Best Silver Stocks to Buy as WallStreetBets Pumps Silver

Silver prices have risen sharply over the last week. What are the best silver stocks to buy as WallStreetBets targets the precious metal?

Feb. 1 2021, Published 8:47 a.m. ET

Silver prices were trading higher on Feb. 1 and continued their good run from the previous week. After squeezing short sellers in many stocks, the Reddit group WallStreetBets targeted silver, which led to a rise in prices. ETFs, like the iShares Silver Trust (SLV) that invests in physical silver, have also risen as well as companies that produce the precious metal. What are the best silver stocks to buy as WallStreetBets targets the precious metal?

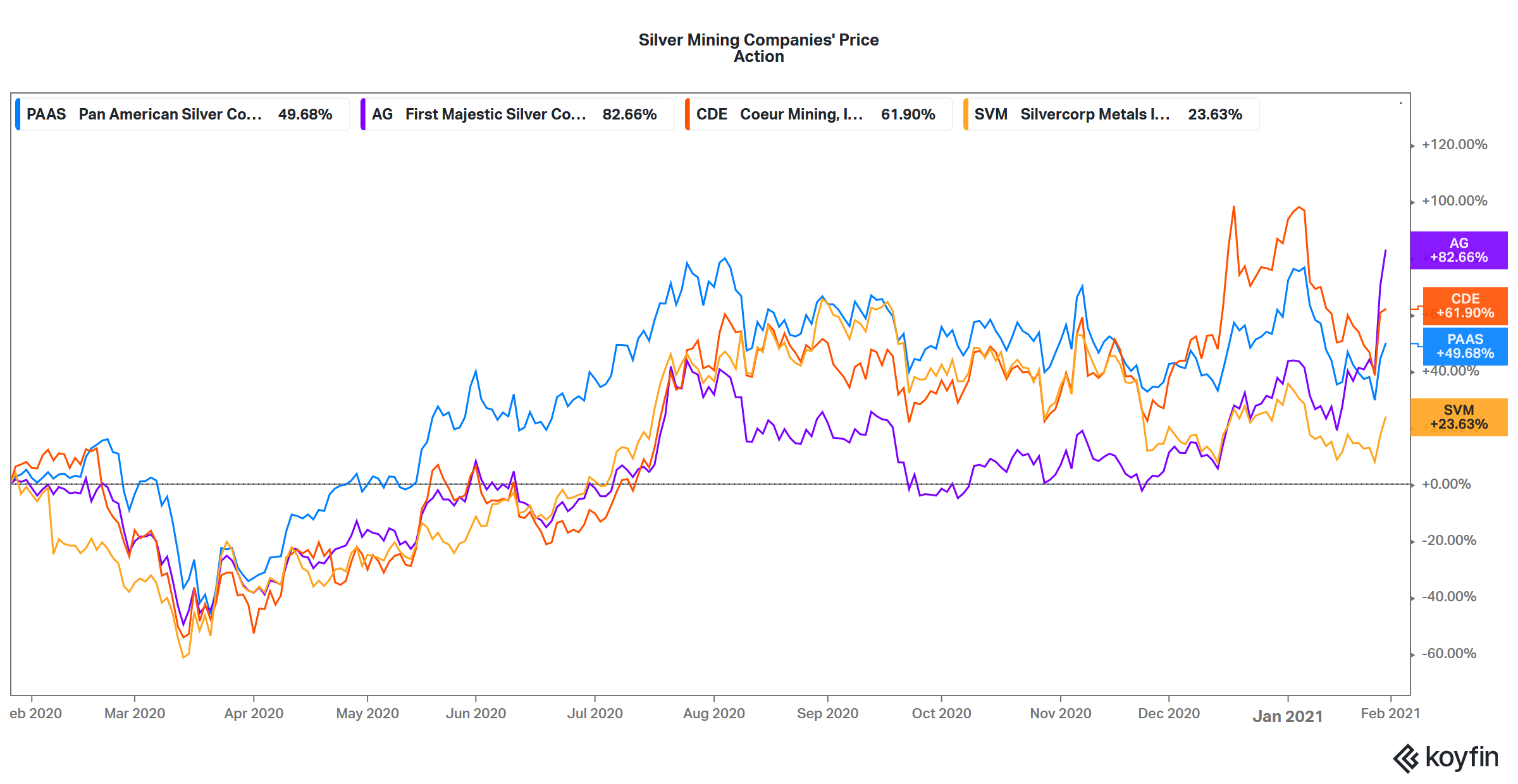

Silver miner stocks have a high correlation to silver prices. Also, they are a leveraged play on silver prices. Mining companies’ stocks rise or fall more than the movement in metal prices.

Best silver stocks

Certain silver stocks are good for investors to buy:

- Pan American Silver Corp. (PAAS)

- First Majestic Silver (AG)

- Coeur Mining (CDE)

- Silvercorp Metals (SVM)

According to PAAS, it has silver reserves of 550 million ounces — the highest in the world. The company also has 5.2 million ounces of gold reserves. It has discovered La Colorada mine in Mexico with an estimated 100.4 million tons of inferred mineral resources. The company’s Navidad mine in Argentina could also be a long-term value driver. PAAS’s mines are spread across the Americas.

PAAS stock looks reasonably valued

PAAS stock has risen 43.6 percent over the last year, while it has fallen 5.8 percent YTD. However, the stock gained momentum towards the end of the last week amid the spike in silver prices. The stock’s valuation looks reasonable with an NTM (next-12 month) PE multiple of 19.2x.

Why AG looks like a good silver stock to buy

AG stock gained sharply last week. Along with the movement in silver prices, company-specific factors also helped the stock move higher. The company has won an initial reprieve in a tax fraud case in Mexico, which led to a buying spree in the stock.

