REIT Four Springs Capital Trust Announces IPO, Will List on the NYSE

Four Springs Capital Trust, a REIT specializing in long-term lease single-tenant properties, is going public next week on the NYSE. Here's what investors can expect.

Jan. 11 2022, Published 9:13 a.m. ET

In a new IPO with terms announced this week, Four Springs Capital Trust plans to go public on the NYSE. Four Springs (FSPR) is based out of Lake Como, N.J., and joins other REITs (real estate investment trusts) on the public market.

The company focuses on acquiring properties that are single-tenant. Four Springs deals with industrial, medical, service/necessity retail, and office properties. Its portfolio holds properties subject to long-term net leases.

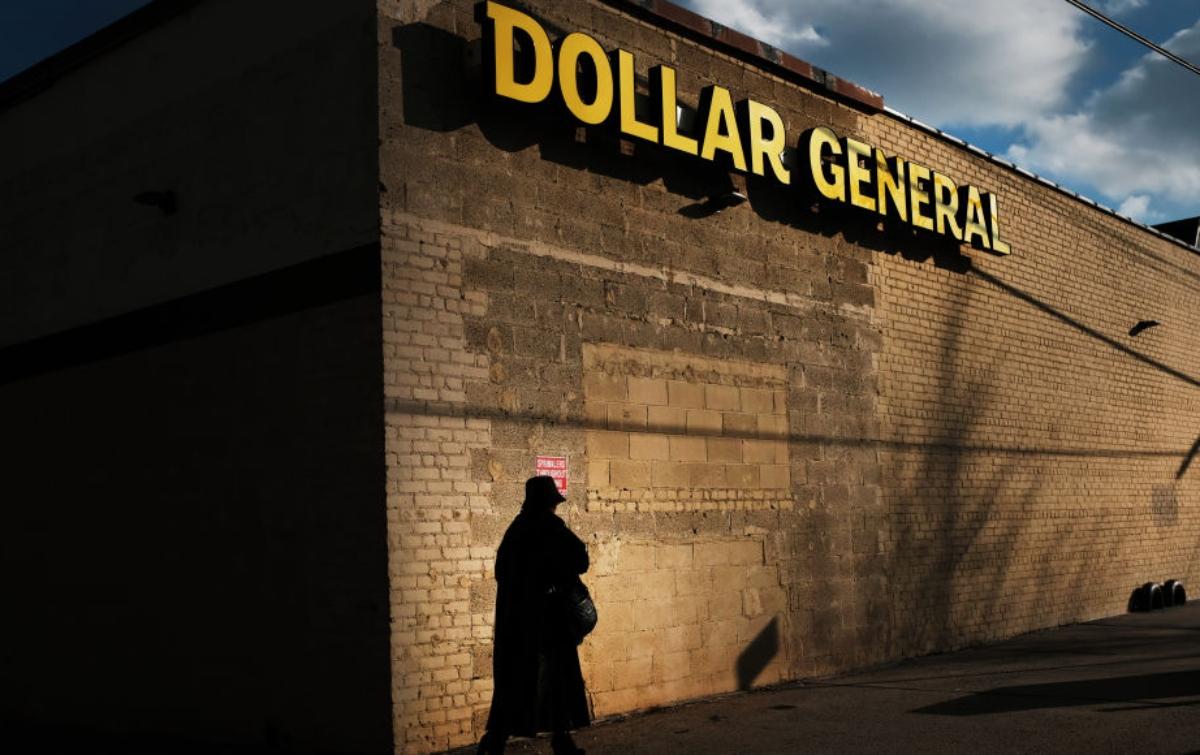

Dollar General is one of Four Springs' top 10 tenants based on current rent percentages.

What's Four Springs Capital Trust's stock price, symbol, and IPO date?

Four Springs Capital Trust plans to list a total of 18 million shares at a price range between $13 and $15 per share. The midpoint of the price range would result in a fully diluted market value of $603 million.

The single-tenant lease REIT plans to list under the stock symbol “FSPR” when it debuts publicly on the NYSE. The joint book runners on the IPO include Morgan Stanley, Goldman Sachs, Wells Fargo Securities, Mizuho Securities, Scotia Capital, Wolfe Research Securities, Nomura Securities, and Berenberg.

BusinessWire noted that FSPR intends to grant the underwriters a 30-day option to purchase up to an additional 2.7 million common shares.

The net proceeds of the IPO are intended to facilitate pending acquisitions and repay outstanding loans. The proceeds will also be used for general corporate purposes.

Four Springs is expected to start trading on January 20, 2022.

FSPR has a solid history and revenues.

The firm was founded in 2012. According to IPOScoop.com, FSPR had $100.35 million in revenues for the last 12 months and -$12.9 million in net income.

As of December 15, 2021, FSPR either wholly owned or had ownership interests in 156 properties across 32 states that were 99.8 percent leased to 68 tenants operating in 37 different industries.

Strategically, the firm focuses on acquiring properties with a purchase price between $5 million and $25 million in order to minimize competition it faces from larger institutional investors who target larger properties.

CVS is another of Four Springs Capital Trust's top customers.

William Dioguardi is the CEO and chairman of the board. He also founded Four Springs Capital, LLC in 2008. The affiliated organization invested in similar properties, and all but one of the properties were acquired by Four Springs Capital Trust when it formed in 2012.

Meanwhile, Coby Johnson is the trust’s president, COO, and secretary.

What publicly traded REITs are competition for Four Springs?

There are plenty of REITs available for investors who want to put a portion of their money into real estate without the hassle of buying properties themselves. Some REITs are non-traded or private, while others are available for trading on a public stock exchange. Here are a few of the other publicly traded REITs on the market right now.

- Brandywine Realty Trust (BDN)

- Power REIT (NYSEAmerican:PW)

- Equinix (NASDAQ:EQIX)

- Safehold Inc. (NYSE:SAFE)

Other large public REITs include American Tower and Crown Castle, both of which own and manage communications sites. Simon Property Group focuses on shopping malls, while Public Storage holds storage facilities. Welltower is the largest healthcare real estate REIT.