Why Investors Like Blue-Chip Stocks and Which to Buy

With concerns about a market bubble swirling, investors are seeking the best blue-chip stocks to buy now for a defensive portfolio.

March 11 2021, Published 2:50 p.m. ET

Blue-chip companies are commercially and financially stable businesses. These companies give us blue-chip stocks. Why do investors like blue-chip stocks? What are the best blue-chip stocks to buy now?

Amid the SPAC frenzy and the rise of meme stocks, there's growing fear of a stock market bubble. It means more investors are considering blue-chip stocks as a defense mechanism in their portfolio.

Top 10 blue-chip stocks to buy now

Many blue-chip stocks are components of the Dow Jones Index, which tracks companies that represent industries deemed to be America’s economic backbone. Here are some of the best blue-chip stocks with a Wall Street buy rating that you might want to consider for your portfolio.

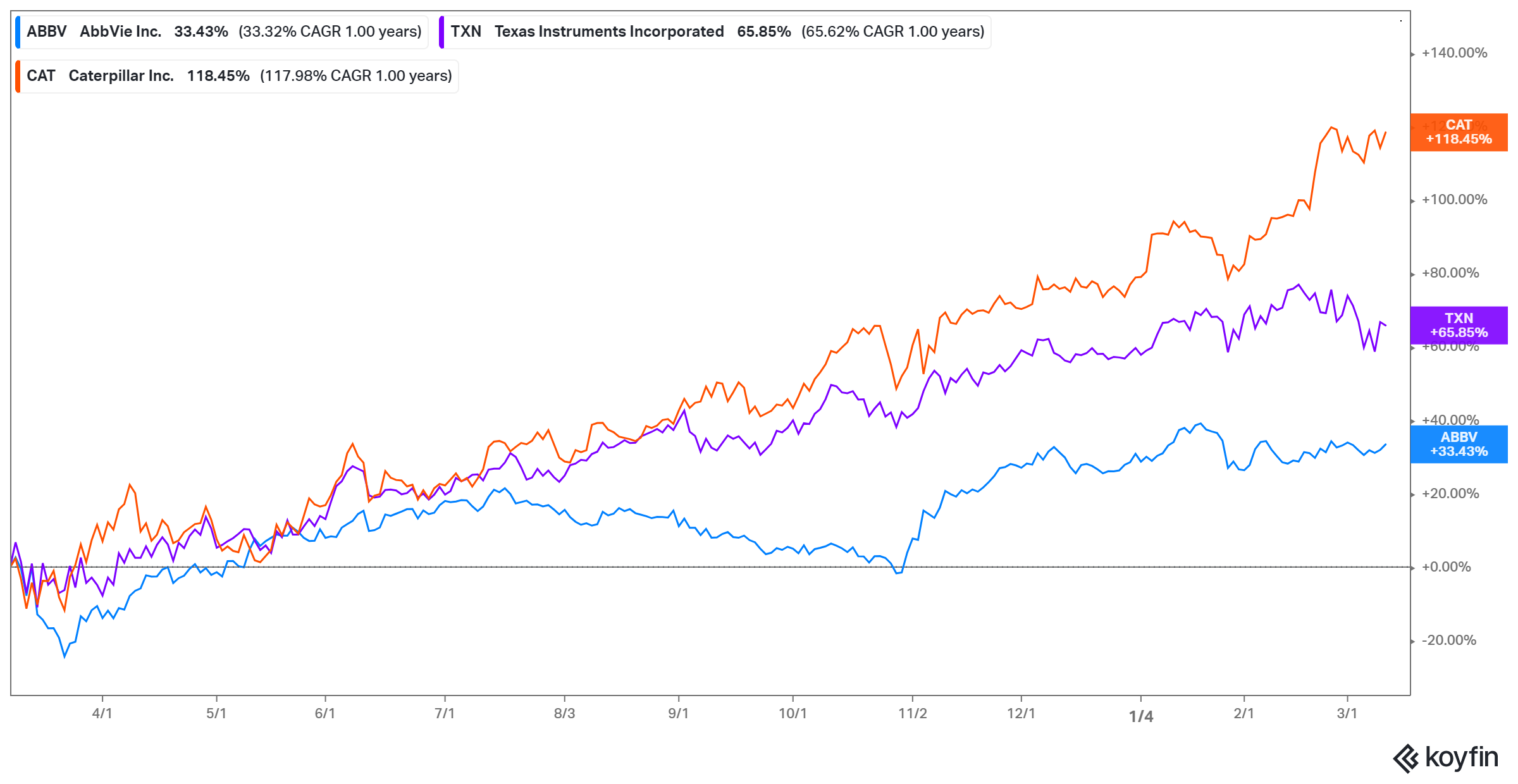

- AbbVie (ABBV)

- Texas Instruments (TXN)

- Caterpillar (CAT)

- Johnson & Johnson (JNJ)

- Apple (AAPL)

- Coca-Cola (KO)

- Procter & Gamble (PG)

- Walmart (WMT)

- Altria (MO)

- Walt Disney (DIS)

AbbVie makes drugs. Humira is among its well-known products. ABBV stock carries a consensus price forecast of $125, which implies a 15 percent upside potential from the current level. Currently, AbbVie stock offers a dividend yield of more than 4.8 percent.

Texas Instruments makes semiconductor components used in a range of devices from industrial machinery to consumer electronics. TXN stock sports a consensus target price of $186, which implies nearly 10 percent upside potential. The stock offers a dividend yield of about 2.4 percent.

Caterpillar makes heavy equipment used in paving roads and preparing building sites. Currently, CAT stock offers a dividend yield of about 2 percent.

Johnson & Johnson is a healthcare and consumer products company. It’s one of the companies that has developed vaccines to fight the coronavirus pandemic and allow life to return to normal. JNJ stock carries a consensus buy rating with a target price of $190, which implies a 20 percent upside potential. Currently, the stock offers a dividend yield of 2.6 percent.

Apple is diversifying outside the iPhone and into services to drive future growth. AAPL stock sports a consensus buy rating with a $150 price forecast, which implies a 25 percent upside potential. AAPL stock offers a 0.7 percent dividend yield.

