BFT SPAC Stock Is Trading at a Discount, Paysafe Merger Date Nears

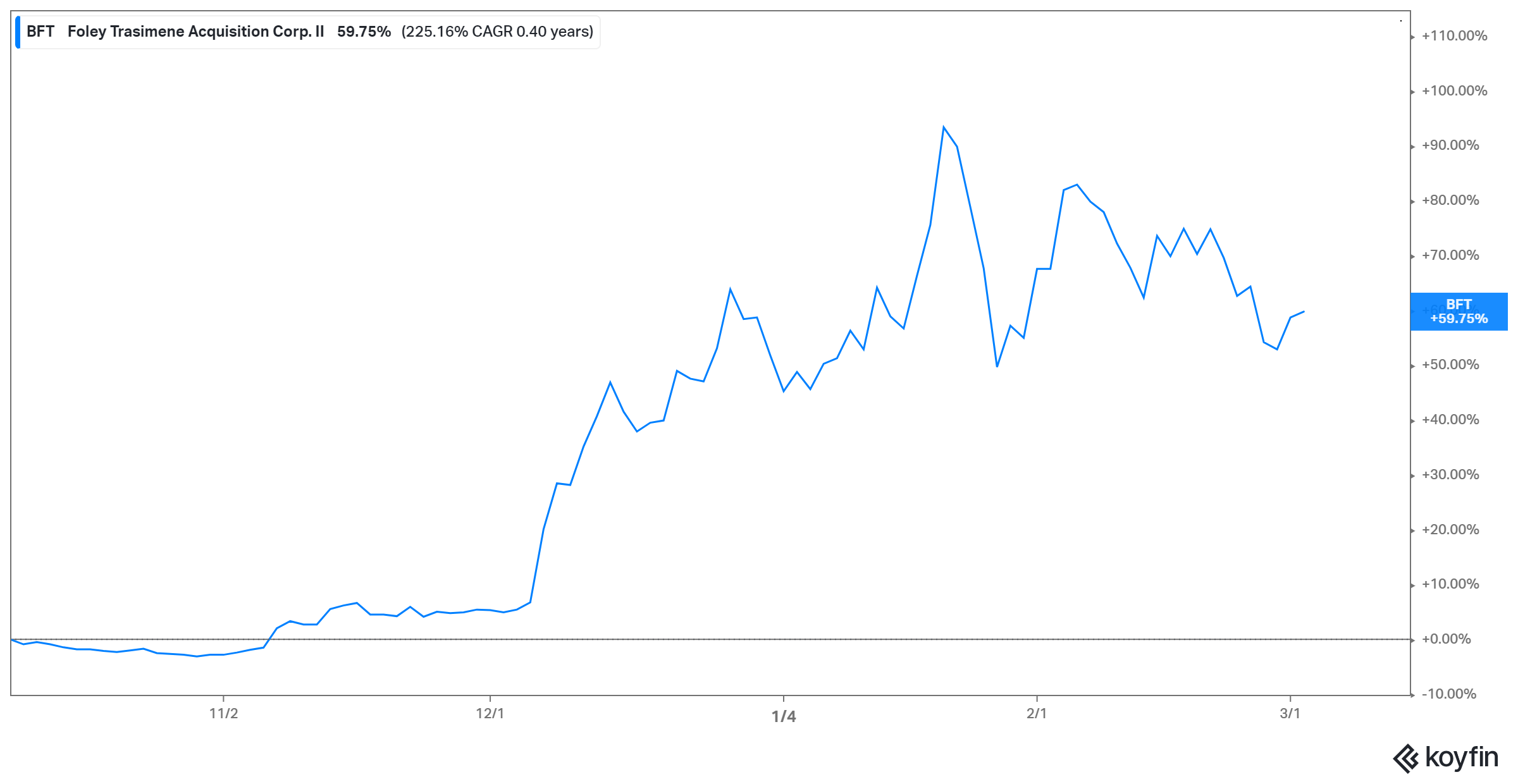

The BFT and Paysafe merger date is getting close. BFT SPAC stock is trading at discount ahead of the transaction closing.

