How Do I Pay Myself With a PPP Loan? — Process and Rules Explained

Sole proprietors with no employees can apply for and use PPP loan funds. Here's everything that you need to know about the process.

April 29 2021, Published 10:28 a.m. ET

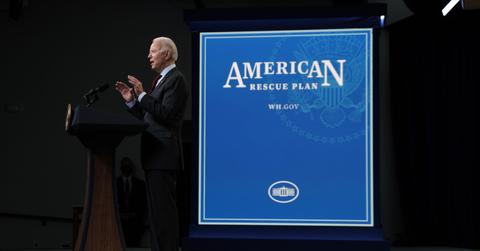

If you’re a sole proprietor or freelancer in need of some financial assistance, the PPP (Paycheck Protection Program) is available. Due to COVID-19, many small businesses suffered and lost income. Sole proprietors and independent contractors who have no one on payroll besides themselves are eligible to receive PPP funding.

The PPP loans can help bridge any gaps small business owners might have between revenue and expenses. The amount of the loans is calculated to cover approximately 2.5 months of income, based on your income returns from the previous year.

How to calculate your PPP loan amount

For those whose business is entirely individual, with no employees, there are some fairly simple calculations to determine the amount of PPP funding you’re eligible to receive. You’ll need to use either your 2019 or 2020 federal income tax return for the calculations.

For those seeking First Draw funds (in other words, you didn't receive funding in the first batch of PPP loans in 2020), use Form 1040, Schedule C, line 31. This figure is your net profit. If the net profit is greater than $100,000, you’ll need to drop it to $100,000.

Divide your net profit number by 12 for your monthly net profit figure. Next, multiply that number by 2.5. This is the maximum PPP loan amount you can receive.

For those who are self-employed farmers or ranchers, the same calculations apply except that they must use Schedule F, Line 9 (gross income) for their starting number. Divide the gross income (maximum $100,000) by 12, then multiply by 2.5 for your loan amount.

Second Draw PPP loan requirements

Some of those who received First Draw funds might be eligible for Second Draw PPP loans. You must have used all of your First Draw funds on authorized expenses and have a documented 25 percent decrease in gross receipts from comparable quarters from 2019 to 2020.

How the PPP loan will impact your taxes

Normally, business loans that are forgiven are taxable income, but PPP loans that are forgiven aren't taxable income. Also, you are allowed to deduct business expenses that you paid for with PPP loan funds. This offers “two layers of tax benefits for PPP loan recipients,” according to NerdWallet.

What expenses can I cover with PPP loans?

PPP loans are meant to help small businesses stay afloat and keep all employees on the payroll. This still applies even to sole proprietors and independent contractors. The PPP loan helps you continue to pay yourself even if income has dropped due to circumstances beyond your control.

The requirements of PPP loans stipulate that first of all, 60 percent of the loan amount must go to cover payroll. Therefore, you must use 60 percent or more to pay yourself a salary.

The other qualified expenses allowed for PPP loans include operating costs, supplier costs, property damage, and worker protection. Some of these might be for rent, mortgage payments and interest, utilities, and business software.

If small businesses and sole proprietors don't follow these guidelines, they will have to pay back the PPP loans. The loans are only forgivable if they are used appropriately.