Being President Has Many Perks—Is Not Paying Taxes One of Them?

The President of the U.S. is required to pay tax on their income. However, they're not required by law to disclose their tax returns to the public.

Oct. 19 2021, Published 6:51 a.m. ET

Paying taxes is a requirement most Americans must meet. If you have any amount of income entering your household, chances are, you need to pay taxes on that money.

The controversy surrounding former president Donald Trump’s lack of paying taxes has many assuming the leader of the U.S. is given a “pass” on having to comply with federal tax laws. Does the president pay taxes?

The president, like all others, must pay taxes.

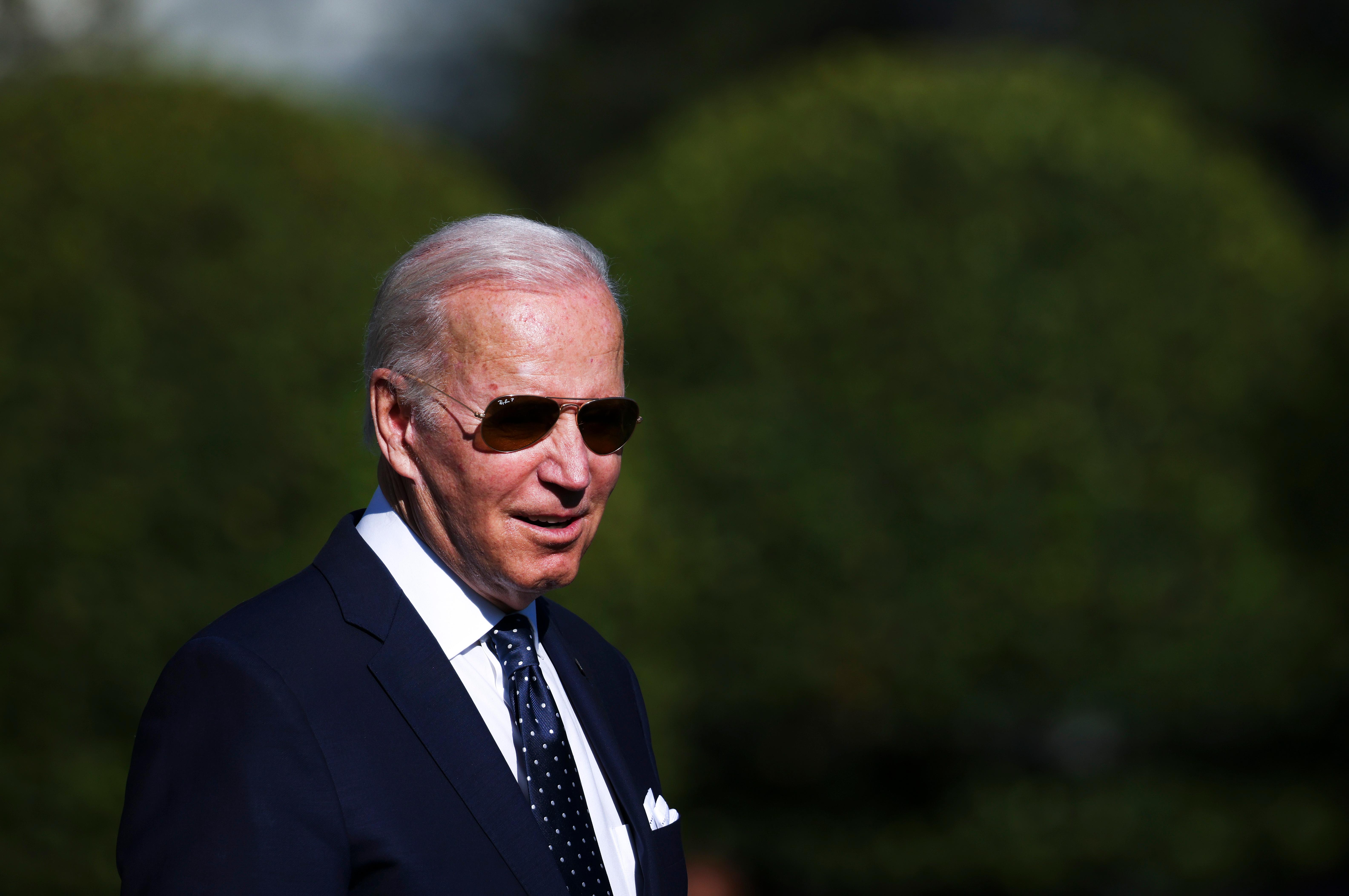

Despite the president’s immense role in government operations, anyone elected as president, even Joe Biden, must pay taxes on their income. The president of the U.S. is currently given a $400,000 annual salary that's paid out on a monthly basis.

In addition, the president is awarded $50,000 annually into an expense account. As this money is not included in the president’s gross income, it's not taxed, but the president’s annual salary is. However, there are ways to offset taxable income, such as deductions.

Are presidents required to disclose their tax returns?

There's no federal law that requires the president of the U.S. to publicly share their income tax returns, although many have done so voluntarily. In fact, it has become a tradition for the president to share their income tax returns with fellow Americans. By releasing their tax returns, presidents are showing they aren’t given any unusual privileges, and that they must comply with federal tax laws like everyone else.

How many tax returns has Joe Biden released?

In total, Biden has shared 23 years’ worth of tax returns. The most recent tax return released was his 2020 return on May 17, 2021. The president and first lady filed their income tax jointly in 2020, something most married couples do to save money, revealing their annual “federal adjusted gross income of $607,336.”

Biden’s 2020 tax return also revealed the couple’s federal income tax rate for 2020 was 25.9 percent, resulting in $157,414 being paid in federal income tax.

Did former president Trump release any tax returns for public viewing?

Trump was scrutinized often for his lack of disclosing his tax returns to the American people. Many blame him for breaking the tradition that “all presidents since 1976” followed prior to him taking office.

Although Trump attempted to invoke his right to keep his tax returns confidential, he was ordered to hand the documents over after the Department of Justice ordered the IRS to release them to Congress “as part of a criminal probe,” according to CNBC.

Once the documents were released, it was discovered Trump “had not paid federal income taxes in 10 of the past 15 years.” Documents also showed the 45th president only paid “$750 in federal income taxes the year he ran for president.” Since the release of records, Trump has filed a lawsuit against his niece Mary Trump and The New York Times, “alleging an insidious plot to obtain and publish his tax records.”