Off Its Highs, AONE Stock Is an Attractive Bet Before the Markforged Merger

One (AONE) SPAC is merging with a 3D printer maker Markforged. Is AONE stock a buy before the merger closes?

March 12 2021, Published 8:09 a.m. ET

Markforged, a 3D printer maker, is gearing up to go public through a reverse merger with One (AONE). The AONE SPAC raised about $200 million in an August 2020 IPO. What's the AONE-Markforged merger date and should you buy the SPAC stock now?

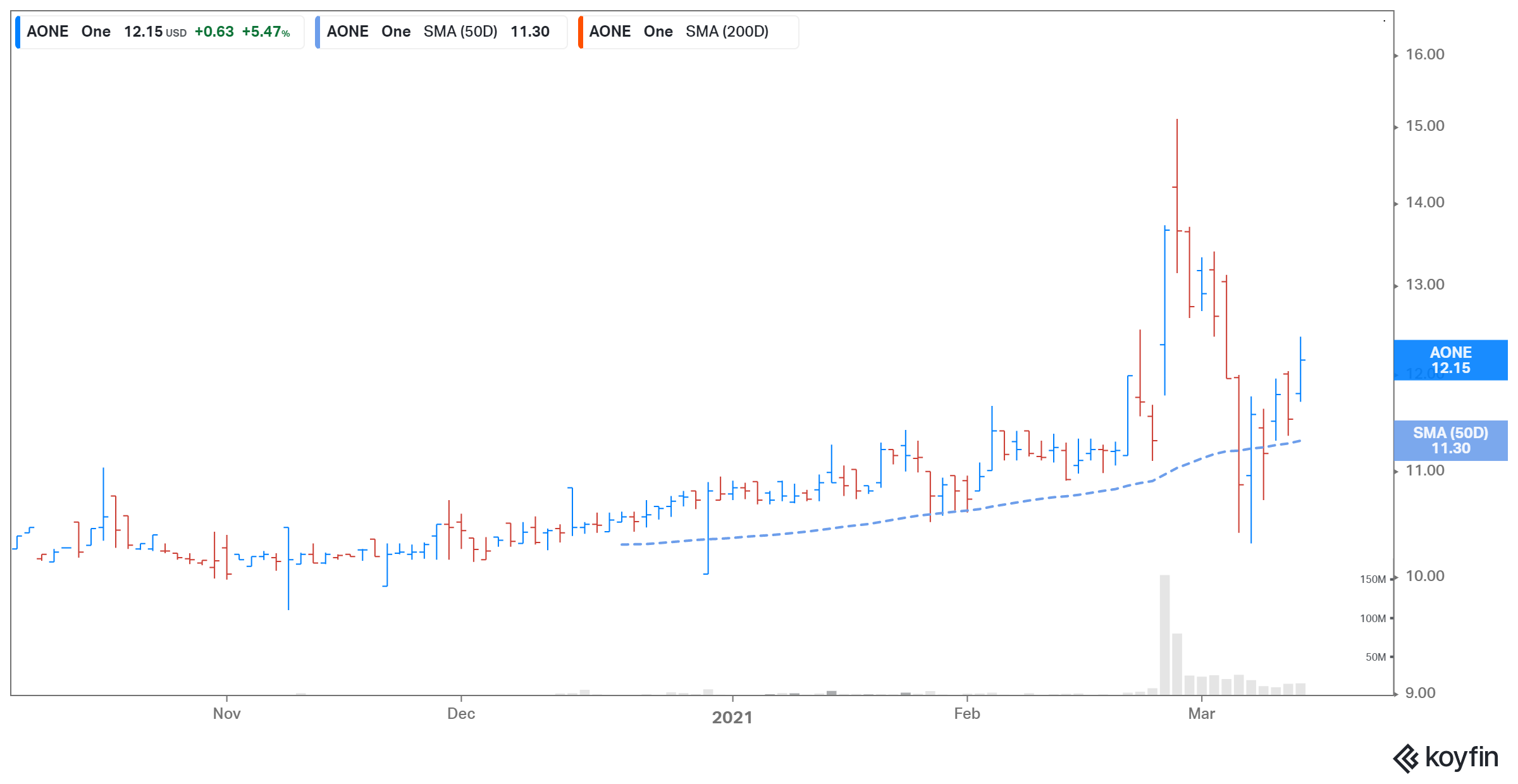

AONE SPAC stock has gained 21.5 percent from its IPO price of $10 per share. However, the stock is still down 20 percent from its 52-week high. On March 11, the stock rose 5.5 percent and closed at $12.15.

AONE SPAC's sponsor

In the August 2020 IPO, the AONE SPAC offered 20 million shares for $10 each. The AONE SPAC is backed by venture investor Kevin Hartz. Hartz is the co-founder and chairman of the ticketing website Eventbrite.

AONE-Markforged merger date isn't final

The AONE-Markforged merger is expected to close in the summer of 2021. The transaction, subject to approval by AONE shareholders and other customary closing conditions, is set to have a pro forma enterprise value of $1.66 billion. The combined entity will be listed on the NYSE under the ticker symbol “MKFG.”

AONE-Markforged merger details

The deal will provide Markforged with nearly $425 million in gross proceeds to fund the company’s growth initiatives. The amount includes about $215 million of cash held by AONE in trust and an additional $210 million in PIPE (private investment in public equity) at $10 apiece.

Investors in the PIPE include Baron Capital Group, Porsche Automobil Holding SE, Microsoft’s Venture Fund M12, and funds managed by BlackRock, Miller Value Partners, and Wasatch Global Investors. Existing Markforged shareholders will likely own about 78 percent of the combined entity when the deal closes.

AONE Stock Price

AONE SPAC stock looks like a buy before Markforged merger.

Currently, AONE SPAC stock is down 20 percent from its all-time high of $15.10, which it hit on Feb. 25. So, is the slump in AONE stock a good buying opportunity? Let’s dive into the company’s valuations for a better understanding.

AONE valued Markforged at a pro forma implied equity value of $2.06 billion. At AONE’s current stock price, Markforged is valued at around $2.51 billion. In comparison, Desktop Metal (DM) and Universal Display (OLED) have market capitalizations of $4.25 billion and $10.45 billion, respectively.

Markforged expects to generate sales of $87.6 million in 2021 and forecasts its sales growing by 39.9 percent in 2022 and 84.3 percent in 2023. The company expects sales of $705.8 million in 2025, which would mean a 2025 EV-to-sales multiple of about 2.35x. Markforged's 2025 adjusted EBITDA margin of around 24.4 percent also looks good.

Markforged is valued at a 2021 EV-to-sales multiple of around 18.9x. In comparison, Desktop Metal and Universal Display have NTM EV-to-sales multiples of 61.0x and 17.6x, respectively. In December 2020, Desktop Metal went public through a reverse merger with TRNE at a valuation of $2.5 billion.

Markforged thinks that the additive manufacturing industry is expected to reach $118 billion in 2029 compared to $18 billion in 2021. Based on the company's strong growth outlook and valuations, AONE stock looks like a good buy. However, the stock is a speculative play until the AONE and Markforged transaction closes.