HeartFlow Is Going Public via a SPAC Merger, Key Details Revealed

HeartFlow is going public through a SPAC merger with Longview Acquisition Corp II and is expecting a value of $2.4 billion.

July 16 2021, Published 9:46 a.m. ET

HeartFlow Holding, Inc., or HeartFlow, has announced terms for its upcoming merger with a SPAC. The 11-year-old firm makes a non-invasive cardiac test for coronary artery disease patients who are stable but symptomatic.

With statistics showing heart disease as the key cause of one-third of deaths and one-sixth of all U.S. healthcare spending, HeartFlow’s core product provides important healthcare technology. The company intends to merge with Longview Acquisition Corp. II to become publicly traded on the NYSE.

What HeartFlow does

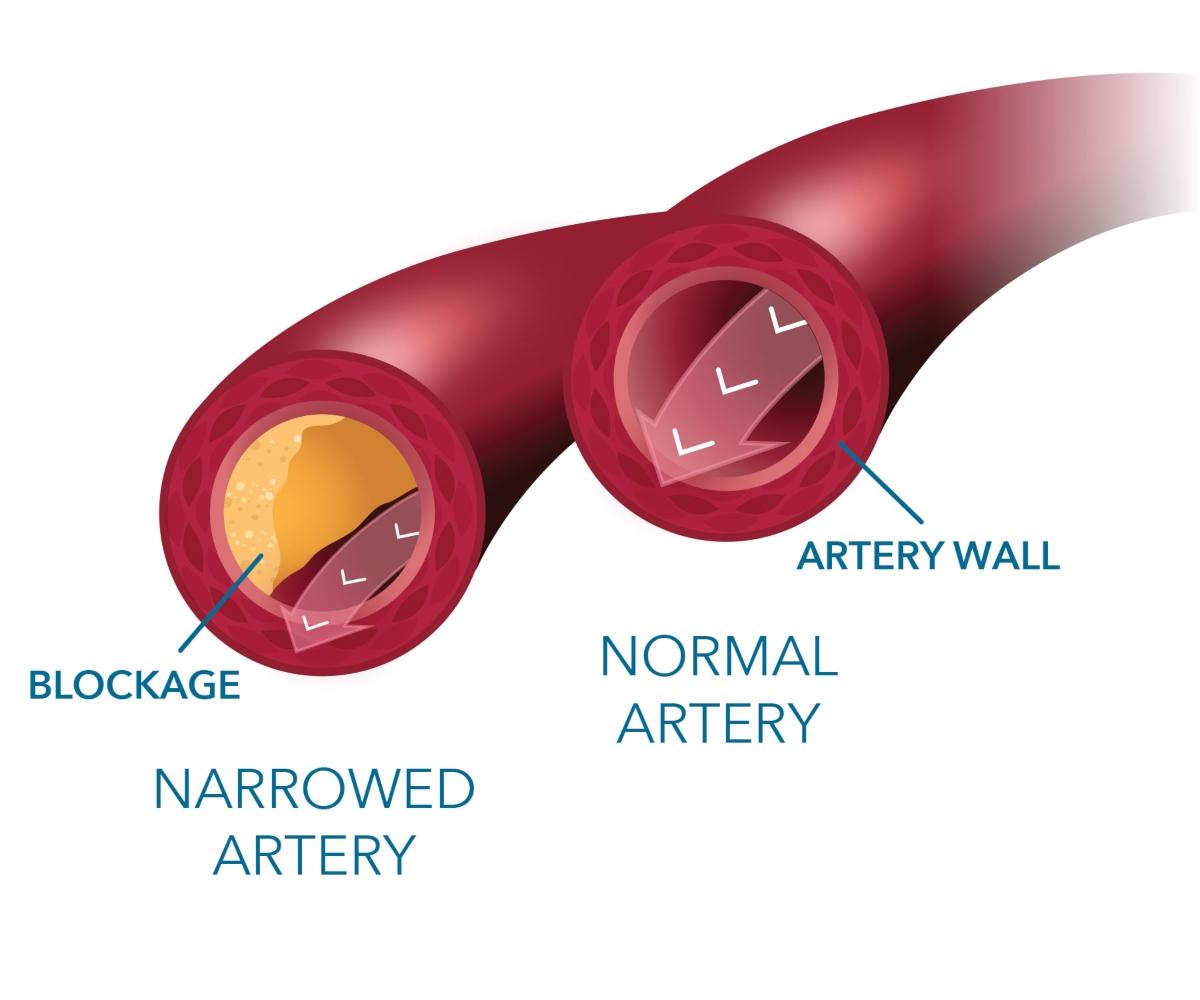

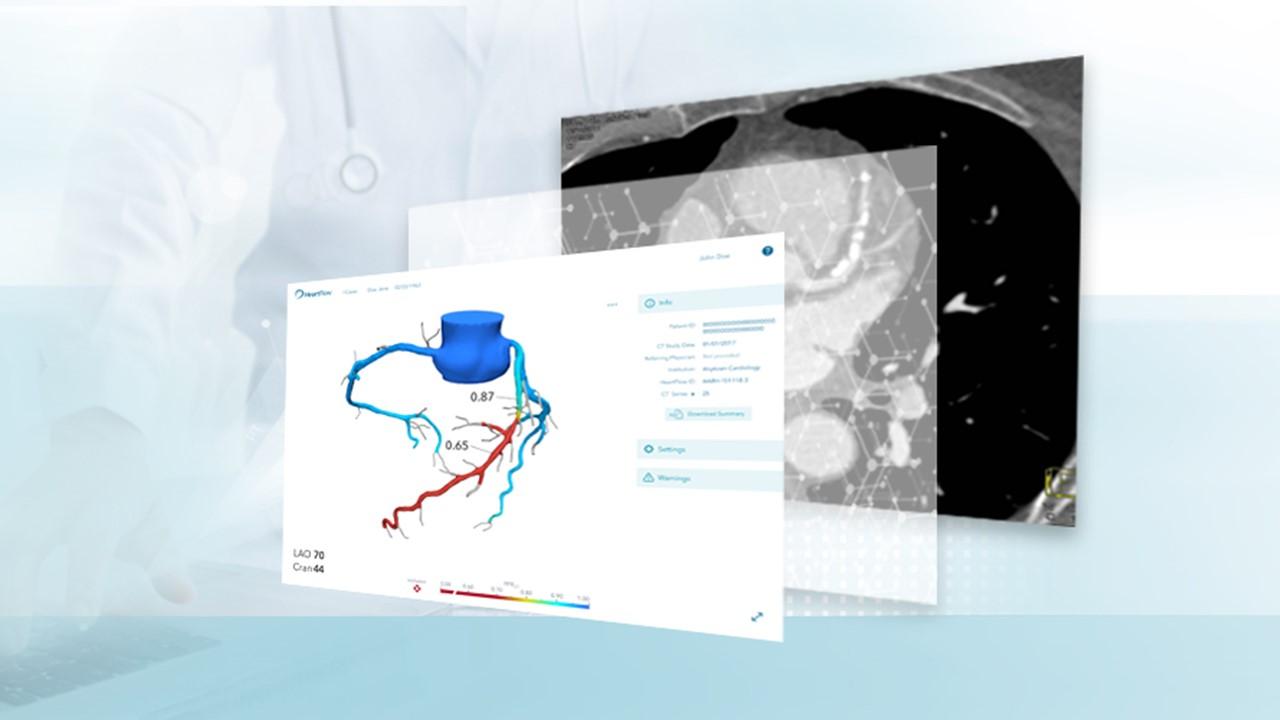

HeartFlow offers the “first and only non-invasive tool to assist with the diagnosis, management and treatment of patients with heart disease.” Its core product, the HeartFlow FFRCT Analysis, creates a digital and personalized 3-D model of the heart, aiding physicians in understanding the extent of a coronary blockage and determining the best course of treatment.

The company says that it has performed its HeartFlow Analysis on over 100,000 patients. It has regulatory clearance and is available commercially in the U.S., EU, U.K., and Japan. HeartFlow’s Chairman is William Weldon, the former Chairman and CEO of Johnson & Johnson.

HeartFlow’s merger with Longview Acquisition Corp. II

HeartFlow has chosen to go public via a merger with a blank-check company, also known as a SPAC. Longview Acquisition Corp. II currently trades on the NYSE as "LGV" and is sponsored by affiliates of Glenview Capital Management, LLC.

