How to Buy Call Options on Robinhood

If you are looking to bet on stocks rising, you can do it on Robinhood using the call options trading feature.

Oct. 23 2020, Updated 1:12 p.m. ET

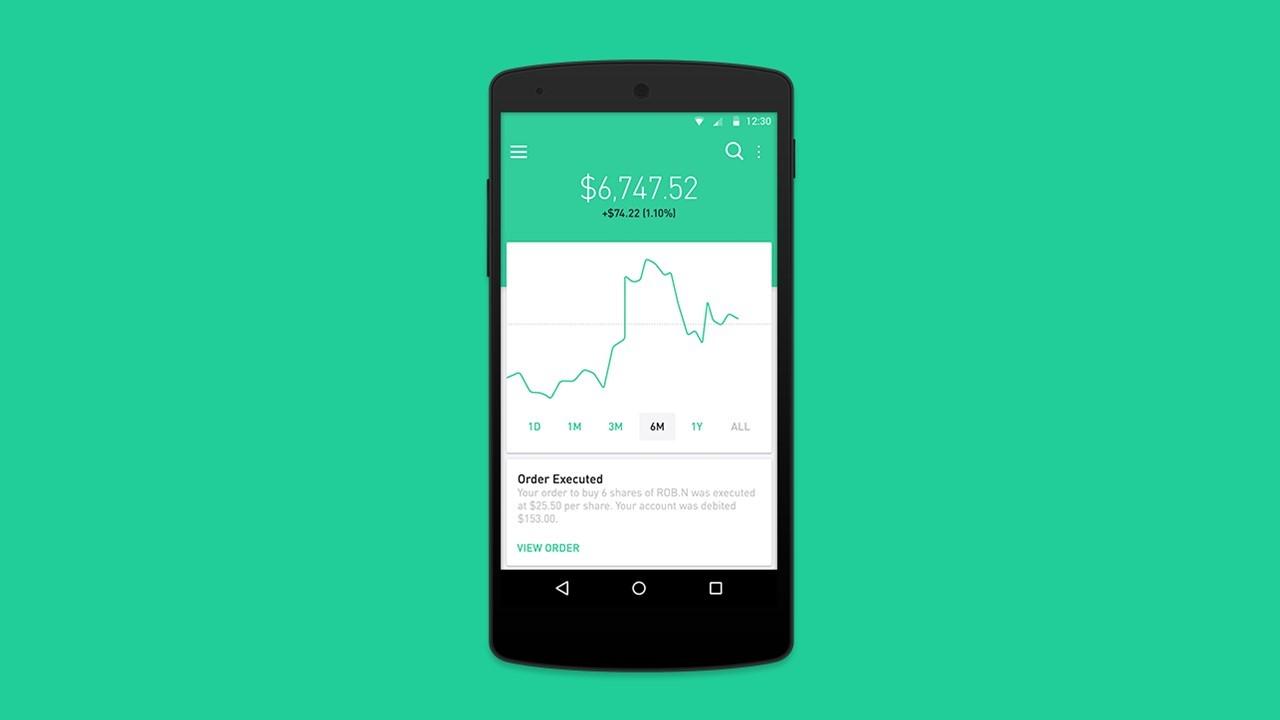

Robinhood is a DIY trading platform that brings investing to the average person, including options trading. Placing a call options trade on Robinhood is straightforward—as long as you are ready for the world of options.

What is a call option?

Although options are complex, reading about them enough will familiarize you with the process. A call option is a contract that says you think a stock will reach a certain higher price at a specified time in the future. In contrast, a put option is a contract that says a stock will be lower at a specified time in the future.

For example, a stock is at $1.00 as of today. You think that it will reach $5.00 (the strike price) in 60 days. You purchase the stock as well as 100 options contracts (the minimum amount you can purchase) at $0.50 per share for a premium of $50.

In 60 days, the stock reaches $20 per share and it surpassed your expectation of $5.00. You can sell your contracts to earn back what you made on the premium or you can sell the 100 shares for a total of $2,000 (and a 400 percent return). In this case, the second choice is wiser.

Call options can feel like bets, but veteran options traders use formulas to mitigate the risk. It's important to keep tabs on your options investments to track fluctuations that may impact your return.

Robinhood's options trading approval process is extremely liberal

One thing worth mentioning is that Robinhood doesn't have a strict approval process for options trading. They let just about anyone place calls and puts, even on margin (or borrowed money). The strategy can be problematic if someone doesn't have a full grasp of what they are getting into. Since options trading is complex, placing calls on margin could lead to detrimental debt.

In contrast, banks like Charles Schwab have a vetting process in place to help set options traders up for success. You have to call customer service and prove your knowledge about call and put options. They will ask you a series of questions to make sure you have done your research and know what you are getting yourself into, which helps prevent debt on the bank's dime.

How to buy call options on Robinhood

Buying call options on Robinhood is a straightforward process:

- On the homepage, search for the stock you want to buy call options for and select it.

- Click "Trade."

- Click "Trade Options."

Robinhood provides the break-even percentage as well as the chance of profit percentage. The platform determines the chance of profit percentage from the Black Scholes model. Be sure to review these before purchasing.

You can only trade options during market hours. Select a Good-til-Cancelled or Good-for-Day order. Day trading regulations still apply on call options.

Here's what to do when it comes time to sell

To sell your options on the Robinhood app, follow these steps:

- Go to the stock's page.

- Click "Trade."

- Click "Trade Options."

From there, you can sell the call. On the web version, go to the stock's page, select the "Trade Options" button and pick which contracts you want to sell.