Shoals Technologies Is the Latest Green Energy Stock to Join the IPO Party

The Shoals Technologies (SHLS) IPO is set for today. Can it deliver stellar returns like ARRY? Should investors buy SHLS stock?

Jan. 27 2021, Updated 9:09 a.m. ET

The last year has been remarkable for green energy companies. Many new green energy companies listed in 2020, either taking the traditional IPO route or through a SPAC (special purpose acquisition company). Shoals Technologies (SHLS), which supplies solar equipment, is set to list today, Jan. 27. Should you buy SHLS IPO stock amid the global push toward green energy?

The rally in green energy stocks picked up after Joe Biden’s election as U.S. president. Among his first decisions as president was rejoining the Paris Climate Deal. He's also issued an order to replace government vehicles with electric versions.

The SHLS IPO date and price

Shoals Technologies has put 77 million shares on offer in the IPO. Of these, nine million are being offered by the company, while the remaining 68 million are being sold by existing shareholders. The underwriters have the option to purchase an additional 11.5 million shares.

The price is set at $25. The company has upsized its offering and price range to match investors' growing appetite for green energy companies. Previously, SHLS was offering 50 million shares for $19–$21.

A look at SHLS's valuation

Shoals Technologies plans to raise $1.9 billion with its IPO. The stock would have a market capitalization of around $4.2 billion at the upper end of the IPO price range. In 2019, the company generated sales of $144 million, and in the first nine months of 2020, it had $136 million in sales and its revenue grew 28 percent. By extrapolating that growth to Q4 2020, it could have seen around $185 million in 2020 revenue, which would mean a price-to-sales multiple of 22.7x

Shoals is seeing profits

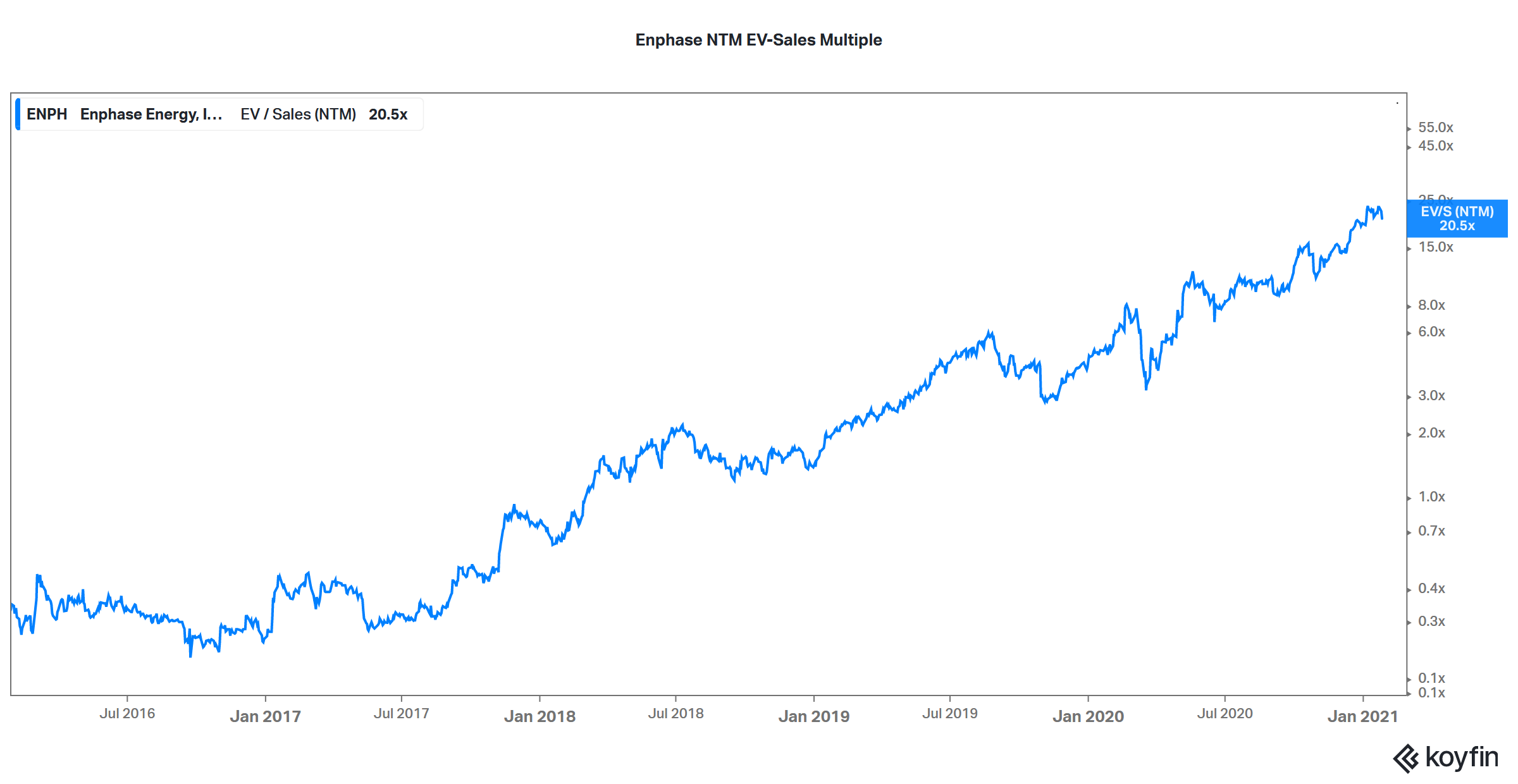

In 2019, the company posted a net income of $25 million, which would mean a PE multiple of 168x. Seen alone, these valuations might seem high, but we should see them in the context of clean energy stocks' rerating. For instance, compared with Enphase, which has a next-12-month EV-to-sales multiple of 20.5x, Shoals looks reasonably valued.

Should I buy SHLS stock?

Considering how its valuation compares and the expected strong growth for solar energy companies under the Biden administration, SHLS stock looks like a good buy. There are bound to be comparisons with solar tracking company Array Technologies (ARRY), whose stock soared after listing in Jan. 2021 and doubled in value. Whereas all IPOs have different risk-reward dynamics, SHLS stock looks like a good opportunity.