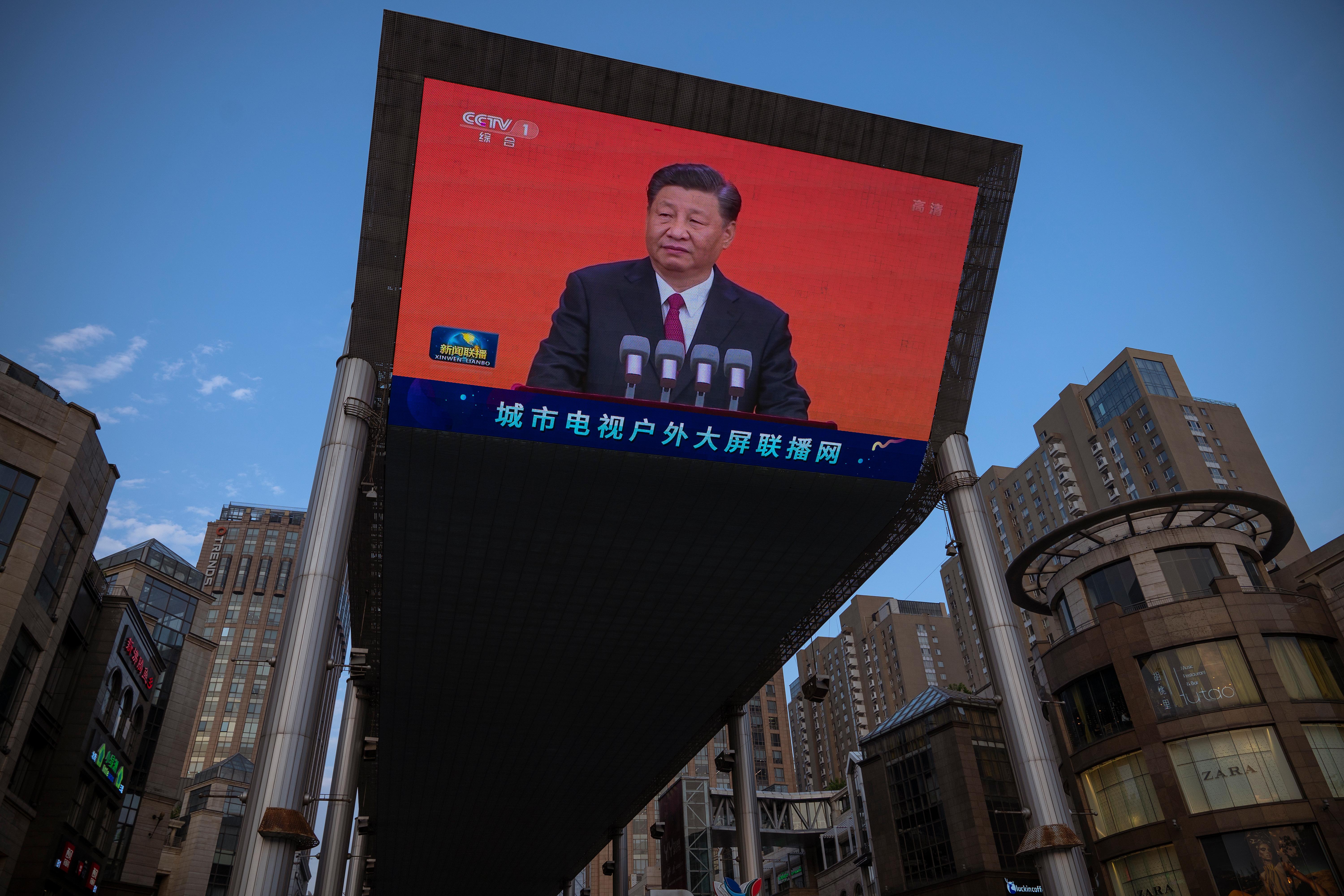

China Bans All Forms of Cryptocurrency, Global DeFi Responds

In a sweeping move, China has banned all cryptocurrency trading and mining. Outlawing crypto is the next step in an increasingly strict economy.

Sept. 24 2021, Published 10:48 a.m. ET

The People's Bank of China, the nation's central bank, has declared an outright ban on cryptocurrency trading. At one time, China was at the helm of more than 70 percent of global Bitcoin production, but mining hubs like Sichuan, Inner Mongolia, and Xinjiang are no more.

Here's what the ban entails for China and the world's crypto economy alike, plus whether or not Chinese crypto investors have a way out.

What the central bank says about crypto

China's central bank made a statement to Chinese residents early on Sept. 24 and said, "Virtual currency-related business activities are illegal financial activities." The People's Bank of China says that digital assets like crypto endanger mainstream wealth.

Like many regulators, Chinese officials have dismissed crypto as a swamp for illicit activity. However, China is the first nation to take such a steadfast approach. While the U.S. recently blacklisted a criminally infested Russian exchange, SUEX OTC, China is taking crypto by the horns.

China's crypto ban impacts all coins and mining

China isn't just banning Bitcoin. The country is banning all cryptocurrencies. The ban includes mainstream altcoins like Ethereum and Dogecoin as well as the thousands of others on the market. The country has also banned cryptocurrency mining.

China's ban impacts the world's crypto economy.

China has been integral to crypto trading, with fluctuations in global Bitcoin and altcoin values often tracing back to Chinese traders. Following the sudden shutdown of China's crypto market, global coin values plummeted.

Bitcoin's value fell 6.7 percent in the last two hours as of 10:00 a.m. ET on Sept. 24. Ether is down 6.4 percent during the same period.

Meanwhile, other countries have been welcoming cryptocurrency into their economies. El Salvador recently made Bitcoin a legal tender, and Ukraine officially legalized cryptocurrency trading. The international push and pull show the different cryptocurrency perspectives and the fate among the masses.

Are there any workarounds for China's crypto investors?

Chinese citizens have traded crypto through foreign exchanges since China first banned crypto in 2019. Now, that workaround is kaput. Foreign exchanges now fall under the umbrella of illegal activity.

China's community of crypto traders saw this coming. The nation has been taking incremental steps toward a full ban over the course of the last year. In May, China warned crypto traders that their digital assets wouldn't be protected if they decided to continue trading. By the following month, banks and payment platforms were forced to comply by halting trading facilitation.

Now, anyone who gets caught trading cryptocurrency will be charged with illegal financial activities and prosecuted accordingly.

Where will the mining go?

In 2019, China accounted for more than 70 percent of Bitcoin production by energy use. In April, that number had fallen to 46 percent, noting the slow-and-steady migration elsewhere. Illicit activity aside, that number is poised to fall to zero.

In the midst of one of China's largest companies potentially collapsing—that's property developer Evergrande, which owes nearly $400 billion in combined debt and liabilities—the country has made no efforts to bail the business out. With a potential economic crash on the horizon, China is taking extreme measures to control citizens' assets.