Is SRAC a Good SPAC Stock To Buy Now?

Now that SRAC stock has dropped from its peak, investors want to know whether SRAC is a buy before the Momentus merger date.

June 3 2021, Published 9:10 a.m. ET

Momentus is going public in a SPAC merger with Stable Road Acquisition (SRAC). The parties recently extended their merger date. At about $11, SRAC stock has pulled back more than 60 percent from its all-time high of $29. Is SRAC a good buy now before the Momentus merger?

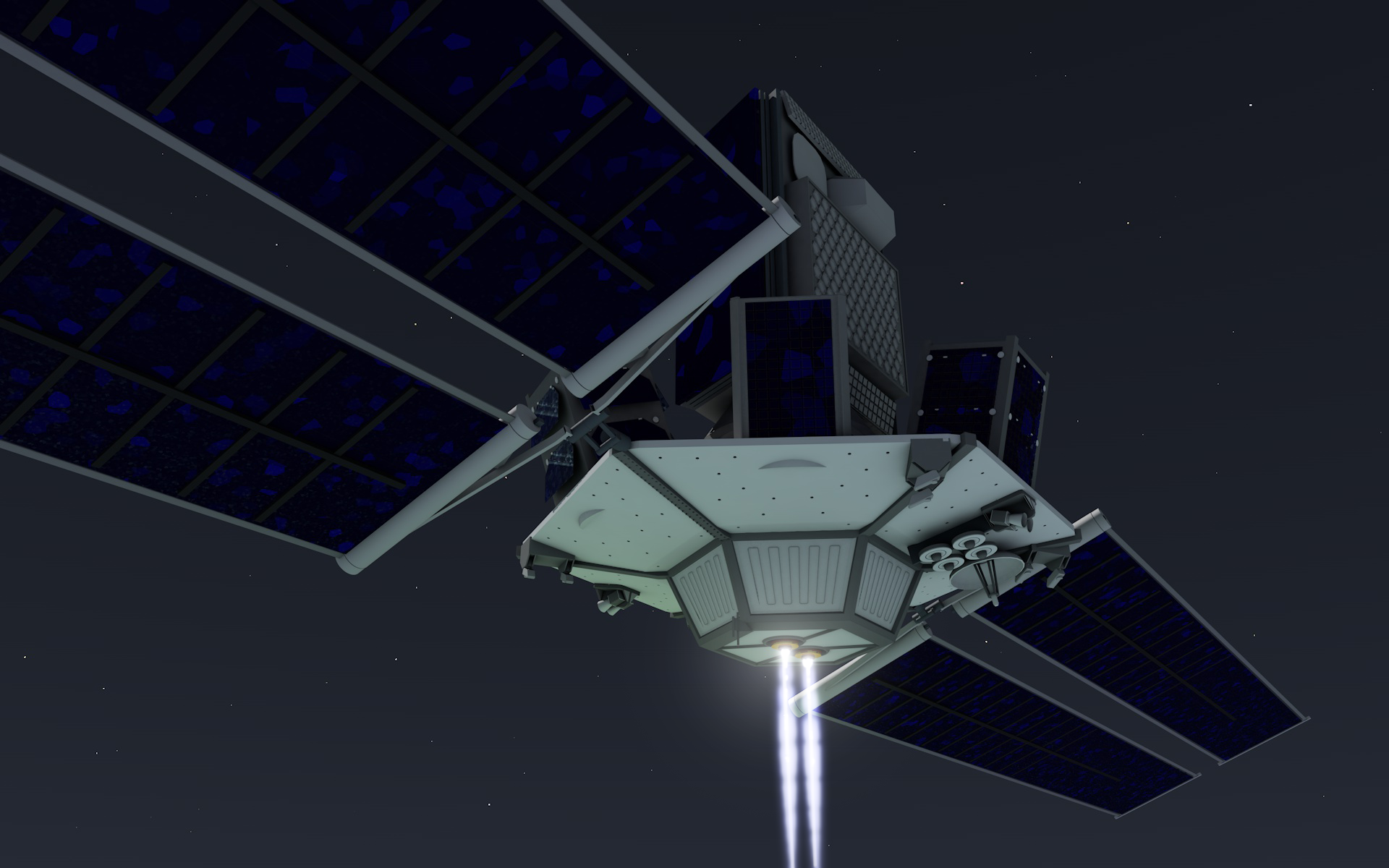

Momentus, a space startup, provides "last-mile delivery" for satellite launches. Once it completes the SPAC merger, Momentus stock will trade under the “MNTS” ticker symbol and replace SRAC stock.

When is the SRAC-Momentus merger date?

Stable Road and Momentus aim to close their merger by Aug. 13. The parties were previously targeting a May 13 closing, but realized they needed more time to complete regulatory processes for the merger closure. More than 66 percent of Stable Road shareholder votes supported the deadline extension request.

If Stable Road had failed to secure enough shareholder votes, it would have been forced to dissolve and refund investors their money. That would have been a major blow to Momentus and its hopes of going public.

When will Momentus fly?

Momentus has encountered regulatory hurdles and doesn’t expect to fly in 2021. In a May securities filing, Stable Road revealed that Elon Musk’s SpaceX had suspended its work with Momentus until it secures government approvals to fly.

Momentus planned to launch a payload on SpaceX’s Jun. 2021 rideshare mission, but was denied FAA (Federal Aviation Administration) clearance due to national security concerns. It also missed a Jan. 2021 launch mission.

A major stumbling block in getting government approvals has been Momentus’s foreign ownership structure. The startup has initiated a process to cut ties with its Russian founder, Mikhail Kokorich, who has already resigned as its CEO and director. He will also cease holding Momentus shares in three years.

Will SRAC stock rise as the merger date approaches?

At $11, SRAC stock is almost back to where it started. Investors sold off the stock on fears Stable Road would miss the Momentus merger deadline. Momentus’s regulatory challenges have also pressured SRAC stock.

However, Stable Road has resolved the deadline issue and Momentus continues to engage with regulators for licenses. Therefore, SRAC stock will likely go up when Momentus secures government approvals to fly and SpaceX restores its partnership.

Is SRAC a good SPAC stock to buy now?

SRAC stock’s 60 percent retreat from its all-time high reached in Feb. 2021 opens a window for bargain hunters. Momentus is also a promising business. Demand for Momentus’s last-mile satellite and space cargo delivery service has grown even before it begins to fly, and the company is currently negotiating deals worth $2 billion.

Stable Road (SRAC) versus Holicity (HOL)

Like Stable Road, Holicity is also taking a space exploration startup public: Astra. Whereas Momentus secured a $1.2 billion valuation in its deal with Stable Road, Astra got $2.1 billion valuation in its Holicity deal. PIPE investors put $175 million into Momentus, and $200 million into Astra.

Stable Road and Holicity both listed their shares at $10 apiece, and SRAC's all-time high is $29, while HOL’s is $22. Both stocks have retreated more than 50 percent from their peaks.

SRAC stock investors will own 11 percent of Momentus stock, with PIPE investors getting 12 percent and SPAC sponsors receiving 2 percent. On the other hand, HOL stock investors will receive a 12 percent stake in Astra stock, with 8 percent going to PIPE investors and 3 percent to the SPAC's sponsors.