Death Cross Stocks: What They Mean and How to Spot Them

While it might sound dramatic, a death cross stock is just another stock chart indicator to look out for. What are death cross stocks?

June 4 2021, Published 10:45 a.m. ET

Stock market lingo can be intimidating, especially when it involves the word "death." With that in mind, a death cross stock sounds awfully dramatic, but it simply refers to a particular indicator you can find on a chart.

What is a death cross stock and, more importantly, what does it mean for investors?

What do death cross stocks mean?

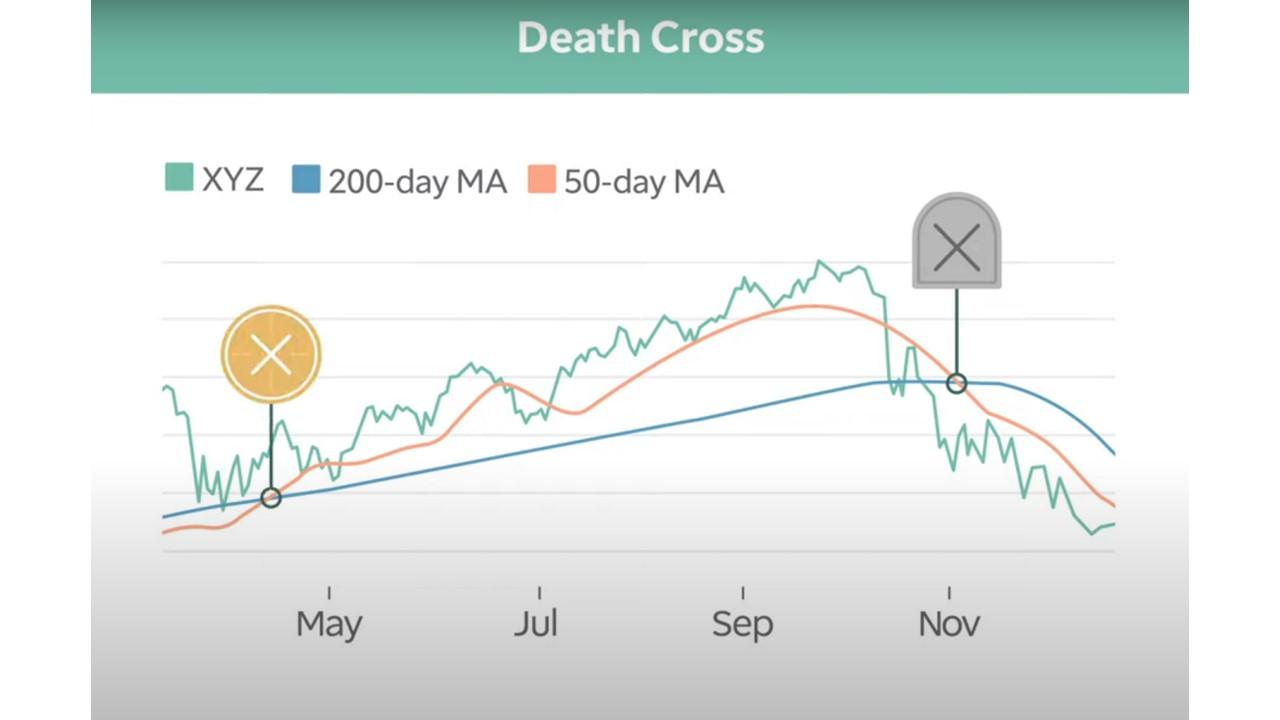

Death cross stocks occur when the 50-day MVA (moving average) of a stock crosses below the 200-day MVA. This is often considered a bearish indicator or a sell signal.

Analysts might change the time frame intervals from 200/50-day MVAs. Other common intervals include 50/20 or 20/10. You need one short-term and one long-term MVA to be able to compare the two. Usually, intervals that are more spread out (like the 200/50-day MVA we originally mentioned) provide a more accurate indicator of a bearish environment for the stock.

Death crosses are the opposite of golden crosses

Unlike death crosses, golden cross stocks occur when the 50-day MVA of a stock crosses above the 200-day MVA. This is often considered a bullish indicator or a buy signal.

Look at a comparative moving average chart to spot death cross stocks

In order to spot death crosses (as well as their golden cross counterparts), you will want to look at a MVA chart that includes a long-term and short-term line.

For comparative MVA charts that use a more condensed time interval (for example, a 20/10-day MVA), you might find more death crosses due to short-term corrections. This could impact your buy and sell strategy, so understand what time interval you want to work with before getting started.

Recent death crosses in FAANG stocks

The FAANG stocks include Facebook, Apple, Amazon, Netflix, and Google.

Netflix (NASDAQ:NFLX) just experienced a death cross at a 200/50-day MVA. The stock's 50-day MVA closed at $513.97, which is $0.53 below its 200-day MVA. Despite the fact that shares are up about 1.3 percent in the morning on June 4, the stock's momentum might be bearish given the death cross. This makes sense considering that the economy is reopening and in-person viewing stocks like AMC are getting all of the attention.

This is the first death cross for Netflix in two years. During that period, all five of the FAANG stocks found themselves in death crosses.

Reddit users and other traders consider death cross stocks in their strategy

Death crosses are an indicator, which makes them an ingredient in an investor's strategy—but it isn't the whole pie. They're largely considered to be a sell, but they aren't always perfect.

In a long-term strategy, a bearish signal doesn't necessarily scream "sell." It might just be a forecast of turbulence, which could also mean an apropos time to average down your cost basis.

As one Reddit user put it, "The death cross is a bit too late to be selling long-term investments, and instead if you have any cash on the sidelines, it's a good time to start scaling into the market."