AvePoint Reports Strong Earnings, Unveils Share Repurchase Plan

Given AvePoint's strong earnings and share repurchase plan, investors are eager to know how much it's worth before the APXT merger date.

April 15 2021, Published 6:55 a.m. ET

AvePoint is going public through a SPAC merger with Apex Technology Acquisition (APXT). The transaction is expected to close at any moment now. How much is AvePoint worth before the APXT merger date?

AvePoint, a Microsoft cloud expert, offers solutions geared toward enterprises using Microsoft products such as Office 365 and Teams. The cloud software startup says its customers include a quarter of Fortune 500 companies. AvePoint will trade under the "AVPT" ticker symbol upon the merger's closure.

AvePoint's earnings and 2021 revenue forecast

AvePoint released its preliminary 2021 first quarter earnings on Apr. 14 after the closing bell. It estimates revenue of $38.4 million–$38.8 million, well within its internal projection. Also, its closely watched subscription revenue is expected to be $26.7 million–27 million, representing a year-over-year increase of more than 49 percent at the midpoint. It expects to post an operating loss of $4.1 million–$11.9 million.

As a result of its strong first-quarter earnings, AvePoint upgraded its 2021 revenue forecast to $194 million from $193 million. In 2020, it generated revenue of $151.5 million.

AvePoint's share repurchase plan and expected impact

AvePoint wrapped up the first quarter with $65.8 million in cash, and is free of debt. It plans to tap into its strong balance sheet to start putting money back in the pockets of shareholders.

AvePoint has unveiled a share repurchase program worth $20 million, a rarity among startups going public. It intends to buy back shares both in the open market and through privately negotiated transactions. The repurchase plan, designed to reduce stock dilution risk associated with the SPAC merger, demonstrates management’s confidence in the startup’s growth and profitability prospects.

APXT stock was unchanged in the regular session on Apr. 14. However, following AvePoint's earnings and share repurchase announcement, APXT rose more than 11 percent in after-hours trading.

How much is AvePoint worth before the APXT merger date?

