Best Gas Stocks to Buy After the Colonial Pipeline Attack

Gasoline prices have firmed up after the Colonial Pipeline attack. What are the best gas stocks that you can buy now?

May 12 2021, Published 8:19 a.m. ET

The ransomware attack on the Colonial Pipeline is among the major cyberattacks that we have seen lately. The attack has led to a rise in gas prices and gasoline stations have run out of gas in some regions. What are the best gas stocks to buy after the Colonial Pipeline attack?

Gas prices in the U.S. were rising even before the Colonial Pipeline attack. Gasoline prices depend on crude oil prices and demand-supply dynamics. The crack spread is also important since it impacts refiners' profit margin. Now, crude oil prices have been strong and WTI is trading near $65 per barrel. In 2020, WTI prices turned negative but they have since rebounded smartly.

Why gas prices are going up in the U.S.

The Colonial Pipeline cyberattack had a negative impact on the supply of refined fuels like gasoline and diesel. To add to that, crude oil prices have strengthened, which has led to higher gas prices in the U.S.

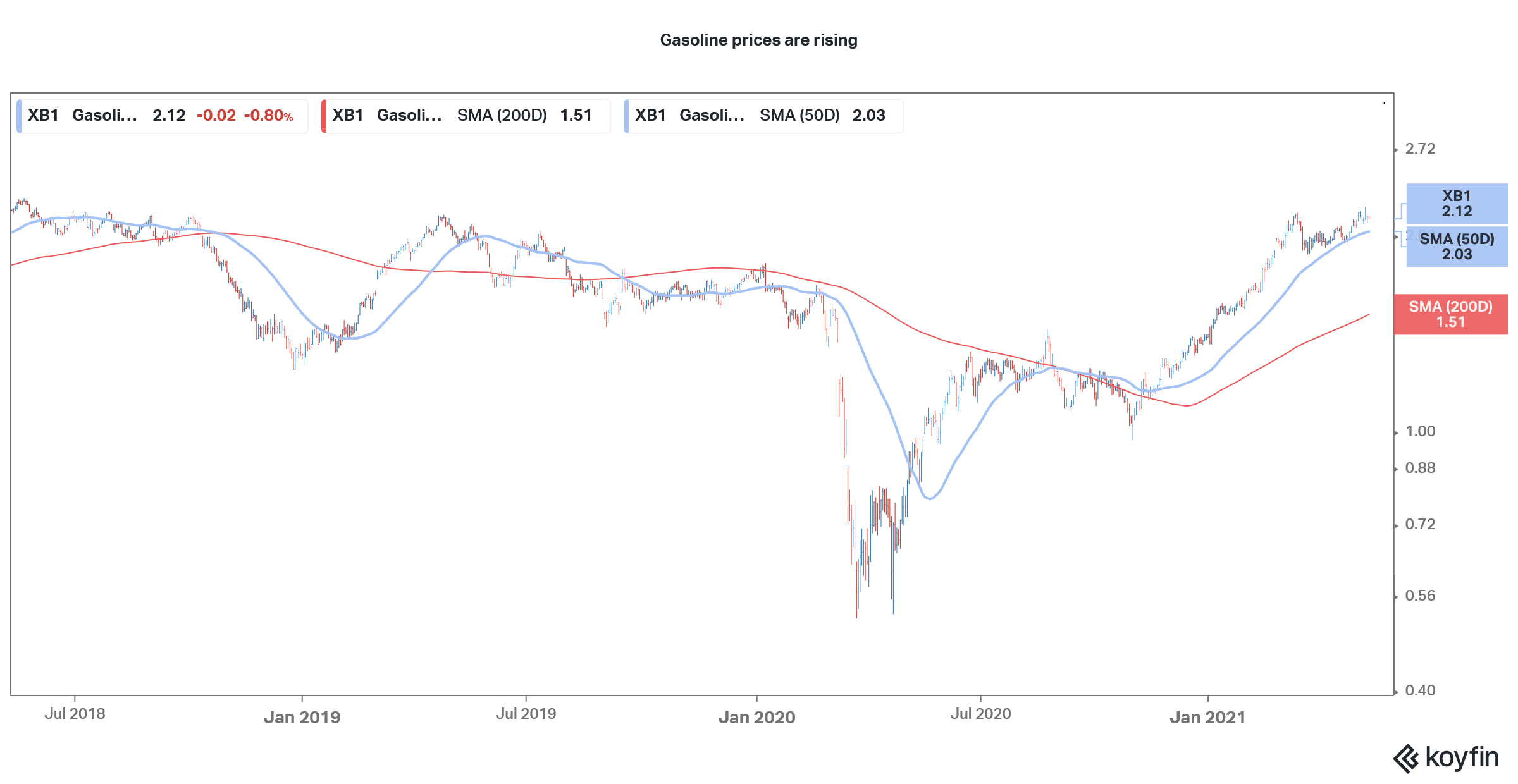

Gasoline prices are rising

Some people are hoarding gasoline.

Think about the early days of the COVID-19 pandemic when supermarkets ran out of essentials like toilet paper. No one wanted to be in a situation where they ended up being short of essentials.

Something similar is playing out again and people are hoarding gas. While Colonial Pipeline expects to restore the pipelines by the end of the week, people are trying to load up on gasoline just in case the restoration takes longer. With Memorial Day approaching, people don’t want to run out of gas.

Meanwhile, U.S. Energy Secretary Jennifer Granholm asked Americans not to hoard gas. In a market where prices are determined by demand-supply dynamics, hoarding and panic buying can lead to even higher prices.

Best gas stocks to buy

According to Barron's, refinery companies like Phillips66 and Valero could benefit from the Colonial cyberattack. PBF Energy could be another winner from the woes of Colonial Pipeline. Meanwhile, shipping rates might rise as traders scramble to get oil from overseas to meet the shortfall. Companies like Scorpio Tankers could benefit from higher shipping rates.

Shipping rates are a function of demand and supply and higher demand can bump up shipping rates. Dry bulk shipping rates have also surged in 2021 amid higher demand for almost everything from iron ore to coal.

Jim Cramer picks his gas stocks

Jim Cramer has identified Chevron, Enterprise Product Partners, Kinder Morgan, and Pioneer Natural Resources (PXD) as his favorite stocks that could benefit from the attack on the Colonial Pipeline.

Should you buy gas stocks now?

The Colonial Pipeline cyberattack has led to a short-term bump in gasoline prices. However, as I argued in an earlier article, the outlook for energy companies is bullish in 2021. The demand-supply scenario is as rosy as we have had in the last five years.

The OPEC block isn't in a hurry to increase production despite the increase in demand and is only increasing it gradually. Also, given the current inflationary environment, traders might find solace in real assets like energy. Incidentally, research has shown that energy prices tend to do well when inflation rises.

Outlook for oil and gas stocks in 2021

Overall, the outlook for gas stocks looks bullish for 2021. We are in a commodity supercycle, which should lead to firmer prices for most commodities including crude oil. While this means that you will have to spend more on gasoline, you could benefit by investing in some oil and gas companies.