Buy GHVI Stock on the Dip Before Matterport SPAC Merger

Pre-merger SPACs aren't always worth the investment, but GHVI is well-positioned to provide returns ahead of the Matterport merger.

April 15 2021, Published 1:06 p.m. ET

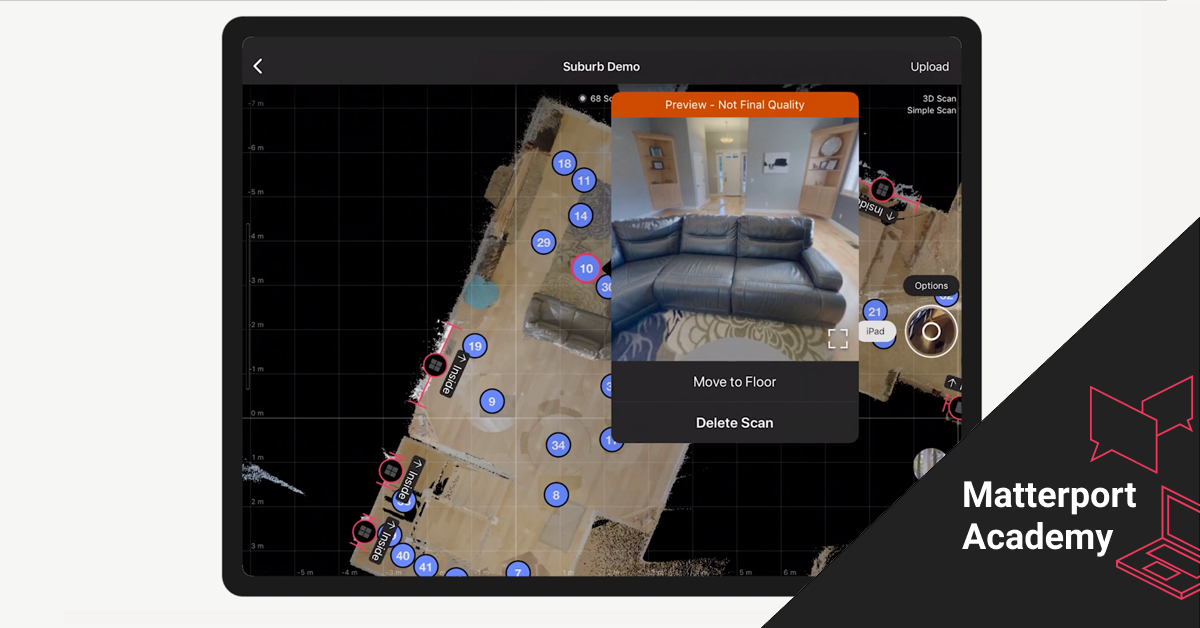

Virtual spaces are a valuable asset, especially since the beginning of the COVID-19 pandemic. Matterport, a California-based tech company specializing in creating 3D spaces, is capitalizing on this relevance by merging with a blank-check company called Gore Holdings VI (NASDAQ:GHVI).

GHVI shares have fallen by more than 46 percent since their peak in mid-February when the shares were trading at $24.46. Now, at $13.17 per share, investors are better positioned to earn from a pre-merger SPAC investment.

Matterport IPO date isn't known yet.

