Is EVgo a Better EV Charging Stock Than Chargepoint?

Some investors are rushing to buy CLII SPAC stock before the EVgo merger. They are hoping for another CCIV SPAC stock moment.

March 2 2021, Published 10:30 a.m. ET

EVgo is going public through a blank-check company called Climate Change Crisis Real Impact I Acquisition Corp (CLII). EVgo provides an electric vehicle charging service. It’s set to expand the options for investors seeking EV charging stocks after Chargepoint (CHPT) also went public. Is CLII SPAC stock a good to buy before the EVgo merger date?

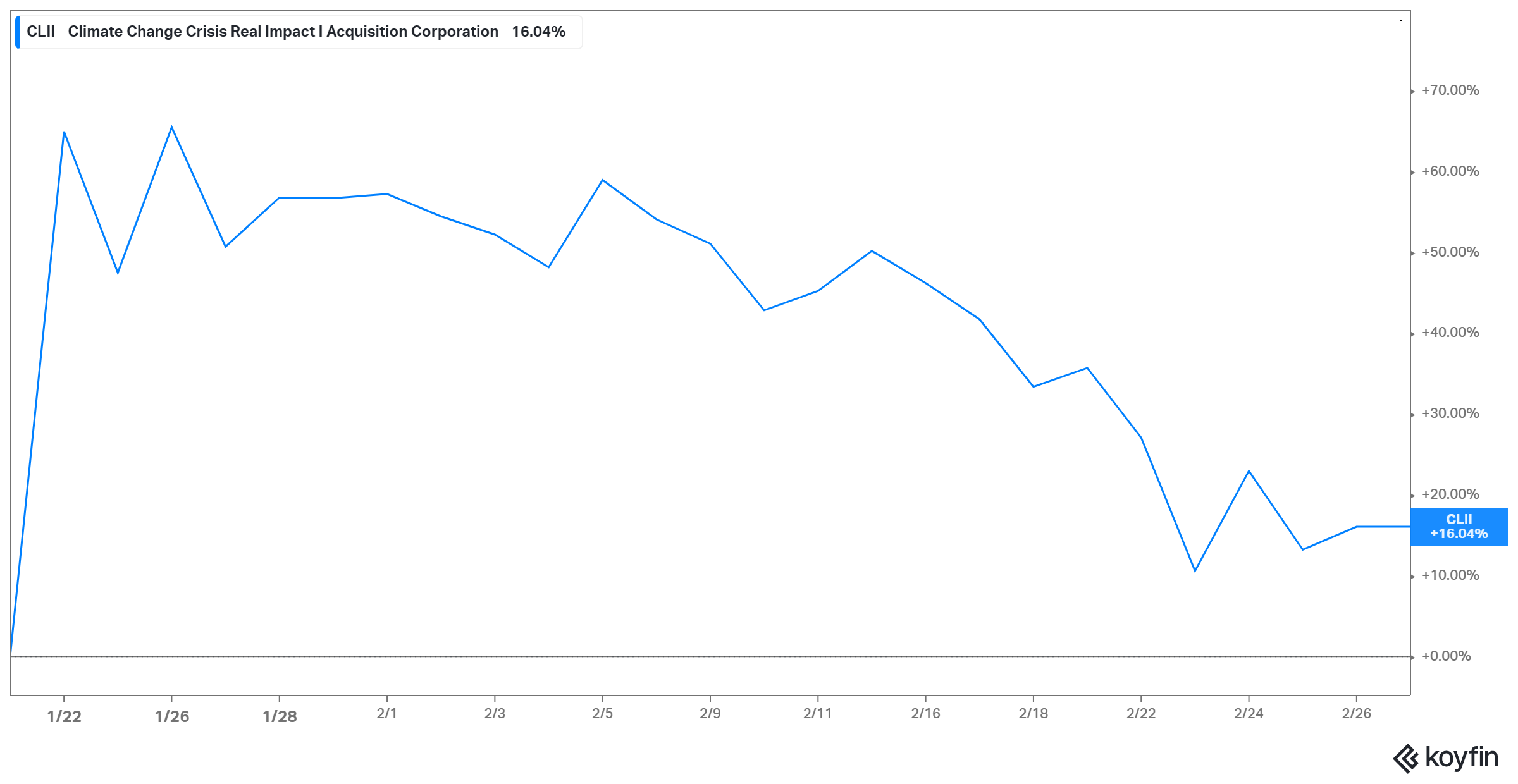

At about $15.50 per share now, CLII SPAC stock has risen more than 50 percent over its listing price. It has been sporting a 16 percent gain since it announced the EVgo merger deal. The stock has traded between a low of $9.75 and a high of $24.34 since its debut.

Now, CLII SPAC stock trades about 36 percent below its recent peak. That looks to be a result of a broad correction in green energy stocks, and EV stocks after the recent surge.

CLII-EVgo merger date

The CLII SPAC and EVgo announced their merger agreement on Jan. 22. They aim to close the transaction by the end of June 2021. The blank-check company raised $230 million in its September 2020 IPO. It raised an additional $400 million through PIPE transactions, which drew institutional investors like BlackRock, Pimco, and Wellington Management. EVgo is set to receive $575 million in net cash to spend toward expanding its charging network to be able to serve more customers.

The CLII SPAC stock symbol will change to “EVGO” after the merger is completed. Investors holding shares of the blank-check company will own about 9 percent of the combined company. PIPE investors will own 17 percent and existing EVgo investors will own 74 percent.

EVgo versus Chargepoint

Chargepoint is Evgo’s major competitor. The others are Blink Charging (BLNK), and Beam Global (BEEM). Chargepoint also went public through a SPAC deal. Its post-merger stock started trading on Mar. 1 and fell by more than 7 percent on its first trading day.

While the EVgo SPAC deal valued the combined entity at $2.6 billion, the Chargepoint SPAC deal valued the combined entity at $2.4 billion. Also, while EVgo will receive $575 million in cash, Chargepoint received $683 million in cash. EVgo intends to use its cash to invest in expanding its charging infrastructure. Meanwhile, Chargepoint will use its cash to repay debt in addition to funding growth.