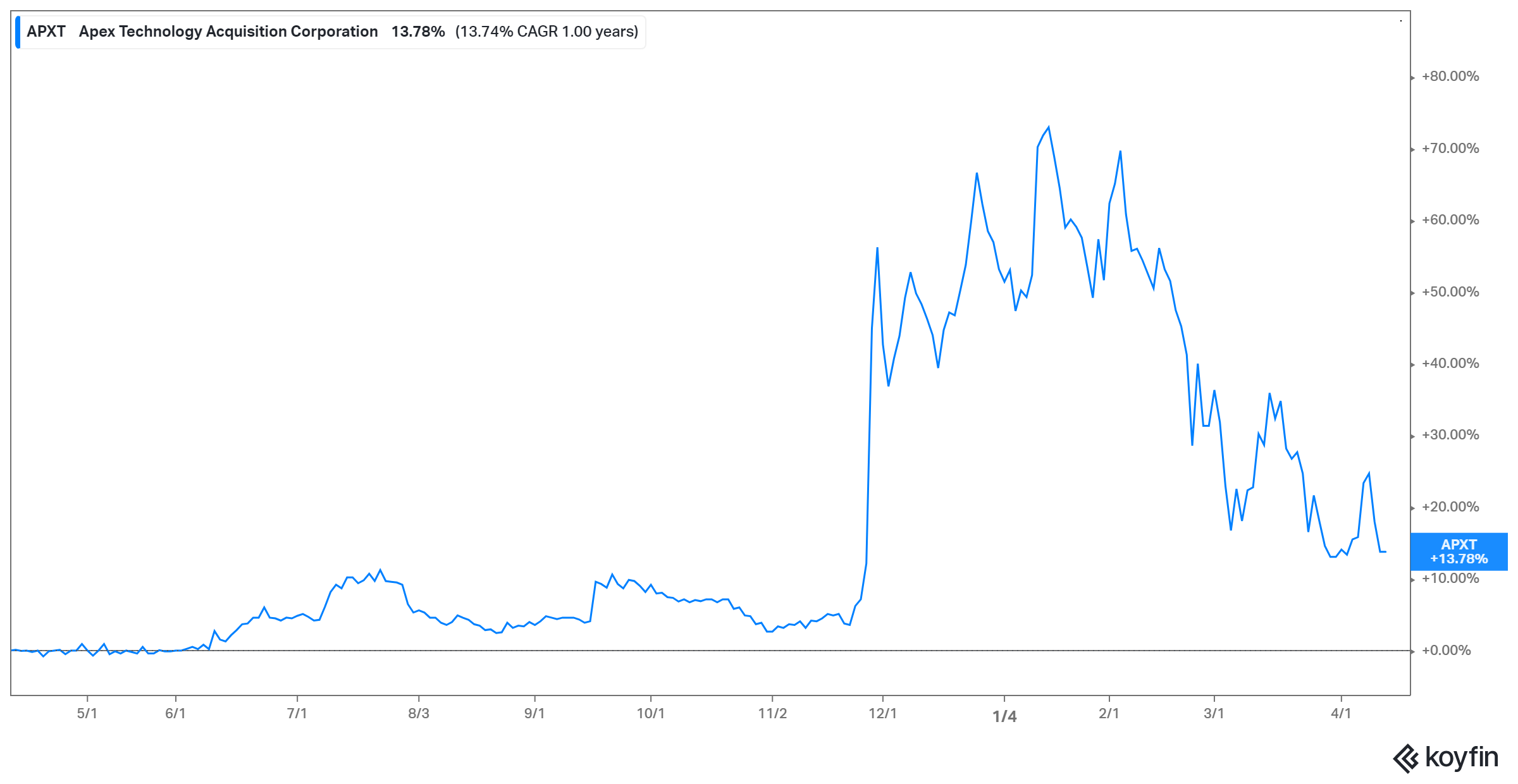

APXT stock has traded between $9.63 and $17.90 since its debut. It finished the last session at $11.15, down almost 40 percent from its peak. Given this decline and AvePoint’s growth projection, investors are wondering if AvePoint is undervalued ahead of the merger.

And indeed, with the strong first quarter earnings, 2021 revenue outlook upgrade, and share repurchase plan, AvePoint just demonstrated that it may be worth more than investors thought.

The Apex SPAC deal valued AvePoint at $2 billion. At the current APXT stock price, AvePoint is valued at $2.2 billion. AvePoint is set to receive $252 million in cash to invest in growing its business. The company expects its revenue to grow to $257 million in 2022 from $194 million in 2021.

When is the AvePoint-APXT SPAC merger date?

AvePoint and Apex announced their merger agreement on Nov. 23, 2020. They had hoped to complete the deal by the end of Mar. 2021, but like many other SPAC mergers, such as the SoFi-IPOE deal, it's been delayed.

The SEC taking a closer interest in SPAC mergers may be causing some delays. But with AvePoint and Apex's merger, boards having already cleared the deal, and it should close soon.

AvePoint's competitors

AvePoint is a Microsoft cloud expert and doesn’t face serious competitive threat. Its competitors include Cipherpoint, ManageEngine 0365, Adaxes, and ShareGate. Comparable companies to AvePoint include Alteryx, Dynatrace, Jamf, and Avalara.

Is APXT a good SPAC stock to buy now?

APXT stock looks like a good buy now for several reasons. First, at almost 40 percent below its peak, the stock offers investors exposuure to AvePoint at a bargain.

Second, the risk of stock dilution looks low. AvePoint is going public as a profitable company with a strong balance sheet. Moreover, management's share repurchase plan shows that the company will work to compensate for stock dilution as soon as possible if it happens.

Finally, as a Microsoft cloud expert, AvePoint looks to be a high-quality business with bright prospects and room to grow. Cloud computing is the future, and Microsoft is among the world’s top cloud vendors.