Coca-Cola makes beverages. Its stock carries a consensus buy rating with a target price of $57, which indicates a 12 percent upside potential. KO stock offers a dividend yield of 3.3 percent.

Procter & Gamble stock has a consensus buy rating. Its target price of $152 implies a 19 percent upside potential. PG stock offers a dividend yield of 2.5 percent.

Walmart stock has a consensus buy rating. Its target price of $163 indicates a 25 percent upside potential. WMT stock offers a 1.7 percent dividend yield.

Altria makes tobacco products. Its stock carries a consensus buy rating and a consensus target price of $50, which implies a 5 percent upside potential. MO stock offers a 7.2 percent dividend yield.

Walt Disney operates theme parks, resorts, cruise ships, produces movies. Recently, it became a major player in the video streaming space with its Disney+ service. The service continues to grow rapidly. The coronavirus pandemic dealt heavy blows to many of Disney’s businesses. However, the future looks bright amid the COVID-19 vaccine rollout. Disney stock carries a consensus buy rating with a consensus price forecast of $207, which implies a 5 percent upside. Disney suspended its dividends in 2020 to control its expenses after the COVID-19 pandemic struck.

Why investors like blue-chip stocks

Blue-chip stocks might not rise as fast as others in the market, but they are dependable. Therefore, including blue-chip stocks in your portfolio can give you peace of mind in a turbulent market. Also, many blue-chip companies get government contracts. They should benefit from more government spending under the Biden administration.

Many investors are familiar with blue-chip companies because their products are part of everyday life. Therefore, beginner investors recognize these companies quickly. That fits well with legendary investor Warren Buffett’s advice that people should invest in companies they understand.

Blue-chip stocks are safe

Because they represent stable businesses that have proven themselves in every kind of economic climate, blue-chip stocks are popular among conservative investors and those investing for retirement. Many blue-chip stocks also pay dividends consistently, which makes them a great choice for those seeking extra income, particularly in retirement. For all investors, blue-chip stocks are great for bolstering and diversifying portfolios.