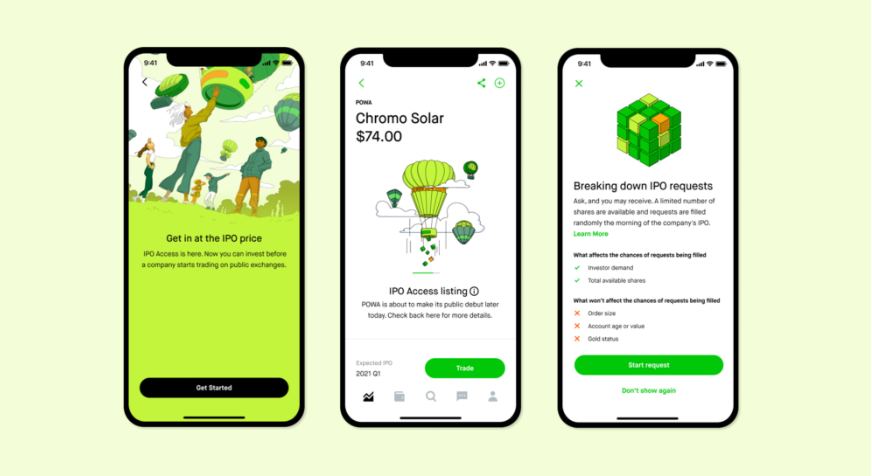

How Pre-IPO Orders Work on Robinhood—Get in at the IPO Price

Robinhood's pre-IPO order feature allows inventors to get in at the IPO price. Is it worth it for the average trader? What are the pros and cons?

July 21 2021, Published 1:59 p.m. ET

Robinhood's attempts to "democratize" the market have gotten it in trouble before. The company's restitution list is teeming with options traders who got in over their heads, due in part to its failure to gatekeep complex investing techniques. Now, with Robinhood offering pre-IPO orders, investors want to know how it works.

Here's the rundown of what a pre-IPO order is on Robinhood, and how the trading process works.

What is a pre-IPO order on Robinhood?

In May, Robinhood launched pre-IPO orders on certain stocks. The segment of stocks that have available pre-IPO orders is small, and it basically allows investors to schedule the purchase of a fresh IPO as soon as it hits the market.

It's a way for retail investors to gain access to IPO prices, which is a luxury that's usually reserved for institutional or preferred investors.

To buy pre-IPO on Robinhood, you have to use a limit order.

As a way to protect investors from the inherent volatility associated with brand-new IPO stock, Robinhood only executes pre-IPO orders as limit orders.

A limit order is a type of order where the investor specifies a maximum price they want to pay for the stock. If the stock's market value is at or below the limit order specification at the time of the trade, it goes through. If the market value exceeds the limit, the trade won't execute.

Because Robinhood only uses limit orders with pre-IPO orders, your order may or may not go through depending on market conditions for the stock.

When can you make a pre-IPO order on Robinhood?

When Robinhood says "pre-IPO," it means just before the stock hits the public market. Usually, retail investors gain access to a stock a few hours after the market open on the day of the stock's debut. By this point, anything could happen with the price, which means that it could be much higher or lower than its starting point as specified in the SEC filing.

Investors can make pre-IPO orders on certain stocks through Robinhood starting at 8:00 a.m. ET and will execute later on (assuming the market value is under your order's limit).

Robinhood provides an estimated stock price

Robinhood takes its stock price estimation straight from the company's SEC filings. Companies can—and often do—change the stock price from the public preliminary filings. It's a risk that investors using Robinhood's pre-IPO orders must take. For example, a company might decide to start trading at a lower price than initially suggested, in which case your limit order could leave you in the dust.

When will Robinhood execute your pre-IPO order?

As long as the stock's market value is within your order's limit, Robinhood will execute your pre-IPO order once the company's stock hits the market. This can be as much as hours after market open on the day of the stock's debut.

Robinhood's pre-IPO orders are not the same as pre-IPO stock

Robinhood makes sure to clarify that this type of pre-IPO order is much different than a pre-IPO stock.

Pre-IPO stock is more of a pre-distributed security to help a soon-to-be-public company hedge against a potentially unsuccessful IPO. In the case of a pre-IPO order, your order won't execute until the stock officially crosses over into the public domain.