How the Crypto Fear and Greed Index Measures Market Opportunities

As cryptocurrencies continue their slump, the Fear and Greed Index is helping investors make sense of it all. How does the index work?

May 24 2021, Published 2:55 p.m. ET

As Bitcoin and other altcoins continue to experience yearly lows, many analysts speculate whether this is the end of the cryptocurrency craze. After all, cryptocurrencies across the board saw unprecedented growth towards the end of 2020. The peaks and valleys aren't new for crypto enthusiasts. They are used to the crypto market's extreme volatility. The Fear and Greed Index could be what helps them navigate the market. So, what is the Fear and Greed Index and how can newcomers to crypto investing use it to their advantage?

The Crypto Fear and Greed Index is made up of several different metrics and factors.

Like the traditional Fear and Greed Index created by CNNMoney, which measures stock market trends, the Crypto Fear and Greed Index attempts to make sense of the crypto market. Published by Alternative.me, crypto investors take cues from the index to gauge whether the current market conditions pose an attractive buying opportunity.

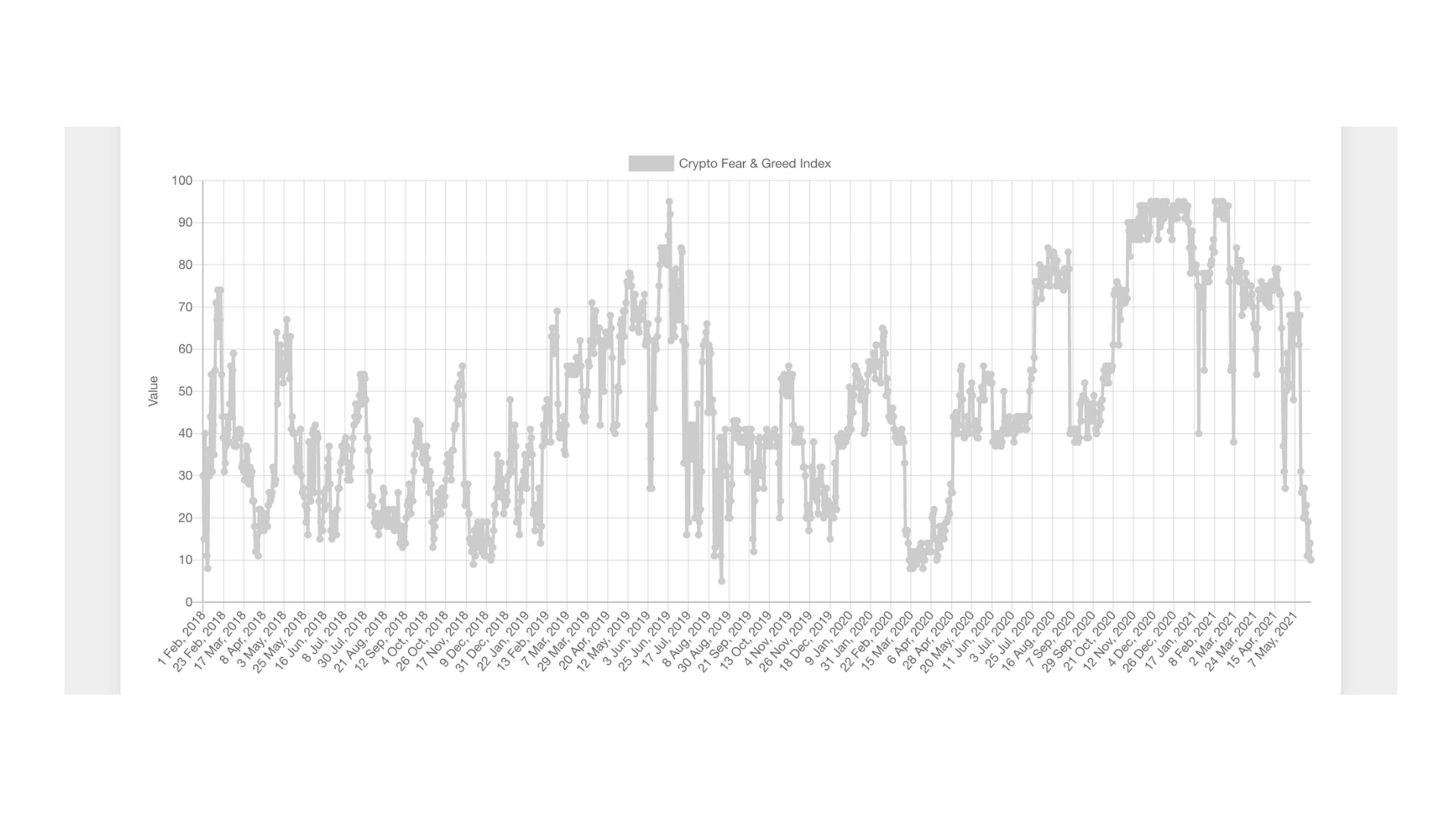

The Crypto Fear and Greed Index measures several factors—volatility, social media, momentum, dominance, Google trends, and volume. The index generates a single number to quantify the market’s current position easily. The score ranges from zero to 100. Zero represents extreme fear and 100 indicates extreme greed.

Extreme fear and extreme greed are used to represent investor behavior.

For the most part, in 2021, the Crypto Fear and Greed Index has been hovering between 50 and 80. This has reflected the crypto market’s steady rise and warm embrace from investors from all backgrounds.

However, after a string of bad publicity for cryptocurrencies, the Crypto Fear and Greed Index has dropped considerably. Since its 37 point drop to 31 on May 13, the index has declined steadily. As of this writing, the index sits at 10—the lowest it has been since March 23, 2020, due to the onset of the COVID-19 pandemic.

What crypto investors can take away from the Fear and Greed Index

While not an exact science, the Crypto Fear and Greed Index paints a clearer picture of the overall sentiment of the cryptocurrency market. A period of extreme fear might indicate a trend of massive selling-offs and knee-jerk bearish commentary, which in turn causes crypto prices to fall. This creates a buying opportunity for crypto investors who view the current state as a temporary dip before the market rebounds.

An opportunity to purchase tokens and coins at a steep discount can provide significant profits for those who take a risk during periods of extreme fear. On the other hand, investors who have already amassed gains and sit on a cache of crypto holdings might look to sell at a time of extreme greed.

The Crypto Fear and Greed Index is a flowing chart meant to reflect many factors to make sense of a highly volatile market. An extreme greed period could forecast massive sell-offs that would cause prices to drop. Extreme fear could raise the flags of prices at abnormal lows and could indicate potential buying opportunities.

In high-risk investment markets like cryptocurrencies and the stock market, investors look to gain any (legal) advantage they can get. The Crypto Fear and Greed Index does just that. However, investors should use it as a tool and not a crystal ball.