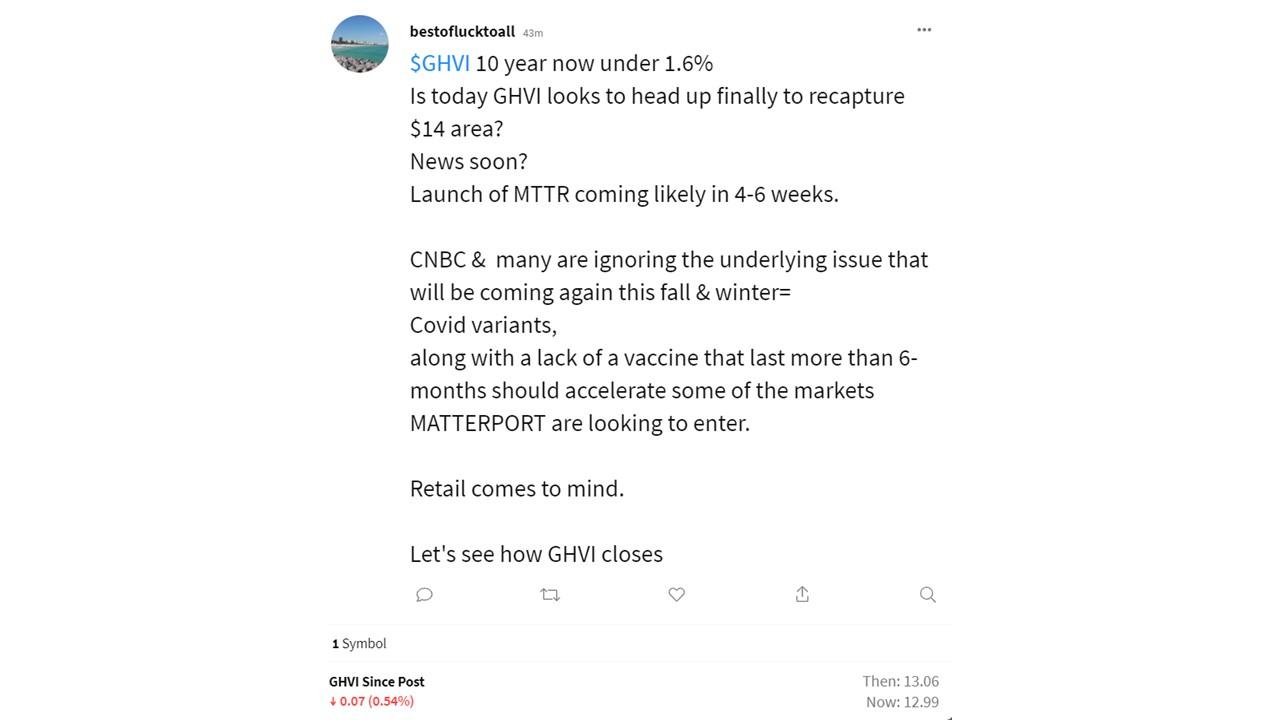

Matterport announced its SPAC agreement with GHVI in early February. The shares swelled 127.32 percent before dropping off. With a target selected, it's only a matter of time until the GHVI ticker transitions over to the new ticker symbol.

As for when the post-merger transition will occur, investors expect the $2.9 billion combined equity deal to finalize soon, but no official word has been given on the date.

When can you buy Matterport stock?

Matterport stock will take over GHVI stock in the post-merger SPAC phase. Investors can purchase GHVI now and still be eligible for a cash swap-out if they don't want to hold onto Matterport stock after it transitions. Otherwise, there's the option of waiting until the ticker switches and making an investment then.

Look out for the Matterport stock symbol.

Matterport will trade under the ticker symbol "MTTR" on the Nasdaq in place of the existing GHVI stock.

Matterport's valuation is slightly high.

For new IPOs, overvaluation is a big concern, even for those taking the SPAC route. Matterport has experienced high growth in the past year. The company expects its 2021 revenues to hit $123 million—a number that will likely multiply five times over closer to 2025. Unlike many high-growth companies, Matterport's prospects of profitability are actually high. The projected post-SPAC valuation of at least $1 billion is a bit rich, but not totally unfair.

Gores Holdings VI's (GHVI) role in the deal

Without GHVI, there might not be a Matterport SPAC. This blank-check company is led by Alec Gores, a billionaire investor worth $2.9 billion in 2021. His company, The Gores Group, has funded more than $4 billion in equity capital. The company mainly focuses on tech companies, although other big names like Hostess and Meridian Medical are in the portfolio as well.

A forecast for Matterport stock

High-growth tech stocks have been in the hot seat this year, mainly because of inflation fears and other economic issues. However, Matterport seems like it has the relevance and strength to succeed beyond its initial boom.

Some of Matterport's biggest growth areas include creating digital twins of physical buildings for purposes of property appraisal, building renovations, and office planning for a post-COVID era. If they can maintain their trajectory and hit those hopeful numbers, early SPAC investors could be golden.

GHVI SPAC stock is a good buy before the Matterport merger.

Any pre-merger SPAC stock comes with a layer of risk. However, GHVI's recent dip means that it might be worth a timely investment before the finalization of the Matterport merger.