Cheap Value Stocks To Buy Now, Before Interest Rates Rise

Investors are looking for cheap best value stocks to buy for 2022, with interest rates expected to rise as the Fed responds to inflation.

Jan. 12 2022, Published 5:18 a.m. ET

Many people know Warren Buffett as one of the world’s greatest investors, but fewer know that he's a big fan of value stocks. If you want to invest like Buffett, you might be wondering what value stocks to buy for 2022.

Value investors seek stocks trading for less than their intrinsic value. Stock prices fluctuate for a variety of reasons. For example, investors may rush into stocks thinking they'll benefit from increased spending. We've seen this in renewable energy and EV stocks, where climate-change spending created huge tailwinds.

When investors chase the hottest trends in the market, they may pull money from other stocks and cause their prices to drop below where they should be. This catches value investors' attention.

Cheap value stocks to buy now

Across the board, several stocks have an attractive valuation and strong potential. Three cheap value stocks you may want to consider for your portfolio are:

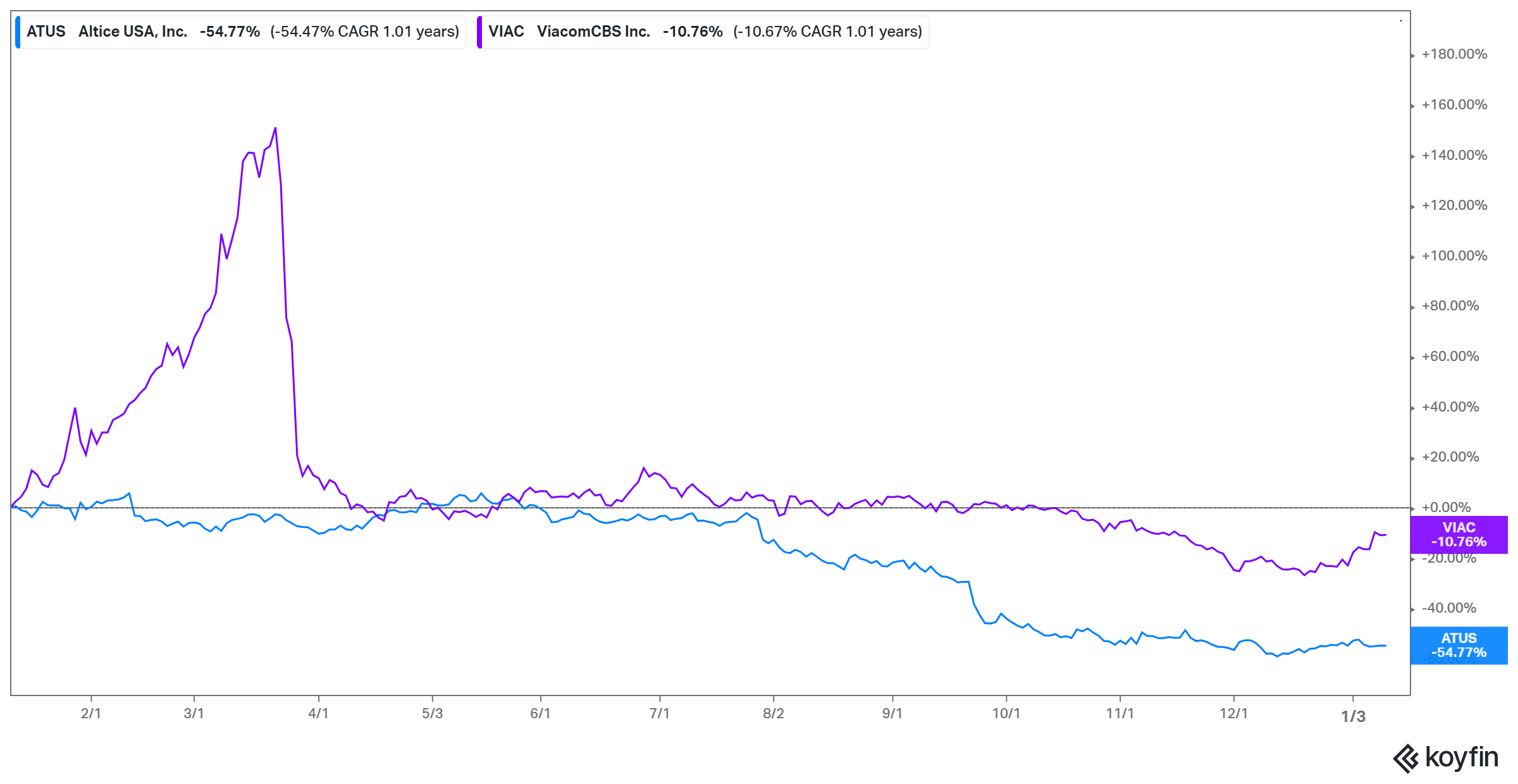

Altice USA (ATUS).

ViacomCBS (VIAC).

Jazz Pharmaceuticals (JAZZ).

Altice, an American communications and media company headquartered in New York City, provides internet access, television, and phone services to millions of residential and business customers across more than 20 states. Altice stock currently trades at 40 percent discount to its 52-week high and carries forward PE ratio of 9.71x.

Meanwhile, ViacomCBS, a multinational media and entertainment company, operates television networks, film production studios, and online video platforms under various brands. ViacomCBS stock has a dividend yield of 2.7 percent, above the sector average of 0.45 percent. The stock is trading 35 percent below its 52-week high and carries a forward PE ratio of 9.10x. Deutsche Bank has named ViacomCBS its top media stock pick.

Jazz Pharmaceuticals develops treatments that target areas of unmet medical needs. The stock has retreated 20 percent from its 52-week high and now has forward PE ratio of 8.58x.

The best value stocks for 2022

The Fed is ready to raise interest rates to tame inflation, and this will make borrowing expensive. That can be blow to companies that rely on credit financing to fuel their growth, but a boon to banks.

As a result, many investors are searching the banking sector for value stocks to buy. One to consider here is Bank of America (BAC). Two other value stocks worth considering for 2022 are Coca-Cola (KO) and FedEx (FDX).

Bank of America is the second-largest lender in the U.S., just behind JPMorgan. In a move that could boost its customer attraction and retention, it's doing away with bounced-check charges and reducing its overdraft fees. BAC stock is Buffett’s second-largest holding after Apple. The stock offers a dividend yield of more than 1.7 percent and trades at forward PE of about 15x.

Soda giant Coca-Cola is diversifying into the alcohol market in pursuit of new growth opportunities. It has partnered with Constellation Brands to produce alcoholic drinks under its Fresca brand. Coca-Cola stock, which is also a top Buffett holding, offers a dividend yield of about 3 percent and trades at forward PE of 25x.

FedEx delivers packages for businesses and consumers. It ships billions of items every year. As shopping shifts online and people order deliveries to their door, FedEx should continue to see growing demand for its service. FedEx stock offers a dividend yield of about 1.17 percent and trades at a forward PE ratio of about 11x.