Best Hydroelectric Stocks for Renewable Energy Investors in 2021

Renewable energy can come in many forms. Hydroelectricity stocks represent one of the many forms. What are the best hydroelectric stocks in 2021?

June 11 2021, Published 11:51 a.m. ET

In early June, cartographers from National Geographic delineated a fifth world ocean—the Southern Ocean. The new ocean joins the Arctic, Atlantic, Indian, and Pacific oceans in global recognition. Naturally, hydroelectric power comes to mind. It's a growing form of renewable energy that depends on the movements of the ocean's waves.

What are the best hydroelectric stocks for your 2021 portfolio?

Brookfield Renewable Partners (BEP) operates hydroelectric power.

Brookfield Renewable Partners (NYSE:BEP) operates a diverse portfolio of renewable energy plants. Hydroelectricity contributes to the company's overall generating capacity of 21,000 megawatts. Ultimately, hydropower makes up 62 percent of the portfolio, which makes Brookfield a global leader in the renewable energy subsector.

Plug Power (NASDAQ:PLUG) sources its renewable energy from Brookfield. PLUG stock has seen dramatic growth over the last year (566 percent trailing 12-month returns). While BEP stock is less dramatic, it's still noteworthy. BEP stock is up 10.56 percent over the last month and 61.5 percent over the last year.

From a long-term perspective, BEP has reliable growth.

Duke Energy Corp. (DUK)

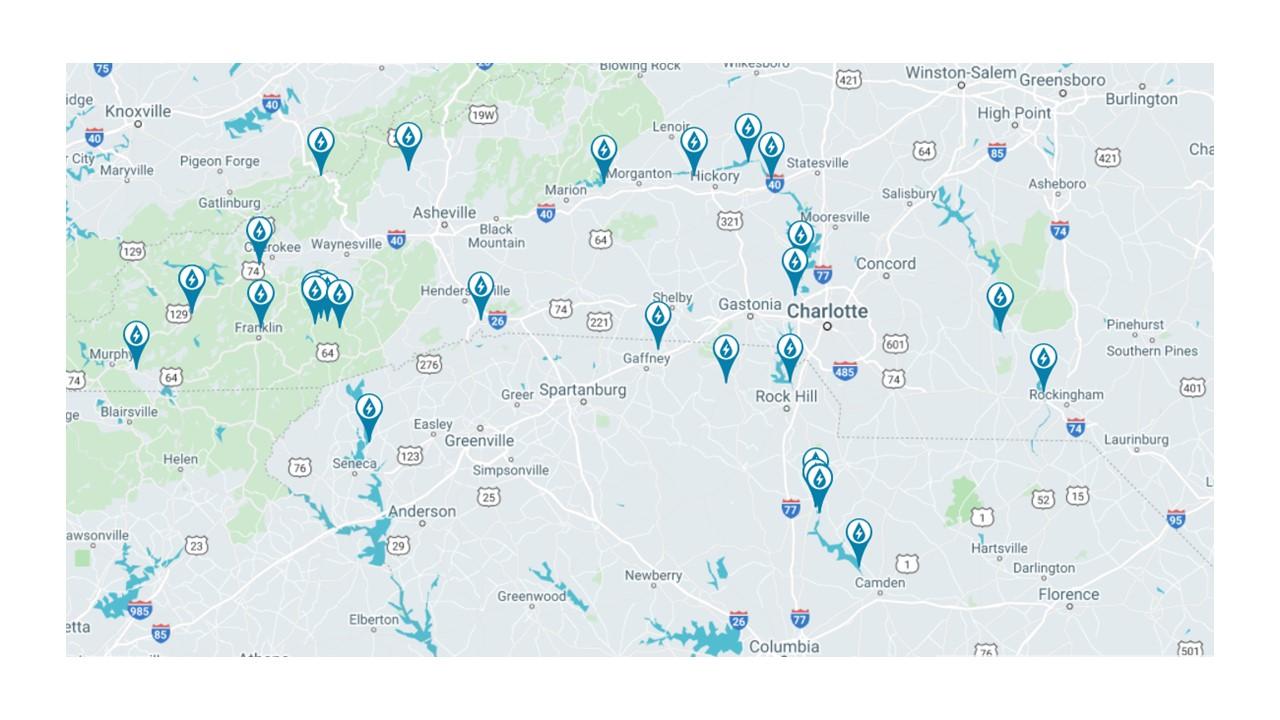

Hydroelectric energy is part of Duke Energy's (NYSE:DUK) renewable portfolio. In fact, Duke Energy started as a hydroelectric company in the Catawba River of the Carolinas and eventually expanded to other forms of energy. Currently, Duke operates 31 hydropower plants in the region.

Despite a near correction in February, DUK stock is up 13.4 percent YTD. Over the last year, the shares have trended gradually upward for a 16.8 percent return. Intermittent volatility is prevalent over the long term, but the returns are reliable and generally lower risk overall.

Centrais Eletricas Brasileiras Eletrobras (EBR) is a Brazilian hydroelectric stock.

Despite Brazilian headquarters, Centrais Eletricas Brasileiras Eletrobras (NYSE:EBR) is listed on a U.S. exchange, which makes it easier for Americans to invest.

Referred to as "Eletrobras" for short, the company operates 48 hydroelectric plants, which makes this form of energy the most prominent in the company's portfolio. Electrobras is researching and engineering possible opportunities in new places, like the international stretch of the Uruguay River and the Bolivian-Brazilian Madeira River basin. It's worth noting that there have been conflicts with Amazon tribes in the past, which ultimately led Eletrobras to terminate contracts.

EBR stock is up 26.83 percent YTD. Despite volatility, the long-term returns are promising. The one-year and five-year returns are 54.46 percent and 266.53 percent, respectively.

Southern California Edison trades under parent company Edison International (EIX).

California is heavily invested in hydroelectricity and one of the key players is Southern California Edison. The parent company is Edison International (NYSE:EIX), which is a public utility holding company.

Southern California Edison's peak system demand for hydropower is more than 22,000 megawatts, which comes from 36 powerhouses and 79 generating units.

Granted, EIX stock isn't without volatility. Investors who wait for major corrections before investing or adding to their investment can compound their returns over the long term. For example, the stock is up just 2.13 percent over the last year with a 21.72 percent five-year decrease and a 384 percent rise over the last two decades.