- Trading in silver futures

- Buying silver mining companies

- Buying ETFs that invest in silver mining companies

- Investing in ETFs that invest in physical silver

- Leveraged ETFs

All of these investment choices have trade-offs.

Best silver stocks

One way to get exposure to silver would be to invest in companies that mine silver. You could choose from any of the companies that get the majority of their revenues from silver mining. Precious metal mining companies produce both gold and silver.

If you are looking at silver exposure, stocks like First Majestic Silver (AG) could be good bets. Pan American Silver Corp. (PAAS) is another reasonably priced stock to play the rise in silver prices. However, silver mining companies are a leveraged play since they usually rise or fall more than the movement in silver prices.

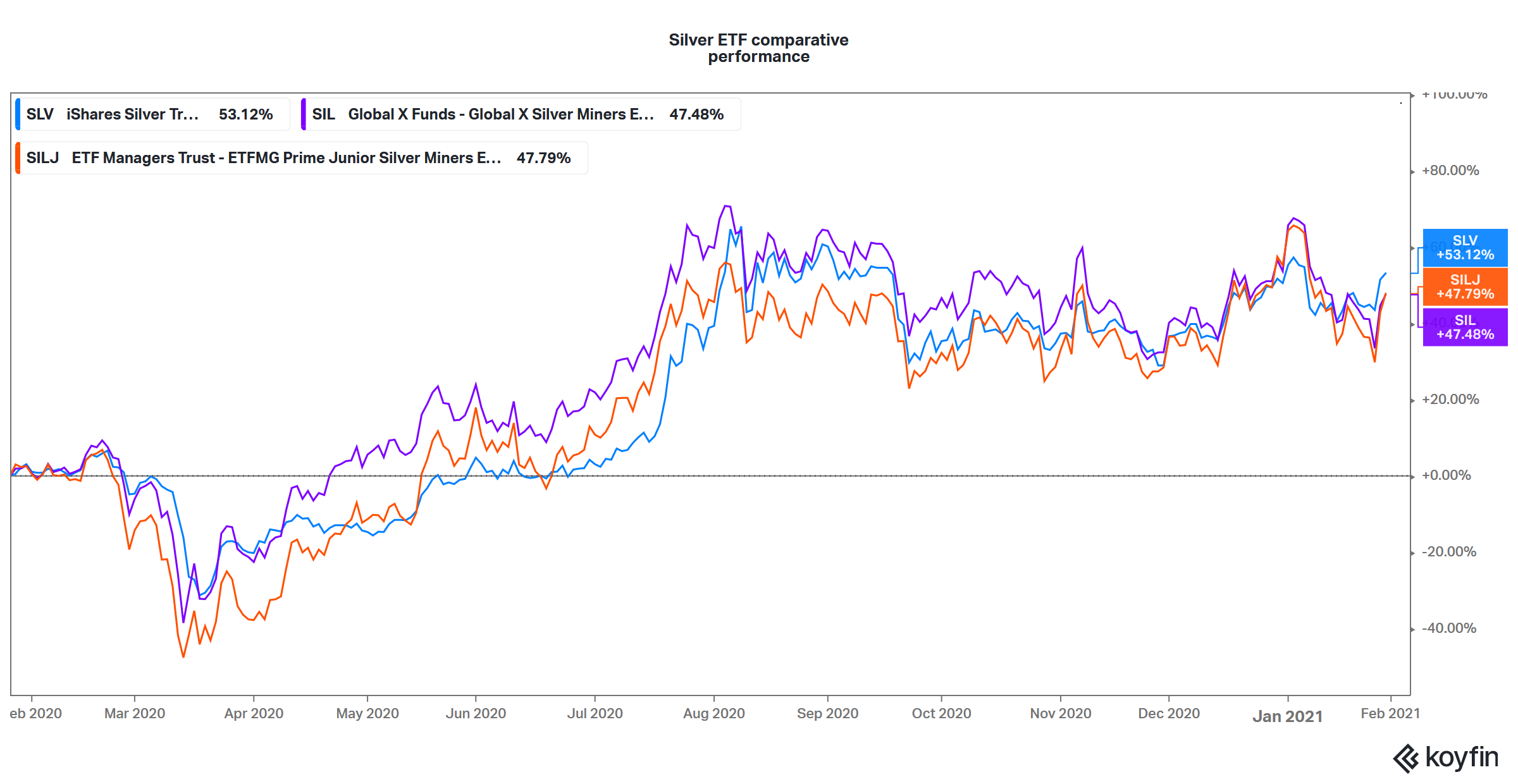

ETFs that invest in silver mining companies

If you want diversified exposure to silver mining companies, you could choose from any of the good silver mining ETFs. The Global X Silver miners ETF (SIL), the iShares MSCI Global Silver Miners ETF (SLVP), and the ETFMG Prime Junior Silver ETF (SILJ) invest in silver mining companies. SIL has assets of $1.1 billion, while SILJ has assets worth $659 million, according to ETFDB.

Silver ETFs

A simple way to invest in silver would be to buy an ETF that's backed by physical ETFs. These ETFs strive to deliver the returns from physical silver after accounting for fees. The iShares Silver Trust (SLV) is the most liquid ETF in this category.

A hybrid way would be to invest in ETFs that give leveraged exposure to silver. For example, the ProShares Ultra Silver ETF (AGQ) gives you a 2x bet on silver prices. The ProShares UltraShort Silver ETF (ZSL) is a -2x bet on silver prices, which means that the gains would be inverse to the movement in silver prices but twice as much.

Best instruments to invest in silver

The best instrument to invest in silver would boil down to your risk-return appetite. If you want a silver allocation to your portfolio for the long term, plain silver ETFs like SLV would fit the bill. Silver mining stocks and ETFs that invest in these can also be good play although their returns might not mimic silver at least in the short term.

If you are comfortable taking the extra risk for higher returns, you can choose a leveraged ETF like AGQ where the gains (and the losses) would be twice the movement in silver prices.

Currently, it would be risky to bet against silver. However, somewhere down the line, if you think that silver prices getting overheated, you can also short them through either futures or the ZSL ETF.