March 3 2021, Published 11:59 a.m. ET

Payments processor Paysafe is going public with the assistance of blank-check company Foley Trasimene Acquisition II Corp (BFT). The BFT-Paysafe merger date is getting close. Should you buy BFT SPAC stock before the transaction closes?

Paysafe provides global payment processing. Its brands include Skrill, Neteller, and Paysafecard. Paysafe is already a huge business that handles $100 million in payments volume annually. BFT SPAC stock has gained almost 50 percent since the Paysafe merger announcement.

BFT SPAC and Paysafe merger date

BFT SPAC and Paysafe announced their merger agreement on December 7, 2020. They aimed to close the transaction in the first half of 2021, which implied that the merger date could extend up to June. Speaking during Cannae Holdings' (CNNE) earnings call on Feb. 22, BFT SPAC sponsor Bill Foley provided a shorter merger timeline. He said that the transaction could be completed before March 31.

The BFT SPAC deal valued Paysafe at $9 billion. Currently, the blank-check company has a market capitalization of $2.3 billion.

After the merger is completed, the combined company will trade under the Paysafe name. Although BFT's stock symbol will change to “PSFE,” it will maintain its listing on the NYSE. In addition to the funds raised through its SPAC IPO, BFT arranged PIPE transactions that raised $2 billion toward the Paysafe deal. The PIPE investors included Cannae, Suvretta Capital, Hedosophia, and Third Point.

Bill Foley’s SPAC track record

Foley, a veteran in the financial services sector, is recognized as a king of SPAC deals alongside Michael Klein and Chamath Palihapitiya. He has launched several blank-check companies besides Paysafe SPAC partner BFT. He launched Austerlitz Acquisition II (ASZ) and Austerlitz Acquisition II (ASU), which raised $1.2 billion and $600 million, respectively, in their February 2021 SPAC IPOs.

He also launched Trebia Acquisition (TREB), which raised $450 million in June 2020, and Foley Trasimene Acquisition (WPF), which has a pending merger agreement with Alight. Foley’s SPAC CF Corporation merged with Fidelity & Guaranty Life in 2017 and formed FGL Holdings. Fidelity National Financial bought FGL Holdings for $2.7 billion in 2020.

The sponsors put in the initial investment to launch a SPAC before raising more money through an IPO to purchase a target business. They usually retain a stake of at least 20 percent in the blank-check company and take charge of hunting for the target business to acquire and take public.

Since SPAC investors usually don't know what type of business they will end up with, they rely on the sponsors' track record to land a good deal. Foley has had a successful profile in SPAC deal-making, which is one of the major draws to BFT stock.

Paysafe's competitors

Paysafe has a long list of competitors, including public and private companies. Its major rivals are PayPal (PYPL), Square (SQ), Stripe, and Payoneer. PayPal and Square stocks have gained 138 percent and 212 percent in the past 12 months, respectively. Payoneer is on its way to the public market through a merger with FTAC Olympus Acquisition (FTOC) whose stock has gained 13 percent YTD. Although the Stripe IPO has long been anticipated, it hasn't been confirmed yet.

Why BFT SPAC is a good stock to buy before the Paysafe merger date

BFT SPAC stock investors are on track to receive about a 14 percent stake Paysafe. There are several reasons you might consider adding BFT stock to your portfolio before the Paysafe merger closing date. First, the stock still looks fairly valued now. Also, the stock trades at about a 20 percent discount to its recent high.

Second, Paysafe appears to be a high-quality business in an industry with bright growth prospects. The coronavirus pandemic has accelerated the shift to online shopping and Paysafe is well-positioned to capitalize. More than 75 percent of the company's revenue comes from e-commerce.