Want To Invest in Social Media, but Not Facebook? These May Be Solid Bets

Some investors are now seeking alternatives to Facebook and Twitter. Here are some of the best new social media stocks in 2021.

Oct. 22 2021, Published 11:13 a.m. ET

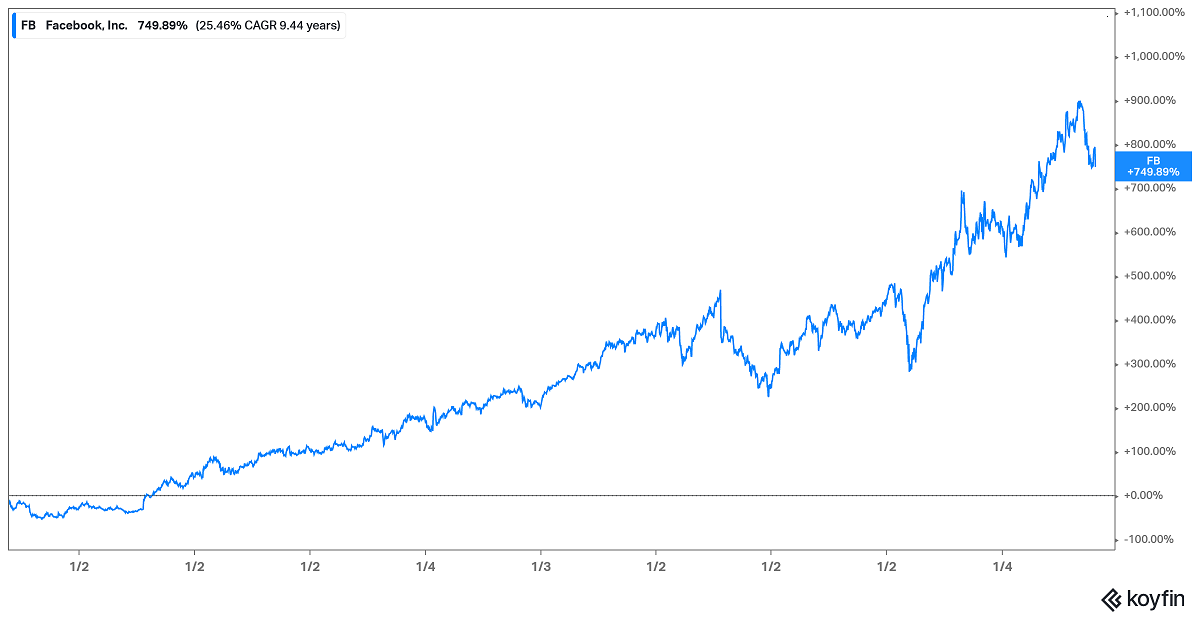

Facebook and Twitter have long been favorites among social media stocks, and have paid off well some shareholders. Facebook stock has gained about 800 percent since its IPO, and Twitter has nearly tripled in the past three years. In 2021, the industry is still growing fast, creating new alternatives to the standard social media stocks. Many investors are wondering which are the best to buy.

The number of global social media users is forecast to exceed 4.4 billion by 2025, compared with 3.6 billion in 2020. At the same time, social media advertising revenue is predicted to grow to $230 billion by 2025 from $154 million in 2021. Even Donald Trump has unveiled a social network, TRUTH, to tap the massive business opportunity.

What are the best new social media stocks to buy in 2021?

Although Facebook remains the top social media company and a highly profitable one, it has been marred by controversy. It also faces the risk of being broken up amid the growing concern over big tech's power. Twitter has also had its share of challenges, including online harassment, causing some people to ditch the platform.

Social media networks other than Facebook and Twitter include:

TRUTH Social.

Nextdoor (KIND).

PayPal (PYPL).

TikTok.

Bumble (BMBL).

Match Group (MTCH).

Tencent (TCEHY).

TRUTH Social

After being banned from Facebook and Twitter, Trump has created a media network that he's taking public through a SPAC merger with Digital World Acquisition (DWAC). The deal could value the network at as much as $1.7 billion and provide hundreds of millions of dollars in additional capital. DWAC stock rose by more than 1,200 percent following the announcement of the TRUTH network.