AG gets almost two-thirds of its revenues from silver. It has three mines that produce silver. All of the mines are in Mexico, which is the world’s largest silver producer. However, having all of the mines in one country signals a higher concentration risk for AG.

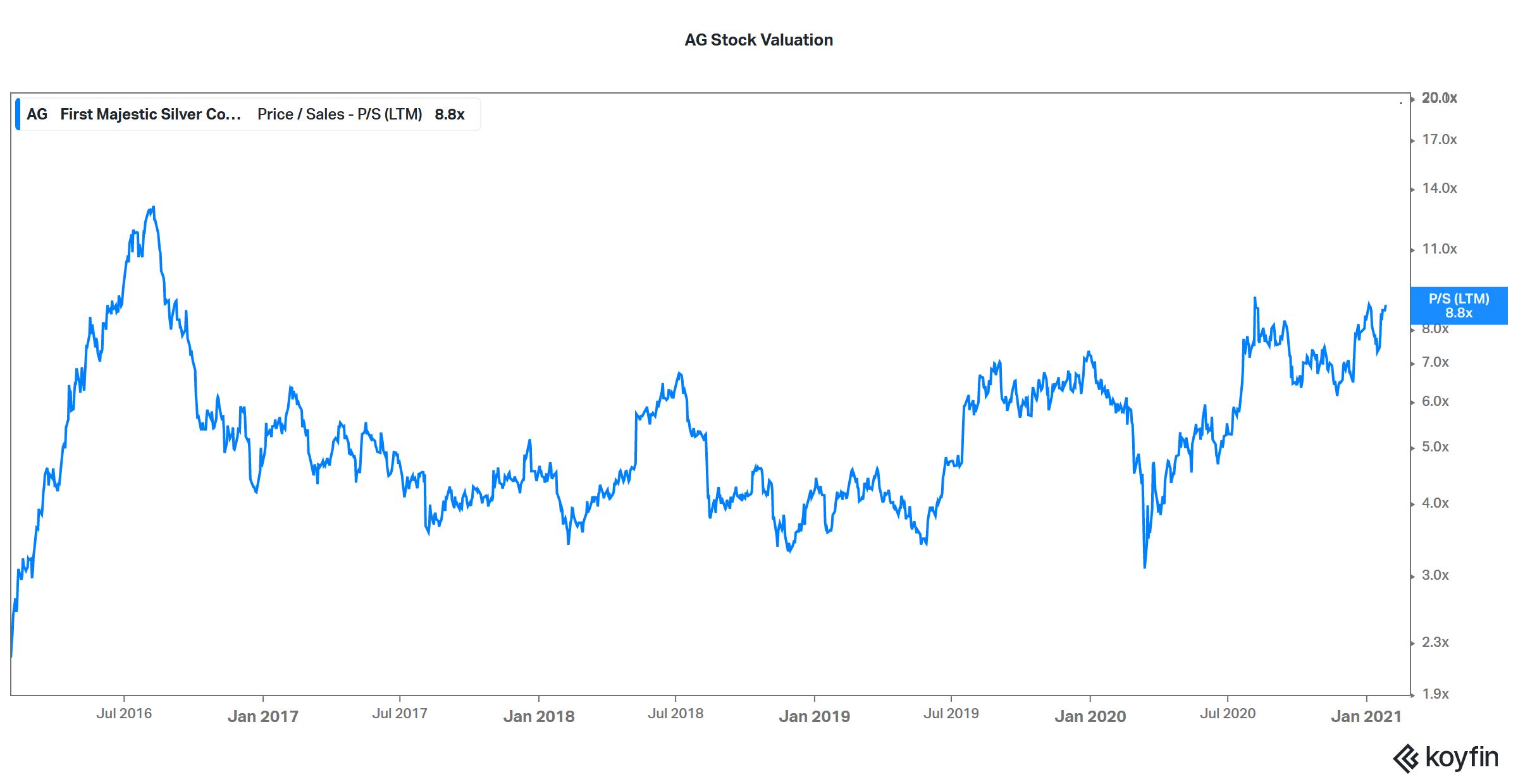

AG stock has gained 83 percent over the last year and is up almost 35 percent in 2021. It trades at an NTM PE multiple of 46.4x. The multiple is higher compared to some of the other silver miners. The stock was trading almost 38 percent higher in the pre-market on Feb 1. AG stock could be among the best plays amid the spike in silver prices.

Coeur Mining is a good bet for investors

Coeur Mining gets around 70 percent of its revenues from silver, while the rest comes from gold. Most silver mines also produce some gold. CDE stock has gained 62 percent over the last year, while it has fallen 12.6 percent YTD. Silver prices and silver mining companies’ stocks were subdued in January before WallStreetBets took on short sellers.

Currently, Coeur Mining stock trades at an NTM PE multiple of 17.8x, which looks reasonable based on silver’s outlook. The company has five operating mines that are spread across the U.S., Canada, and Mexico. Having diversified operations lowers the risk profile for mining companies. Coeur Mining has organic growth opportunities that can add shareholder value in the medium to long term.

Silvercorp Metals has mines in China

Silvercorp’s mines are in China, unlike the other miners that we discussed with mines in the Americas. The company got 64 percent of its revenues from gold and silver in the third quarter of 2020, while the rest came from sales of zinc and lead.

SVM stock trades at an NTM PE multiple of 17.5x, which is in line with the industry. The stock has gained 23 percent over the last year, while it has fallen 3.4 percent for the year.

What’s the outlook for silver?

Recently, silver has been in the spotlight due to the discussions on WallStreetBets. Silver’s outlook is positive due to its diverse use. The investment demand could be elevated in the medium term amid the still uncertain macro environment. Silver’s industrial demand is also expected to rise as the industrial recovery gains momentum in 2021.