EVgo has set up more than 800 chargers across 34 states. Chargepoint has more than 115,000 charging spots. EVgo says that it currently serves more than 220,000 customers. Chargepoint has more than 4,000 corporate customers. Both companies have plans to expand their charging network to better capitalize on the growing market opportunity as more drivers adopt electric cars.

Outlook for EV charging stocks

As more electric cars come to market and drivers seek convenient ways to top up on the go, the demand for public EV charging will continue to rise. Easy access to fast charging is going to be central to the broader adoption of electric cars. The Biden administration plans to build 550,000 electric vehicle charging stations and shift the government fleet to electric models.

It bodes well for EV charging companies like EVgo as the government throws its support behind efforts to encourage drivers to transition from gas-powered cars to electric models, which are good for the environment.

EVgo looks well-positioned to capitalize on the booming electric vehicle charging demand. It already operates charging stations across 34 states and aims to build a nationwide charging network. EVgo will use the money from the CLII SPAC deal to fund the expansion of its charging infrastructure.

CLII SPAC looks like a good buy

EVgo chargers are built to work for electric cars from any manufacturer. With Tesla charging stations only serving Tesla drivers, public charging provider EVgo has a huge market to serve. EVgo chargers are strategically located on city streets, in store parking lots, and outside office buildings.

In 2020, EVgo partnered with General Motors to help the traditional automaker set up nearly 3,000 charging stations as it plans to sell more electric cars in the coming years. EVgo partnered with Uber and Lyft to charge electric cars in their ride-sharing fleet.

With Chargepoint and Blink Charging stocks trading at above $30 and $40, respectively, CLII SPAC stock at about $15 might appeal to investors seeking cheap EV stocks.

Finally, pre-merger SPAC stocks have generally paid off well for investors. For example, CCIV stock soared as much as 500 percent and delivered huge returns for early investors before the Lucid Motors merger announcement. CLII SPAC stock could be a good addition to your portfolio ahead of the EVgo merger.