BioNTech Stock Forecast: BNTX Could Rise After FDA Approval

BioNTech (BNTX) stock was trading sharply higher after getting full FDA approval for its COVID-19 vaccine. What's the forecast for the stock and how high can it go?

Aug. 23 2021, Published 11:50 a.m. ET

BioNTech (BNTX) stock was trading sharply higher in the early price action on Aug. 23 after the FDA granted full approval to the Pfizer-BioNTech COVID-19 vaccine. What’s the forecast for BNTX stock and how high can it go after the FDA approval?

Pfizer stock was up only about 2 percent in early trading. The company has announced the acquisition of Trillium Therapeutics at a massive premium, which seems to be weighing down the prices. Usually, the stock price of the company that announces the acquisition at a premium falls on the news.

What the FDA approval means for BioNTech

The FDA has given full approval to the COVID-19 jab from Pfizer-BioNTech. The move is positive for BNTX stock. First, it would help address the vaccine hesitancy for some people who are worried about the safety of the vaccines. While it can take years for a vaccine approval, the process was fast-tracked for COVID-19 vaccines.

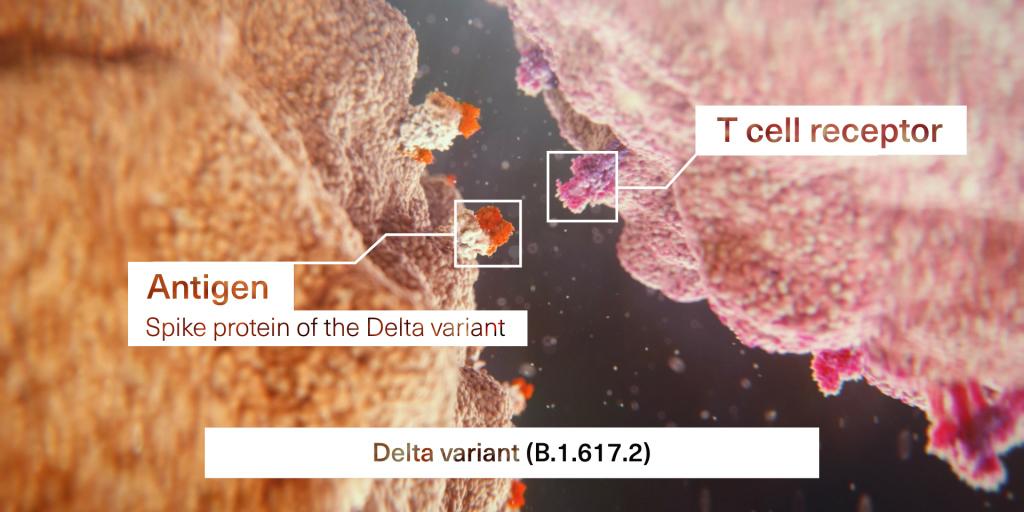

The pace of vaccinations in the U.S. has slowed down even though new daily cases have surged amid the spread of the Delta variant. A survey from Kaiser Family Foundation showed that 30 percent of those who aren't vaccinated will likely get vaccinated if the vaccine gets full approval.

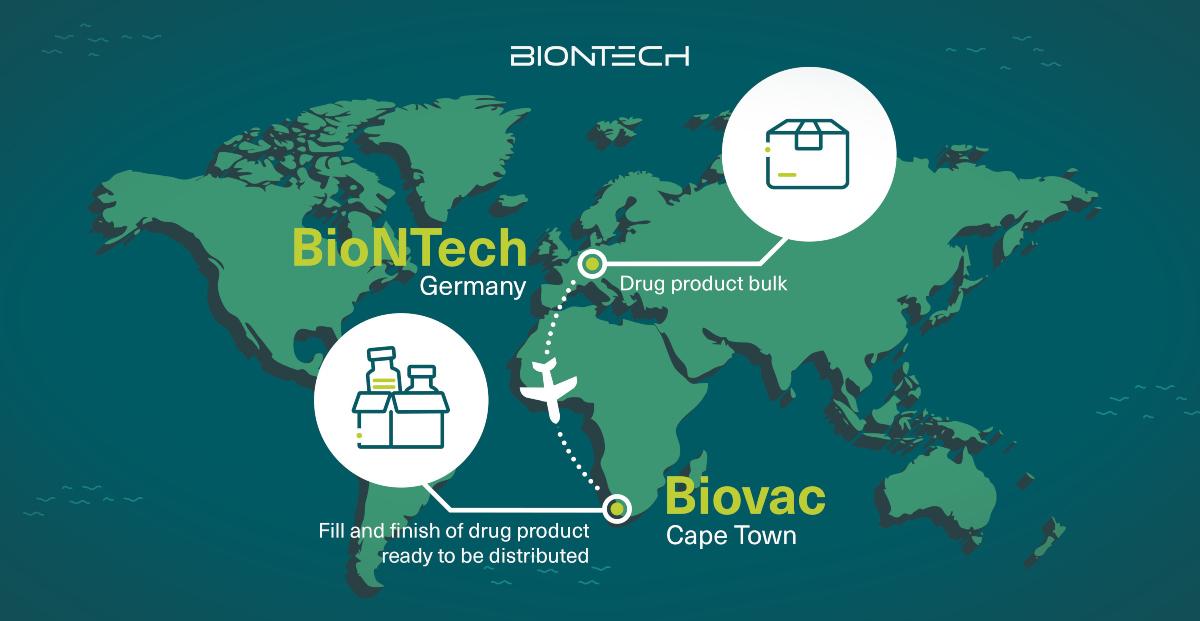

The vaccine from Pfizer and BioNTech has become the first vaccine to get full FDA approval. This would also help increase the vaccine’s adoption in other regions where it competes with other vaccines including those from Moderna and AstraZeneca.

BNTX stock forecast

According to data from CNN Business, BNTX has a median target price of $398.64 which is a premium of only about 5 percent over the current prices. Analysts don’t seem too bullish on the stock and eight of the 12 analysts rate it as a hold or some equivalent. Two analysts each rate it as a buy and a sell.

How high can BNTX stock go?

The street high target price for BNTX stock is $450, which is almost a 19 percent premium over the current prices. More analysts could raise the target price for BNTX after the FDA approval.

Also, the plan for booster doses has been gaining traction, which could lift the demand for companies producing COVID-19 vaccines. Earlier this month, Pfizer and BioNTech submitted initial data to the FDA to support booster doses of the COVID-19 vaccine.

Booster doses could help take BNTX stock higher.

“The data we’ve seen to date suggest a third dose of our vaccine elicits antibody levels that significantly exceed those seen after the two-dose primary schedule. We are pleased to submit these data to the FDA as we continue working together to address the evolving challenges of this pandemic,” said BNTX CEO Albert Bourla.

Looking at the technicals, BNTX stock seems reasonably bullish and trades above all of the key moving averages including the 50-day and 100-day SMA (simple moving average). The 14-day RSI (relative strength index) is 58.3, which is a neutral indicator.

BNTX stock looks attractively priced with an NTM PE multiple of 8.2x. The stock is still down around 18 percent from the 52-week highs and looking at the positive sentiments after the FDA approval, it could retest its highs.