Larry Robbins, the chairman of Longview and CEO of Glenview, discussed the merger. He said, “We are thrilled to co-invest with the associates, leadership and shareholders of HeartFlow to promote rapid adoption of their life-saving, revolutionary approach to cardiac evaluation.”

Another Glenview-associated SPAC is Longview Acquisition Corp., which merged earlier this year with Butterfly Network.

HeartFlow's valuation and stock symbol

In the merger with LGV, HeartFlow expects to have a combined pro forma enterprise value of $2.4 billion with an estimated $400 million in cash after closing.

Up to $599 million in gross proceeds will go to HeartFlow from Longview's $690 million cash in trust. This will enable growth and an option to repurchase $110 million of equity from long-term shareholders and employees or about 5 percent of pro forma shares outstanding.

Longview will distribute any excess cash in trust to shareholders through a dividend of $91 million just before closing. Pro forma for the business combination, about 73 percent of the company will be owned by HeartFlow’s legacy shareholders of HeartFlow and employees.

The merged company will operate under the name HeartFlow Group, Inc. and trade on the NYSE under the new symbol “HFLO.”

When is the HeartFlow IPO date?

The transaction merging HeartFlow with Longview Acquisition Corp II is expected to close during the fourth quarter of 2021, according to the company press release.

J.P. Morgan Securities LLC and Cowen and Company, LLC are acting as financial advisers to HeartFlow for the merger. UBS Investment Bank is acting as sole financial and capital markets adviser to Longview