Why FUSE Stock Fell on News of the MoneyLion Merger

The Fusion Acquisition (FUSE) SPAC is merging with MoneyLion. Is FUSE stock a buy before the deal closes?

Feb. 17 2021, Updated 7:17 a.m. ET

American digital financial platform MoneyLion is gearing up to go public through a reverse merger with Fusion Acquisition (FUSE). The SPAC raised approximately $305 million in a June 2020 IPO. Previously, FUSE said that it was formed with the focus of merging with private fintech companies. Should you buy FUSE SPAC stock before its merger with MoneyLion?

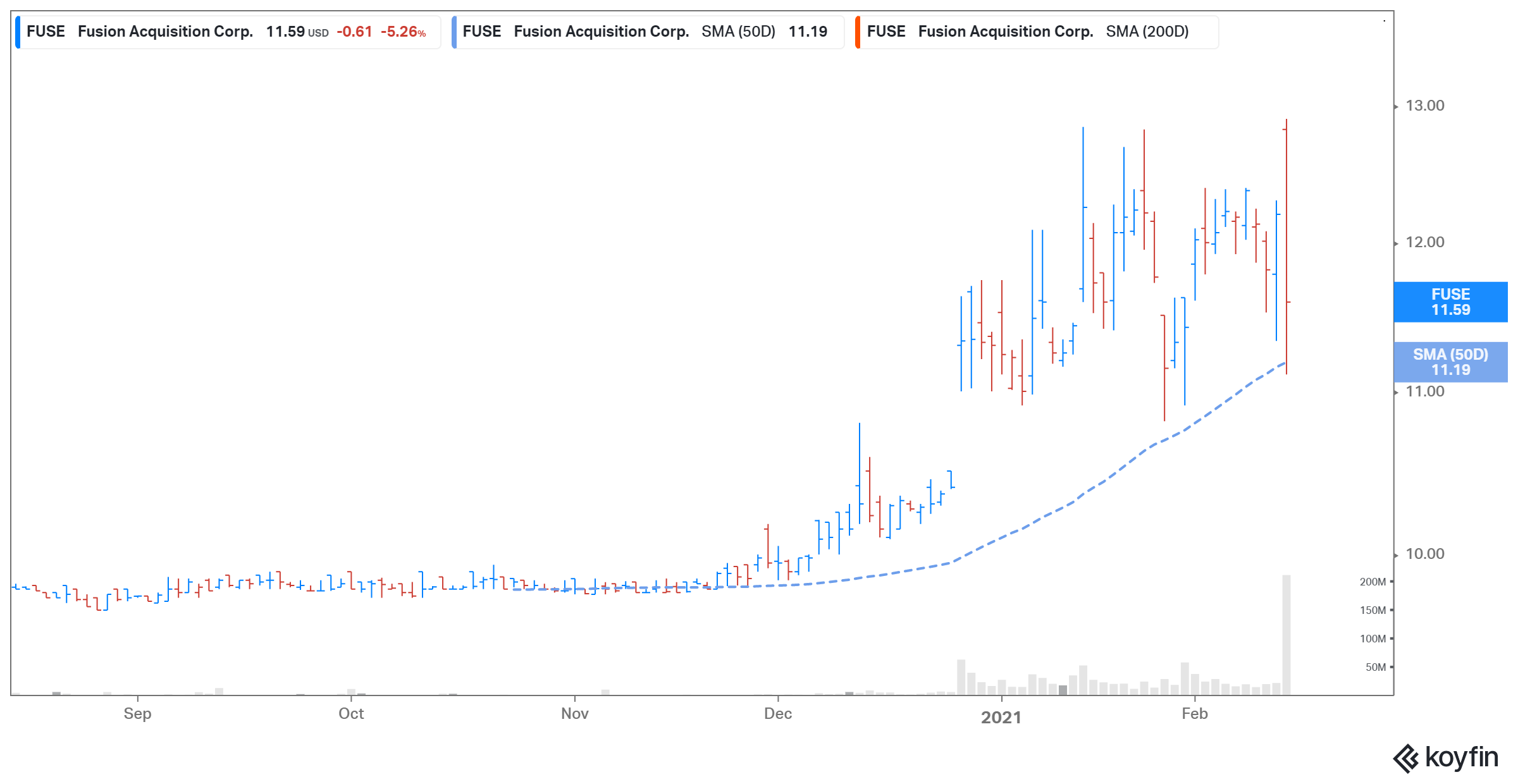

FUSE SPAC stock has gained 16 percent from its IPO price of $10 per share. On Feb. 12, the stock lost 5 percent to close at $11.59 following the merger news. FUSE stock was also down 2.5 percent in premarket trading on Feb. 16.

Who owns FUSE?

The FUSE SPAC's founder and CEO is John James, who also led fintech company BetaSmartz and co-founded Boka Group. Jim Ross, chairman at Fusion, worked at State Street for more than 20 years. Ross is also known for launching the popular SPDR S&P 500 and SPDR Gold Trust ETFs.

The FUSE-MoneyLion merger date

The FUSE-MoneyLion merger is set to close in the first half of 2021. The merger is subject to approval from Fusion shareholders and other customary closing conditions, and the combined entity will be listed on the NYSE. The pro forma enterprise value of the deal is estimated to be $2.4 billion.

MoneyLion’s valuation

The deal will provide MoneyLion with nearly $526 million in cash proceeds to fund the company’s growth initiatives. The amount includes about $350 million in cash held by FUSE in trust and an additional $250 million in PIPE (private investment in public equity) at $10 per share. Investors in the PIPE include BlackRock and Apollo Global Management. MoneyLion shareholders are set to own about 76 percent of the combined company at the deal's closure. The combined company’s pro forma implied equity value is about $2.9 billion.

MoneyLion versus SoFi

Founded in 2013, MoneyLion is a fintech company that offers mobile banking, investment services, and a credit builder platform. MoneyLion reports that its Credit Builder Plus platform boosts credit scores by over 60 points in 60 days in 50 percent of cases. The company has more than 1.4 million users.

MoneyLion competitor Social Finance (SoFi) is also planning to go public through a SPAC deal with Social Capital Hedosophia V (IPOE). The blank-check company is sponsored by billionaire venture capitalist Chamath Palihapitiya. IPOE stock rose about 58 percent after the merger announcement. The deal values SoFi at about $8.65 billion. SoFi, which offers loans, savings, and investments, has more than 1.7 million users.

FUSE stock fell after MoneyLion merger news

FUSE stock fell after the MoneyLion merger announcement, as investors anticipated a better-known brand to be affiliated with the SPAC. There were also rumors that a large financial institution sold FUSE shares just before the merger announcement.

In 2021, MoneyLion is planning to introduce various new products that could boost its growth, including a crypto platform. In 2021, MoneyLion’s adjusted revenue is expected to increase by 88 percent year-over-year to $144 million.

Should you buy FUSE stock?

FUSE stock is a speculative bet until the Fusion-MoneyLion merger is closed. In 2023, MoneyLion expects to generate $424 million in revenue, and its 2023 price-to-sales multiple is 5.7x. SoFi has a 2024 price-to-sales multiple of 4.1x.