El Salvador Makes Bitcoin a Legal Tender—Here's How That Works

The President of El Salvador has made Bitcoin a legal tender, which is a first for sovereign nations. What does that mean in action?

Sept. 7 2021, Published 10:39 a.m. ET

Bitcoin's volatility doesn't seem to phase El Salvador President Nayib Bukele, who just made the original cryptocurrency a legal tender for his country. Moving forward, El Salvadorians will be able to institute Bitcoin payment options for any good or service.

How will El Salvador implement this law, and what implications can we expect to see for the Central American nation?

El Salvador is the first sovereign nation to make Bitcoin a legal tender.

On Sept. 7, El Salvador officially became the first sovereign nation to mark Bitcoin as a legal tender. For the country, this means that Bitcoin will be right alongside the U.S. dollar, which the country uses as its official currency.

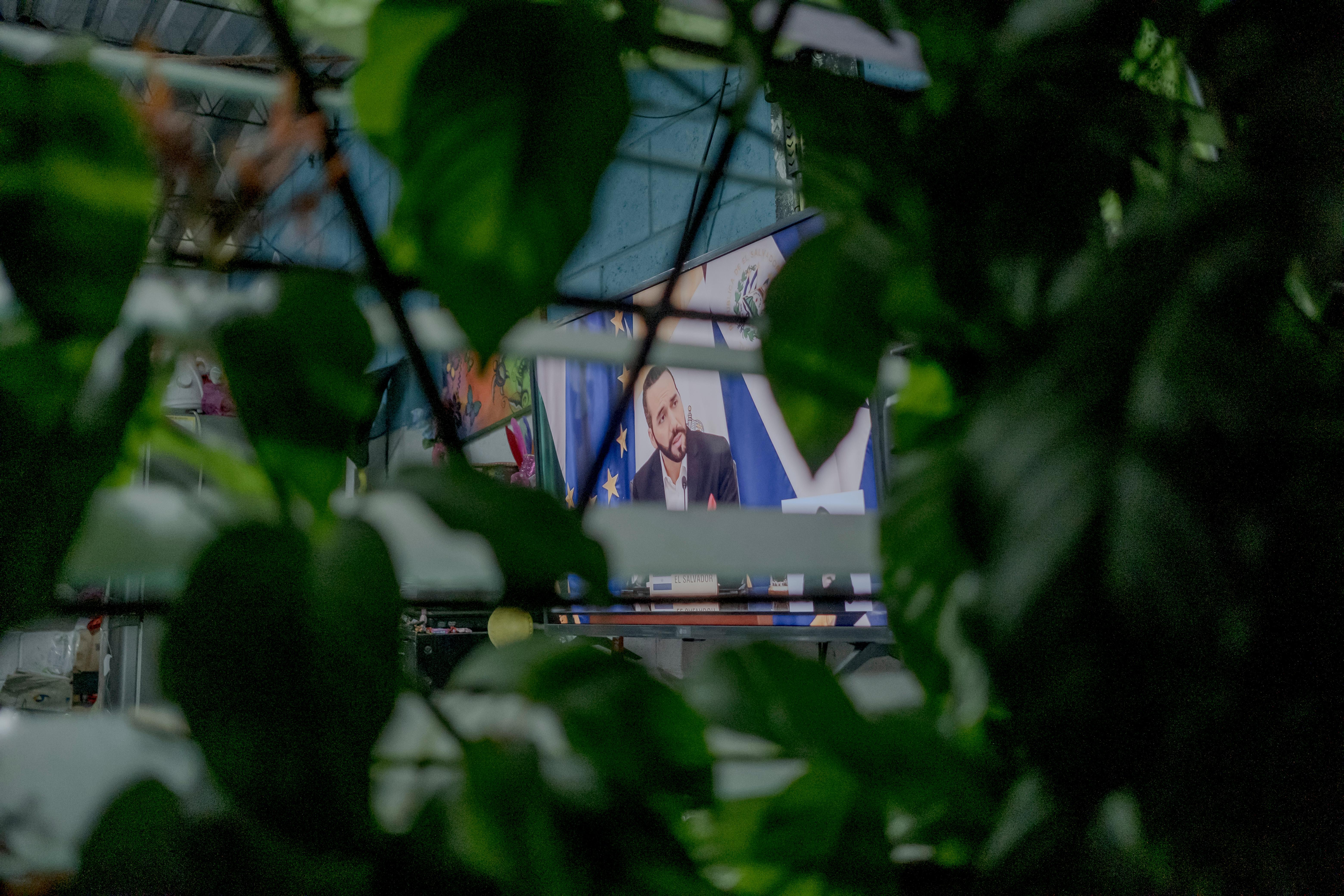

El Salvador President Nayib Bukele put the law into effect. At 40 years old, Bukele is a populist who boasts an approval rating of at least 75 percent, much of which is the result of his handling of the COVID-19 pandemic.

President Nayib Bukele is casting a wider net.

Some residents and global citizens claim that Bukele uses authoritarian tactics, but others aren't questioning his motives. This debate seeps into the Bitcoin issue as well.

On February 9, 2020, Bukele entered his country's legislative assembly surrounded by military soldiers. Some people viewed it as a coup-like interrogation, but Bukele insisted that it was a way to get legislators to approve his national security plan. Now, Bukele's act of making Bitcoin a legal currency is up for debate as well.

Bitcoin could help El Salvador save on remittances.

El Salvador migrants who live in the U.S. contribute a large portion of the GDP. In 2019, about 20 percent (or nearly $6 billion) of the country's GDP came from remittances. This means that a close a fifth of El Salvador's GDP comes from money sent back to families living in the nation.

Of course, this comes with transfer costs, and Bukele hopes that having Bitcoin as a legal currency will cut down on the fees. Thanks to Bitcoin, transactions that take place across the border could take place without international exchange fees that currently burden the GDP.

El Salvador is taking a risk by legalizing Bitcoin.

Cryptocurrency isn't all rainbows and butterflies, which many crypto investors know firsthand. It's an extremely volatile market, and while one Bitcoin is currently worth $50,830.00 as of Sept. 7, that's 14.3 percent lower than the coin's peak on Apr. 16.

In the two-year period ending December 29, 2019, Bitcoin lost 70 percent of its value. Given that El Salvador's economy is already on shaky ground, it's a big risk. However, if it pays off, El Salvador could become a hotspot for Bitcoin trading and mining. Bukele wants to use the country's volcanos to power mining through geothermal energy).

Ultimately, the risk could put El Salvador in a fickle position with the U.S. Since the country uses the U.S. dollar, federal banks could potentially cut ties.

What countries could make Bitcoin a legal tender next?

After Bukele first announced the decision to make Bitcoin a legal tender earlier in 2021, countries like Argentina, Paraguay, Brazil, and Panama endorsed the decision. Paraguay might be next. If it doesn't go all the way, it could still implement laws that favor the use of Bitcoin.