SRAC Stock Is an Attractive Bet Before the Momentus Merger

SRAC SPAC is merging with Momentus, which is a space company that plans to offer in-space transportation services. Is SRAC stock a buy?

March 19 2021, Published 8:28 a.m. ET

Momentus, a space company that plans to offer in-space transportation services, is gearing up to go public through a reverse merger with Stable Road Acquisition Corp. (SRAC). The SRAC SPAC raised about $172.5 million in a November 2019 IPO. What's the SRAC and Momentus merger date and should you buy the SPAC stock now?

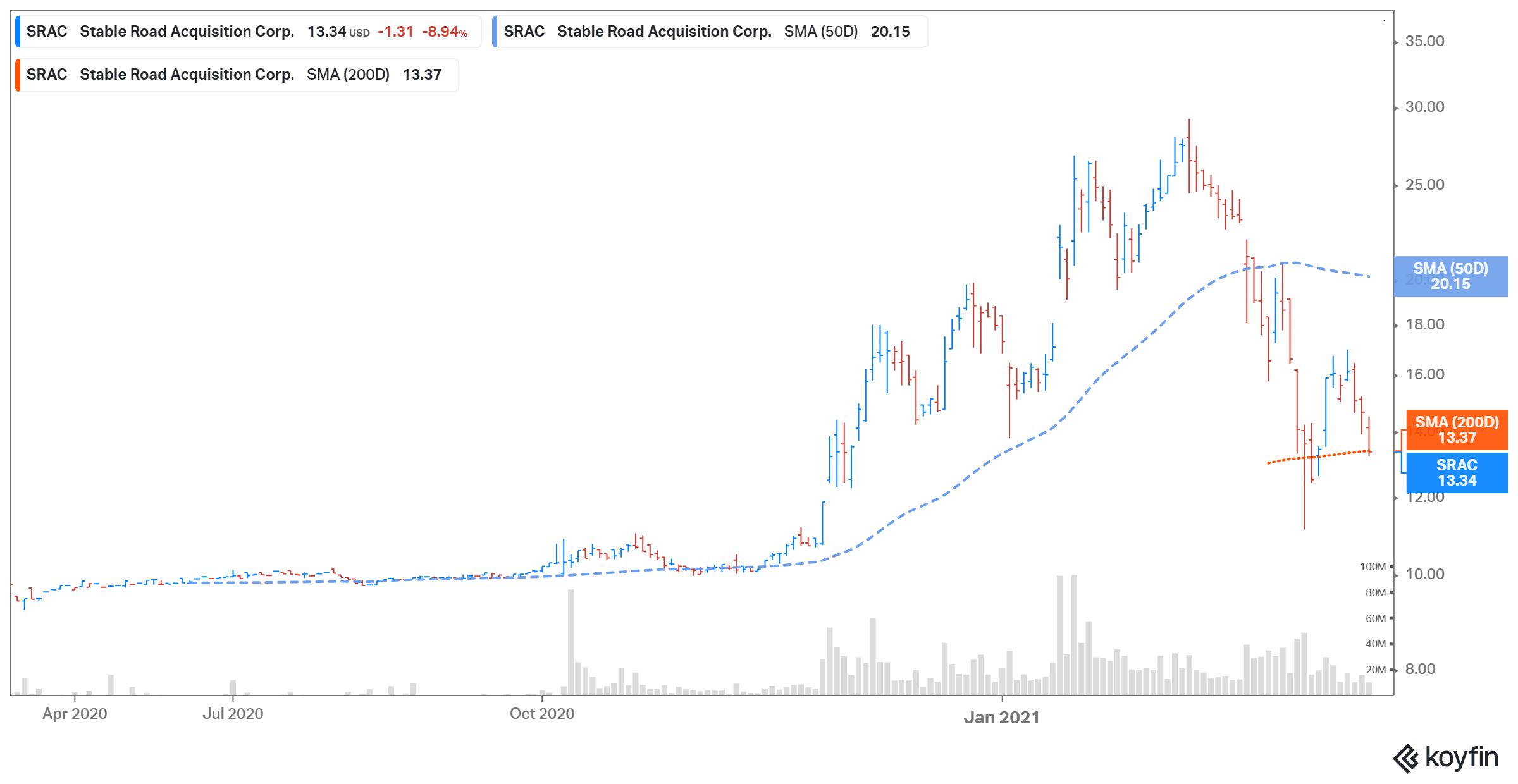

SRAC SPAC stock is up 33.4 percent from its IPO price of $10 per share. However, the stock is still down 54.3 percent from its 52-week high. On March 18, the stock fell 8.9 percent and closed at $13.34.

Why SRAC SPAC stock is falling.

SRAC stock is trading almost 54 percent lower than its high of $29.18, which it reached on Feb. 10. The stock has been falling due to a broader sell-off as bond yields rise.

SRAC and Momentus merger date

The SRAC and Momentus merger is expected to close in early 2021. The transaction, subject to approval by SRAC shareholders and other customary closing conditions, is set to have a pro forma enterprise value of $1.2 billion. The combined entity will be listed on the Nasdaq under the ticker symbol “MNTS.”

The deal will provide Momentus with nearly $310 million in cash to fund the company’s growth initiatives. The amount includes about $172.5 million of cash held by SRAC in trust and an additional $175 million in PIPE (private investment in public equity) at $10 apiece. Existing Momentus shareholders will likely own about 75 percent of the combined entity when the deal closes.

Momentus versus Virgin Galactic

