FANG Stocks Have Nothing to Do With Vampires and Everything to Do With Big Tech

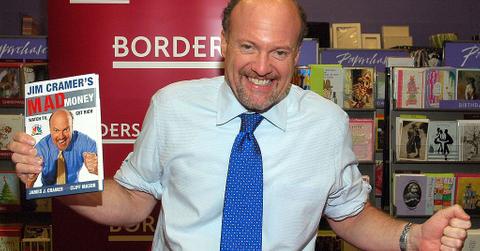

FANG, an acronym created by Jim Cramer, is a group of high performing technology stocks. Should you invest in FANG stocks?

Dec. 7 2020, Published 2:11 p.m. ET

Originally coined by Mad Money host Jim Cramer, FANG is a group of high-performing American technology stocks that includes Facebook, Amazon, Netflix, and Alphabet, or Google. They are all large-cap stocks that deal with technology products and internet services. In addition, they are all considered to be growth stocks because of their rate of product and service development.

Facebook dominates the online social media and social networking, while Netflix has taken a huge lead in subscription video on demand. Amazon rules the markets for cloud-computing infrastructure and e-commerce. And Google is the king of internet search.

FANG stocks make up a sizable portion of the S&P 500 Index and are commonplace in hedge fund management portfolios. As a result, fluctuations in the FANG stock position can have a huge impact on the stock market at large. In 2017, investors then added Apple into the list to form the term FAANG.

Is Microsoft a FANG stock?

Microsoft isn’t a part of the FANG group stocks. It was likely left out of the FANG group because it dominates in enterprise but not in the home. Customers don’t have the same deep engagement with Microsoft’s products as they do with their iPhone or Facebook page. In June 2017, Goldman Sachs coined the acronym FAAMG for Facebook, Amazon, Apple, Microsoft, and Google.

What is the best FANG stock?

I believe Amazon is the best FANG stock to buy now. Amazon is the largest business-to-consumer e-commerce company globally. Its Prime membership program has more than 150 million global customers who have been extremely loyal to the company’s online marketplace. While e-commerce accounts for a major part of its revenue, the tech company has found profit engines in advertising and cloud computing services.

Is there an ETF for FANG stocks?

There is no fund or ETF dedicated solely to the FANG stocks, although some are heavily weighted to the group. When it comes to trading in FANG stocks ETFs, there are about 22 funds that trade in the U.S. with relatively higher exposure to FANG companies along with other stocks, excluding inverse and leveraged funds and those with lower than $50 million in assets under management. Here are the three best FANG ETFs.

- NYSE Technology ETF (XNTK) is a large-cap growth fund focused on tech stocks. The fund tracks the NYSE Technology Index. XNTK has generated a 1-Year trailing total return of about 62 percent. The top three holdings of the fund are Tesla, JD.com, and Shopify.

- Invesco QQQ Trust (QQQ) tracks the NASDAQ 100 Index. QQQ has generated a 1-Year trailing total return of about 46 percent. The top three holdings of the fund are Apple, Microsoft, and Amazon. QQQ is structured as a unit investment trust which provides a fixed portfolio as redeemable units to investors.

- iShares Expanded Tech Sector ETF (IGM) is a large-cap growth fund focused on tech stocks. The fund tracks the S&P North American Technology Sector Index. IGM has generated a 1-Year trailing total return of about 43 percent. The top three holdings of the fund are Apple, Microsoft, and Amazon.

Is FANG stock a good buy?

Anyone who has invested in FANG stocks over the years may have made a lot of money. FANG companies exhibit various competitive advantages that make them attractive long-term investments. FANG companies benefit from the network effect. For instance, Amazon’s Prime service brings millions of shoppers to its marketplace daily, which makes its seller services more appealing to third-party merchants. Facebook’s products are valuable to new customers due to its more than 2.5 billion other active users.