Is Flutter Stock a Good Buy as FanDuel Leads Over DraftKings?

Investors are interested in Flutter Entertainment's stock forecast as FanDuel maintains a strong lead over DraftKings in the U.S. sports betting market.

Jan. 10 2022, Published 9:50 a.m. ET

Flutter Entertainment is a global gambling company headquartered in Ireland. It’s listed in London under the ticker symbol "FLTR." In the U.S., Flutter shares trade over-the-counter under the ticker symbol "PDYPY" and have dropped 30 percent over the past year. What’s Flutter Entertainment's stock forecast? Should you buy the current dip in Flutter stock?

Although the crypto space has continued to see a huge influx of investors chasing after metaverse and Web 3.0 cryptocurrencies, there are still great opportunities in the stock market. Many investors want to know if Flutter stock is a good investment.

What does Flutter Entertainment do?

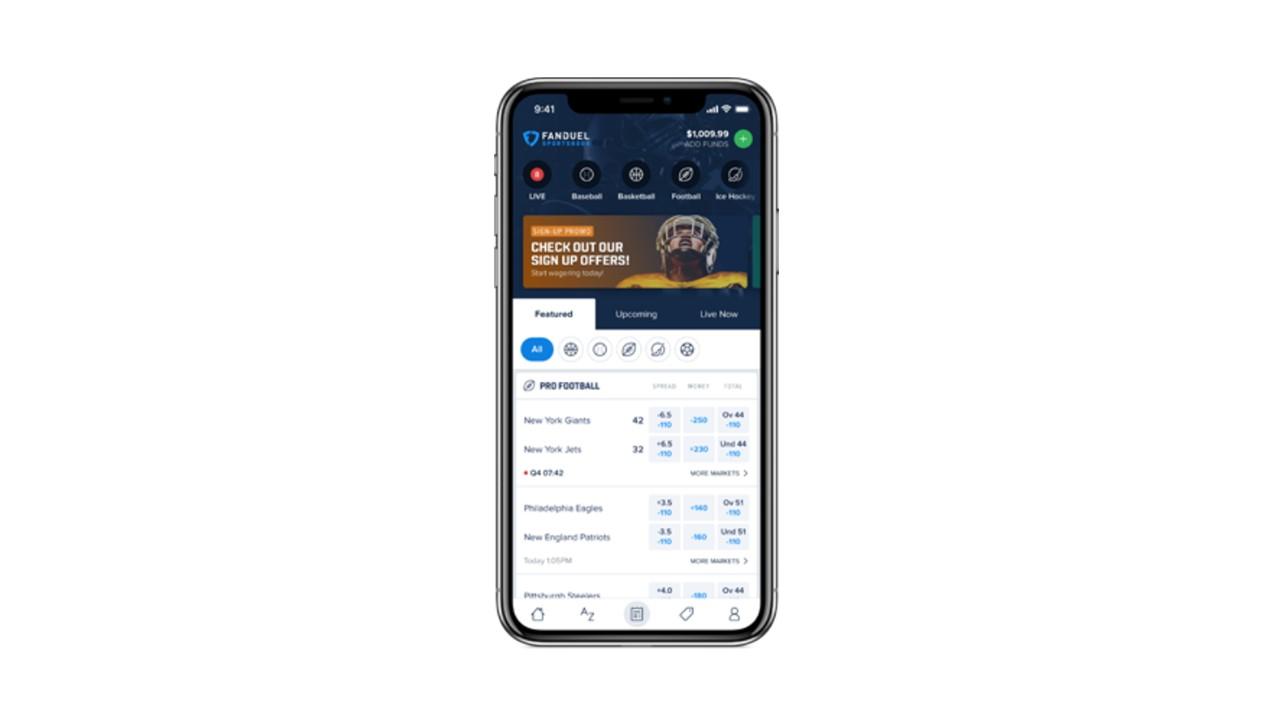

Flutter operates a large portfolio of gambling brands that together serve more than 14 million customers globally. Its brands include FanDuel, FOX Bet, Paddy Power, Betfair, and Sportsbet. The Flutter brands are PokerStars, Adjarabet, and TVG. The services include online sports betting and casino games.

Flutter’s FanDuel leads DraftKings in the lucrative U.S. market

FanDuel runs an online sports betting platform and it has a large presence in the U.S. market where it competes with DraftKings. It finished 2021 with the largest share of the U.S. market at 42 percent. DraftKings ranked second with about a 30 percent share of the market.

In 2018, a U.S. Supreme Court ruling removed a federal ban on sports betting. As a result, gambling on the results of sporting events is now legal in dozens of states and the market continues to expand. The U.S. sports betting market is on track to grow to more than $140 billion from $72 billion in 2021.

Is Flutter Entertainment stock a good investment?

Even with its already dominant market share in the U.S., Flutter’s FanDuel sees more room to grow. FanDuel CEO Amy Howe has learned that the gambling industry has mainly overlooked women. She wants to grow the business by appealing to female audiences. Under Howe, a former Live Nation Entertainment executive, FanDuel has launched several initiatives to attract female customers. Flutter’s U.S. revenue increased more than 85 percent in the third quarter of 2021.

Flutter has continued to make strategic acquisitions that have the potential to accelerate its growth in key markets. Recently, Flutter acquired Tombola, an online casino platform with a large presence across several European countries including Italy, the U.K., and Spain.

Tombola’s revenue has increased at an annual rate of 23 percent over the past five years. Flutter agreed to spend 402 million pounds on the acquisition. Flutter explains that Tombola perfectly aligns with its safe gambling strategy and will boost its presence in the U.K. online gambling market.

In another expansion move that bodes well for the stock’s prospects, Flutter is acquiring Sisal, an online gambling operator that mostly serves the Italian market. Flutter explained that the Sisal acquisition aligns with its strategy to build a strong presence in regulated markets globally. Sisal’s pre-tax profit jumped almost 60 percent to 211 million pounds in 2021. Flutter expects to close the Sisal acquisition in the second quarter of 2022.

The Tombola and Sisal acquisitions should help diversify Flutter’s business and minimize its risk. In sports betting, unfavorable sporting results can have a negative impact on earnings. Tombola and Sisal bring more traditional casino offerings that can help balance off weakness in the sports betting segment.

Flutter Entertainment's stock forecast looks promising in 2022.

Flutter had a rough run in 2021 but that could change in 2022. FanDuel’s expansion plan, particularly the focus on drawing more female customers, should make Flutter stock look more attractive. The strategic acquisitions like Tombola and Sisal should make Flutter’s business more resilient in the future.

Currently, Flutter stock trades at about $77, which represents a 35 percent decline from its 52-week high of about $120. The FanDuel expansion, strategic opportunity, and the desire to buy the dip could see Flutter stock double in 2022.