Founded in 2017, Momentus is a space company that plans to offer in-space transportation and infrastructure services. The company’s partners and customers include NASA, SpaceX, and Lockheed Martin. Momentus expects to generate sales of $19 million in 2021 and forecasts its sales growing by 682 percent in 2022 and 293 percent in 2023. The company expects to turn EBITDA and unlevered free cash flow positive in 2023. In 2027, Momentus expects to report sales of $4.0 billion and an EBITDA of $2.5 billion. The company projects an EBITDA margin of 61 percent in 2027.

Momentus faces competition from Virgin Galactic. In 2019, Virgin Galactic went public through a reverse merger with a blank-check company Social Capital Hedosophia. Virgin Galactic is an aerospace and space travel company. The company is expected to report sales of $5.2 million in 2021 and $85.7 million in 2022. In 2020, Virgin Galactic reported sales of $238,000

Space exploration stocks list

Space exploration stocks include Virgin Galactic, Boeing, Lockheed Martin, Maxar, Aerojet Rocketdyne, and Iridium Communications. Astra Space is going public through a reverse merger with Holicity (HOL), while AST SpaceMobile is going public via New Providence Acquisition (NPA) SPAC.

SRAC Stock Price

SRAC SPAC stock is a buy before Momentus merger

SRAC valued Momentus at a pro forma implied equity value of $1.51 billion. Meanwhile, at SRAC’s current stock price, Momentus is valued at around $2.0 billion. In comparison, Virgin Galactic and Aerojet Rocketdyne (AJRD) have market capitalizations of $7.6 billion and $3.7 billion, respectively.

In Momentus’ presentation announcing the transaction, the company provided a comparison with its peers. Its 2024 EV-to-sales and 2025 EV-to-sales multiples are 1.0x and 0.6x, respectively. Virgin Galactic’s 2024 EV-to-sales and 2025 EV-to-sales multiples are 11.4x and 9.1x, respectively. However, Momentus looks expensive based on the NTM EV-to-sales multiple.

Momentus thinks that it has an addressable market size of $415 billion, which is set to reach $1.4 trillion by 2030. Based on Momentus’ strong growth outlook and valuations, SRAC stock looks like a good buy. However, the stock is a speculative play until the SRAC and Momentus transaction closes.