Nextdoor

Nextdoor, a platform for building neighborhood connections, is similar to Facebook and Twitter, in that it primarily makes money from advertising. But it also has an e-commerce segment that features product listings from local businesses. Nextdoor has attracted more than 63 million users across the U.S., and has the potential to grow even bigger internationally.

Similar to Trump’s TRUTH, Nextdoor plans to go public through a SPAC merger as soon as Nov. 2021. The stock is set to trade under the “KIND” ticker symbol. Investors can get exposure to Nextdoor through blank-check company Khosla Ventures Acquisition II Co (KVSB).

PayPal

PayPal is known as a digital payment company, but it also has serious social media business ambitions. Its popular Venmo app has a social segment that lets people share information about their purchases with friends. It turns out PayPal is keen to expand its social media business and has explored acquiring Pinterest (PINS) for as much as $45 billion.

TikTok

TikTok, a platform for sharing short videos that sometimes go viral, has been a major hit among young people. Although TikTok stock is currently private, that could change. At one point, it looked like investors would have a chance to get exposure to it through Oracle and Walmart stock, but that deal has been shelved since Trump's departure from the White House.

Bumble and Match

There's also Bumble and Match, which operate popular online dating apps. Like other social media networks, they stand to benefit from the expanding social media advertising and shopping markets.

Tencent operates WeChat, a Twitter-type social platform that serves China. WeChat looks to have bright growth prospects as more of China's population comes online and businesses embrace digital advertising. It also stands to benefit from the e-commerce boom.

The best social media stocks ETF

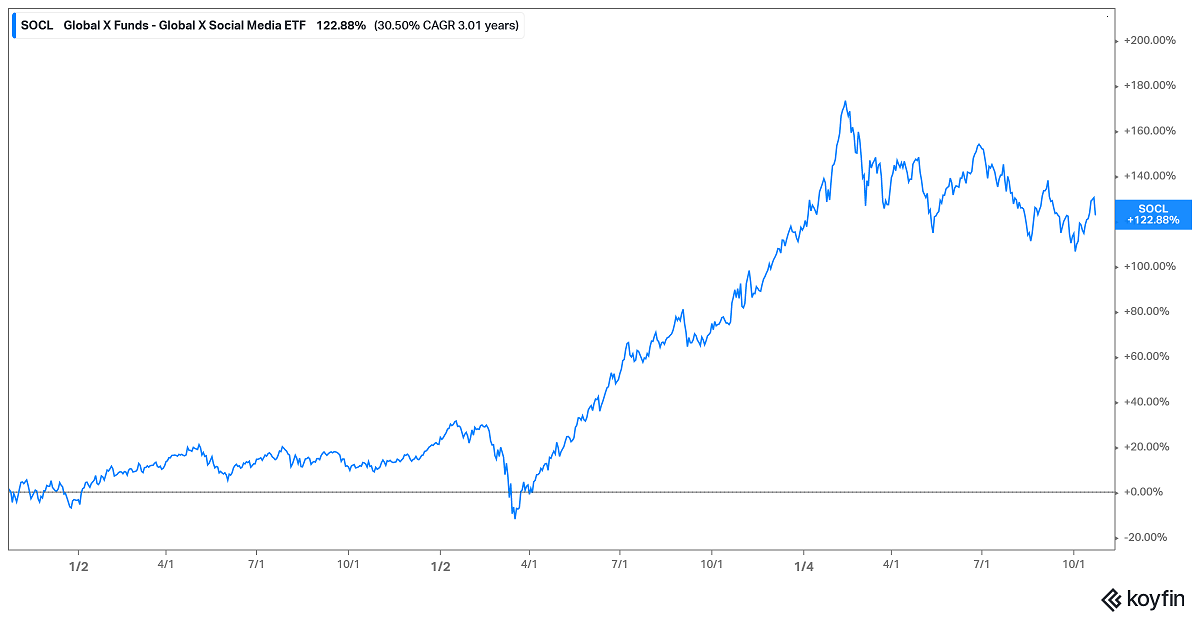

If you’re not for investing in individual social media stocks or you want exposure to Facebook alongside new social media stocks, the Global X Social Media ETF (SOCL) may be for you.

The fund invests in a range of social media companies around the world. In addition to Facebook and Twitter, its top holdings include Snapchat, Tencent, and Match Group. The fund has more than doubled investors’ money in the past three years. It charges an expense ratio of 0.65 percent.